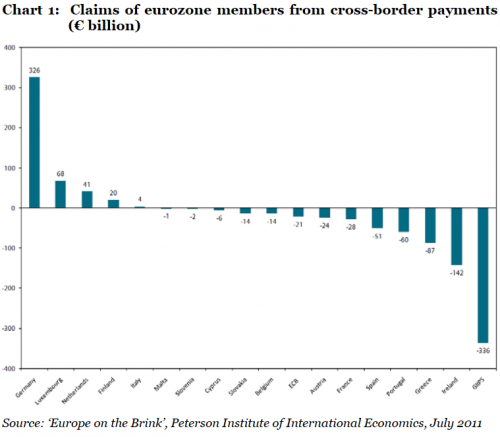

Germany’s role in all of this is pivotal. If you have any doubts, look at chart 1 below. Germany has almost single-handedly carried the eurozone through the crisis so far. Germany, however, demands responsibility from its troubled partners (which is fair enough). Merkel knows that with the next German parliamentary elections little more than a year away, domestic politics will increasingly set the stage for her in the months to come. She knows she is in a mine field and will have to step carefully.

In German culture, responsibility equals austerity, but austerity translates in to slow growth, and slow growth is the last thing the troubled eurozone countries need right now. There is thus a fundamental clash between the demands made by Germany and the needs of its partners. For precisely that reason, our political leaders need to think out-of-the-box, if the eurozone is going to survive this crisis. Here is what I think is needed:

1. Establish a credible lender of last resort. The EFSB with €440 billion of fire power3 is a bad joke. Italy resides over the third largest bond market in the world with €1.8 trillion of sovereign debt outstanding, €700 billion of which must be rolled over the next 3 years. We estimate that at least €2 trillion would be required to make the EFSF credible.

2. Get the debt restructuring over with. The current policy of ‘pretend and extend’ is extremely damaging, and the sooner our political leaders bite the bullet and accept a haircut is required on Greek, Irish and Portuguese debt, the better.

3. Support the banking system, not the sovereigns. A haircut of 40- 60% on Greek, Irish and Portuguese sovereign debt will undoubtedly put several banks in to trouble. If the banks go down, we all go down, so supporting them is critical. Where does the money come from? From the same sources which would have provided the funds to prop up the sovereigns (which is no longer required, following the haircut).

4. Eliminate red tape. Labour market reforms are required across the eurozone. The Spanish prime minister will tell you he has already done a lot to make Spain a more productive country. The reality is that he is less than a mile into a marathon run in the Gobi desert. This will be painful but utterly necessary. Other reforms will also be required. The September letter will focus on one particular idea I have which could revive residential property markets around the world. Stay tuned.

5. Think the unthinkable: fiscal union. I do not for one second believe a monetary union can survive longer term without full fiscal integration. Throughout history, there is not a single successful example. The question is whether Merkel can convince her countrymen (including herself) to join a fiscal union with countries which have proved terribly inept at managing their fiscal affairs? I suspect the answer is no.

The eurozone is well and truly in Dire Straits (for reasons which are largely self imposed). Only time will tell whether the political leadership in Frankfurt and Brussels can deliver Brothers in Arms or if it will all be Money for Nothing. Thus far they have been pretty good at delivering rhetoric, but rhetoric has no staying power, and their willingness to take tough decisions remains unproven. Today the ECB is buying Italian and Spanish government bonds. Let’s see what their appetite is like when they have spent €1 trillion and markets remain fragile. For this and the other reasons I have stated previously, my money remains on a complete restructuring of the euro.

1 Source: ‘Europe on the Brink’, Peterson Institute of International Economics, July 2011

2 http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/100011278/pleaseeurope- either-put-up-or-break-up/

3 As the EFSB will be keen to protect its credit rating, only about €250 billion of the €440 billion in the rescue fund will in fact be available for lending purposes.

Niels C. Jensen

© 2002-2011 Absolute Return Partners LLP. All rights reserved.