Expect the unexpected

by Capital International Asset Management

So far, 2011 has been marked by natural disasters in Japan, escalating unrest across the Middle East and North Africa, surging oil prices, Standard & Poor’s downgrade of the U.S. long-term credit rating, and volatility in the global stock markets.

Clearly, recent events have shown the world remains an uncertain place, says Capital Research and Management Company (CRMC) portfolio manager Jim Rothenberg. But over his 40 years of investment experience, Jim says he’s come to expect the unexpected. “Those four decades of experience have led me to the conclusion that surprise and change and the unexpected are the norm, not the unusual,” Jim says.

Standard & Poor’s 500 Composite Index has also experienced its share of “shock events,” but for many decades the market has demonstrated an ability to overcome adversity. The market’s resilience has been particularly evident in its climb from the March 2009, an advance that is largely due to solid company earnings, says CRMC portfolio manager Greg Johnson.

“Earnings have been one of the key determinants of the market’s strength, and that’s a testament to how well corporate America has done over the last couple of years,” according to Greg. He and other portfolio counselors attribute much of the strength of the U.S. market to opportunity for U.S. companies. “The developing nations are fueling overall world growth,” says CRMC portfolio manager Claudia Huntington. “As the world becomes more integrated, where a company is headquartered isn’t as important as where it does its business. Well-managed companies in industries that have global characteristics expand to where they can find opportunities.”

Although the economy, markets and political events have commanded attention recently, the focus for investment professionals at the Capital organization remains on finding companies with sustainable growth prospects, strong cash flow and healthy balance sheets. “Over time, if you invest in successful, leading companies, we believe that approach will be more consistently rewarding than basing investment decisions on some estimate of future macroeconomic developments,” says CRMC portfolio manager Brad Vogt.

Uncertainty is likely to always be a factor for investors, Rothenberg says. “I think a diversified portfolio is the best prescription, and that portfolio should explicitly address the realities of a much more global world,” Jim says. “But don’t forget to expect the unexpected, because next time will also be full of surprises.”

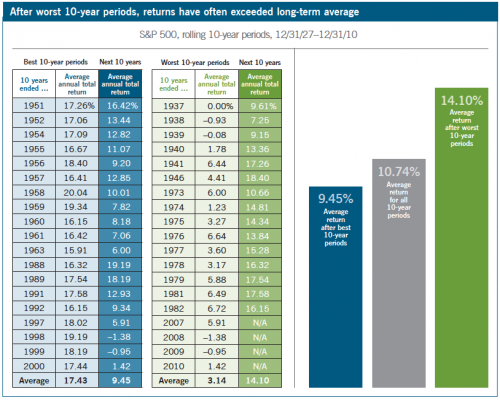

Over the S&P’s history, periods of strength have often followed weakness

Source: S&P. Based on average annual total returns in US$ of 74 rolling 10-year periods, divided into quartiles. The range of returns for each quartile is as follows: Quartile 1 (top/best quartile), 15.91% to 20.04%; Quartile 2, 11.06% to 15.28%; Quartile 3, 7.06% to 10.66%; and Quartile 4, –1.38% to 6.72%. The average return for the years after the best and worst periods is the average of the average annual total return of the periods following each period in the top and bottom quartile, respectively. Data are not available for future 10-year periods; therefore, the last return for the “next 10 years” is for the period 12/31/00– 12/31/10. The S&P 500 Index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or taxes.

- Over time, the stock market has demonstrated strength in the face of adversity.

- The chart depicts the best and worst 10-year returns for the S&P 500 since 1927. The 10 years ended December 31, 1958, had the highest average annual return, or 20%.

- The data for the worst 10-year periods show that the market has demonstrated the ability to recover and advance after extended periods of decline. Past returns aren’t predictive of future results, but history suggests that equity investing may still hold opportunity for long-term investors.

“Investors who stay the course will be better

positioned to participate in the market’s eventual

recovery. The key is to maintain a longterm

view and a well-diversified portfolio.”

— Jim Rothenberg, portfolio manager,

Capital Research and Management Company

click image to enlarge

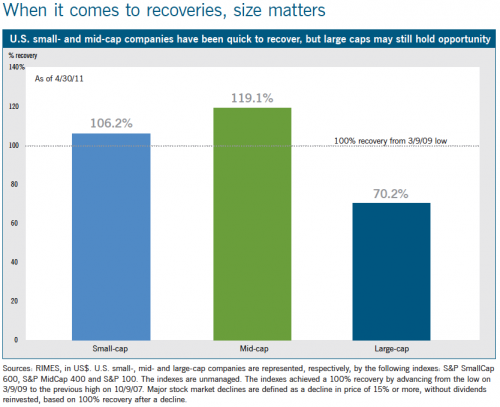

- Every recovery is different, the size of a company may be a factor in how its share price is affected by economic and market cycles. Historically, smaller companies have been the most severely impacted by an economic downturn or market decline. If they survived, smaller companies have also been most likely to experience the most dramatic increases. Conversely, the value of large companies has been slower to rise.

- The chart shows that since the low on March 9, 2009, the advance among U.S. small- and mid-cap companies has outpaced larger companies.

- Large companies have fared relatively well, but they haven’t experienced the same surge since the market’s bottom and may be undervalued.

“You can invest in a number of large-cap

stocks with great balance sheets, cash flow,

earnings outside the U.S., that are

reasonably managed, for about 80% of

what the market multiple is for

small- and mid-cap stocks.”

— Greg Johnson, portfolio manager,

Capital Research and Management Company

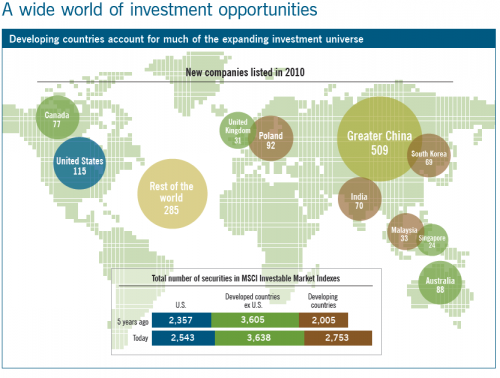

Source: Ernst & Young, Global IPO Trends, 2011; FactSet; and MSCI USA, MSCI World ex USA and MSCI Emerging Markets Investable Market Indexes. The MSCI Investable Market Indexes represent approximately 99% of the equity investment opportunity set. For the U.S. and other developed countries, the minimum market capitalization is $342 million; for developing countries, it is $171 million. The number of new companies shown for each country on the map represents initial public offerings (IPOs) attributed to the domicile nation of the company undertaking an IPO, as of December 2010. Greater China includes China, Hong Kong and Taiwan. The rest of the world constitutes 64 countries with 1% or less IPO activity by number of listings or capital raised. The total number of securities shown in the bar chart for each country/country group labeled “5 years ago” and “Today” is as of May 2006 and May 2011, respectively.

- Around the world, the number of listings for new companies regained traction in 2010, with 1,393 initial public offerings. The capital raised in 2010 was double the amount raised in either 2008 or 2009.

- The bulk of the action occurred in greater China, where 509 new listings raised nearly $132 billion in capital, nearly half of the funds raised globally during 2010.

- The evolution of equity markets has been under way for several years, led by developing countries.

“The brisk growth in China, India and much

of the emerging world has opened up new

markets and business opportunities.”

— Carl Kawaja, portfolio manager,

Capital International – Global Equity

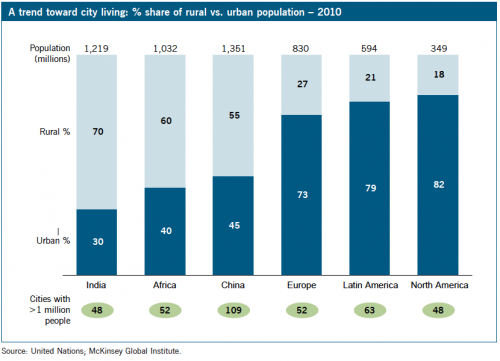

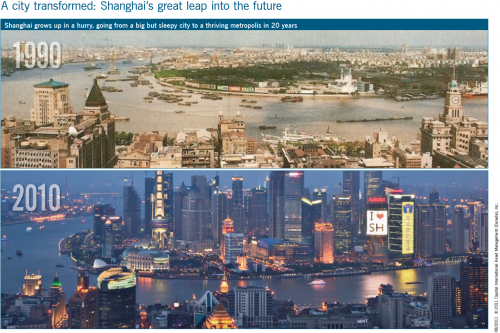

Urbanization: A trigger for infrastructure growth and consumer spending

- Rapid urbanization offers opportunity for global companies, as more people leave subsistence agriculture for better economic opportunities in cities worldwide.

- Africa is now almost as urbanized as China and has as many cities with 1 million people as Europe. China has more cities with 1 million people than any other region.

- As incomes rise, demand grows for consumer goods, schools, railroads, financial services and hospitals. Many of the companies that appear well-positioned to benefit from expansion into developing countries are based in the United States and Europe.

“I believe this is an extremely strong

tailwind, and it’s one of the most positive

long-term factors in building portfolios at the

Capital organization.”

— Shelby Notkin, portfolio manager,

Capital International – U.S. Equity

click image to enlarge

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The statements expressed herein are informed opinions, speak only to the stated period, and are subject to change at any time based on market or other conditions. Additionally, in the Multiple Portfolio Counselor System, differences of opinion are common, and the opinions expressed by an individual do not necessarily reflect the consensus of the team. Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. This document is for informational purposes only and is not intended to provide any tax, legal or financial advice. Capital International Asset Management (Canada), Inc. or its affiliates assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained about each product or firm, as the case may be, has been supplied without verification by us and may be subject to change. The Capital International portfolios are available through registered dealers. For more information, please consult your financial and tax advisors for your individual situation. Capital International Asset Management (Canada), Inc. is part of The Capital Group Companies, Inc., a global investment management firm originated in 1931. Our funds are subadvised by our affiliates, Capital Research and Management Company and Capital Guardian Trust Company (part of Capital Group International, Inc.). These groups, which manage equity assets independently from one another, are among the world’s largest providers of global/international equity investment services. Some of the investment professionals featured are not directly involved with managing the Capital International portfolios.

Visit us at http://capitalinternational.ca