Emerging Markets Cheat Sheet (September 12, 2011)

Strengths

- China’s consumer price index (CPI) in August dropped to 6.2 percent from 6.5 percent in July. The market expected the People’s Bank of China (PBOC) to stop raising interest rates, and it may lower the required reserve ratio from the current 21.5 percent for major banks.

- The Bank of Korea, the central bank, left its benchmark rate unchanged at 3.25 percent for a third month, conforming with the market expectation.

- Indonesia’s central bank held its reference rate at 6.75 percent, remaining unchanged for the seventh straight month. The Philippine central bank also maintained its benchmark rate at 4.5 percent for the third straight meeting. The Bank of Malaysia kept policy rate on hold at 3 percent. This indicates economic growth has been moved to the frontline on the policy list while inflation control has been the priority since last year.

- China’s Ministry of Construction said 86 percent of the social housing projects have begun construction in the first eight months of this year, i.e., start-up units are 8.68 million out of total target of 10 million. This will create demand for construction materials and equipment.

At 6.9 percent year-over-year, July industrial production in Turkey was considerably stronger than the consensus, which estimated a 4.0 percent year-over-year increase. This reading puts industrial production growth in the first seven months of the year at 10.2 percent compared with the same period of 2010. The chart below illustrates this year’s industrial production growth compared to 2010 with total industrial production growth reset to 100 in January 2005.

Weaknesses

- In China, food prices increased 13.4 percent, and pork prices rose 45.5 percent on a year-over-year basis in August. Controlling prices remain a hefty task and, because of that, China’s monetary policy may not change its tightening stance.

- Thailand’s consumer confidence fell to 73.8 in August, despite the efforts made by the new government to raise the minimum wage.

- Malaysia saw its July exports increase 7.1 percent, down from June’s 9.6 percent; imports rose 2 percent.

- China’s Purchase Manager Service Index fell to a record low in August to 50.6 percent from 53.5 percent.

- Although credit expansion is still robust, BCA Research points to signs of stress among corporate borrowers in Brazil. Consumer loan delinquency rates are also rising, weighing on banks’ bottom lines despite policy easing.

Opportunities

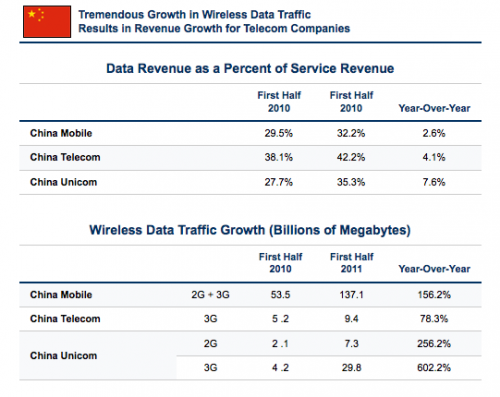

- In a recent global mobility study, Jefferies’ TMT analysts predicted that multiple trends centered around mobility—including higher wireless bandwidth, the immediacy of social networking and advances in devices—are transforming the full technology, media and telecommunications food chain: handset, tablet and other hardware manufacturers; telecommunications service providers, network infrastructure and semiconductor vendors, and developers of end-user software, content, and payment systems. The chart below shows how fast the explosive wireless data traffic growth is and how it increases its shares in revenue contributions for the three telecom operators in China.

- Amid a string of recent catastrophic accidents, mounting unease over Russia’s ageing transport is increasing pressure on President Medvedev to overhaul infrastructure sooner rather than later. The Russian government budgeted billion of dollars for infrastructure spending in 2015 through 2020, but it may no longer be able to postpone it until then.

Threats

- The emerging markets in Asia are now concerned with economic growth as well as inflation pressure. On one hand, inflation is still at high level; on the other hand, exports and industrial activities are slowing down. The declining economic environment may eventually hinder consumer spending, an area that has been a preferred investment focus since inflation flared up in early 2010. Although the Asian governments are now holding off further benchmark rate increases, they have no optimal policy to cure both economic symptoms at the same. The equity market, with forward pricing mechanism, is actually in the pricing process toward recession.

- Real rates in Brazil—the highest in the world—broke below 6 percent last week. BCA Research calls the breakdown “historic.” They believe rates (both in nominal and real terms) will move much lower in the months ahead due to disappointing growth.

- The Hungarian government may force the nation’s lenders to swallow losses on foreign-currency mortgage loans by fixing the Swiss franc as much as 20 percent below prevailing rates. The vote on this proposal is expected this weekend.