Looking for Three Signs of a Market Bottom

by Ryan Lewenza, CFA, CMT, U.S. Equity Strategist, TD Wealth

In May of this year, we turned cautious on U.S. equities given: 1) weak seasonality from May to September, 2) the end of

Quantitative Easing 2 (QE2) in June, and 3) the extreme bullish sentiment that we witnessed in Q1/11 which, from a

contrarian perspective, was negative. We’ve maintained our cautious and defensive posture since that time and will

remain so until we see the following signs:

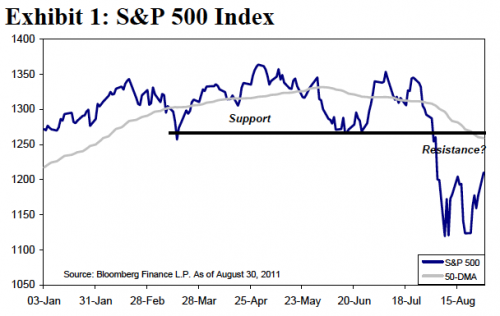

- S&P 500 Index (S&P 500) breaks above key resistance of 1,260/70

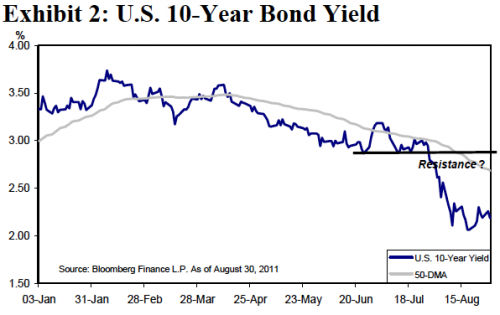

- 10-year bond yield breaks above 2.7-2.9% range

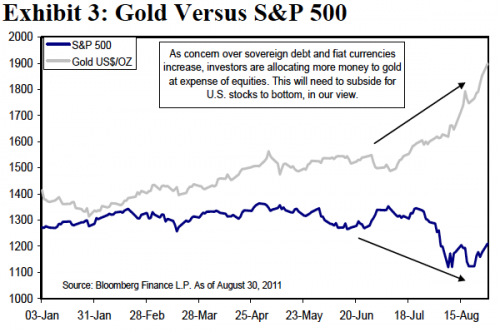

- Gold prices pull back, following its huge run

In the recent sell-off, the S&P 500 broke through key support of 1,260/70. We are now witnessing an oversold bounce with the S&P 500 closing in on the key 1,260/70 level. This level is important because: 1) the 50-day MA currently intersects at 1,260, and 2) this level was previous support in March and June of this year. When key technical supports are broken they become resistance levels on the way back. Therefore, if we see the S&P 500 break back above this now resistance level, it will signal a stronger market to us, and that the correction could be over.

- Readers of our work know that we watch the bond markets closely to help us isolate turns in the equity markets. With the U.S. 10-year bond yield falling to record lows of around 2%, clearly the bond market is pricing in slowing economic growth, and potentially even a recession.

- For us to get more positive on equities, we will need to see the 10-year yield bond move higher, breaking above the 2.7-2.9% range, which would signal to us that the growth scare is over and investors are moving back to more risky assets, such as stocks.

- We remain long-term bulls of gold, but believe that the recent parabolic move in gold prices has been negative for U.S. equities. Said differently, as investors grow more concerned over sovereign debt issues and the prospect of a recession, investors have been moving funds out of equities and into gold, given its safe haven status in times of distress. Essentially, some investors are growing wary of paper assets, and as such, are moving funds into hard assets like gold.

- We believe a pullback in the overbought gold market will be necessary for U.S. equities to stabilize and move higher in the coming months.

Conclusion: In sum, the confluence of these three events occurring would greatly impact our near-term cautious view, making us more constructive on equities, believing that the current market correction has ended.

***

Looking for Three Signs of a Market Bottom - September 1, 2011

Appendix A – Important Disclosures

Full disclosures for all companies covered by TD Securities Inc. can be viewed at https://www.tdsresearch.com/equities/coverage.disclosure.action

Research Dissemination Policy

TD Waterhouse makes its research products available in electronic format. TD Waterhouse posts its research products to its proprietary websites for all eligible clients to access by password and distributes the information to its sales personnel who may then distribute it to their retail clients under the appropriate circumstances either by email, fax or regular mail. No recipient may pass on to any other person, or reproduce by any means, the information contained in this report without the prior written consent of TD Waterhouse.

Analyst Certification

The TD Waterhouse Portfolio Advice & Investment Research analyst(s) responsible for this report hereby certify that (i) the recommendations and technical research opinions expressed in the research report accurately reflect the personal views of the analyst(s) about any and all of the securities or issuers discussed herein and (ii) no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the provision of specific recommendations or views contained in the research report.

Conflicts of Interest:

The TD Waterhouse Portfolio Advice & Investment Research analyst(s) responsible for this report may own securities of the issuer(s) discussed in this report. As with most other TD Waterhouse employees, the analyst(s) who prepared this report are compensated based upon (among other factors) the overall profitability of TD Waterhouse and its affiliates, which includes the overall profitability of investment banking services, however TD Waterhouse does not compensate analysts based on specific investment banking transactions.

TD Waterhouse Disclaimer

The statements and statistics contained herein are based on material believed to be reliable, but are not guaranteed to be accurate or complete. This report is for information purposes only and is not an offer or solicitation with respect to the purchase or sale of any investment fund, security or other product. Particular investments or trading strategies should be evaluated relative to each individual’s objectives. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance. This document does not provide individual, financial, legal, investment or tax advice. Please consult your own legal, investment, and tax advisor. All opinions and other information included in this document are subject to change without notice. The Toronto-Dominion Bank and its affiliates and related entities are not liable for any errors or omissions in the information or for any loss or damage suffered.

TD Waterhouse Canada Inc. and/or its affiliated persons or companies may hold a position in the securities mentioned, including options, futures and other derivative instruments thereon, and may, as principal or agent, buy or sell such securities. Affiliated persons or companies may also make a market in and participate in an underwriting of such securities.

TD Waterhouse represents the products and services offered by TD Waterhouse Canada Inc. (Member – Canadian Investor Protection Fund), TD Waterhouse Private Investment Counsel Inc., TD Waterhouse Private Banking (offered by The Toronto-Dominion Bank) and TD Waterhouse Private Trust (offered by The Canada Trust Company).

TD Securities Disclaimer

“TD Securities” is the trade name which TD Securities Inc. and TD Securities (USA) Inc. jointly use to market their institutional equity services.

TD Securities is a trade-mark of The Toronto-Dominion Bank representing TD Securities Inc., TD Securities (USA) LLC, TD Securities Limited and certain corporate and investment banking activities of The Toronto-Dominion Bank.

Trade-mark Disclosure

Bloomberg and Bloomberg.com are trademarks and service marks of Bloomberg Finance L.P., a Delaware limited partnership, or its subsidiaries. All rights reserved.

All trademarks are the property of their respective owners.

®/ The TD logo and other trade-marks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or in other countries.