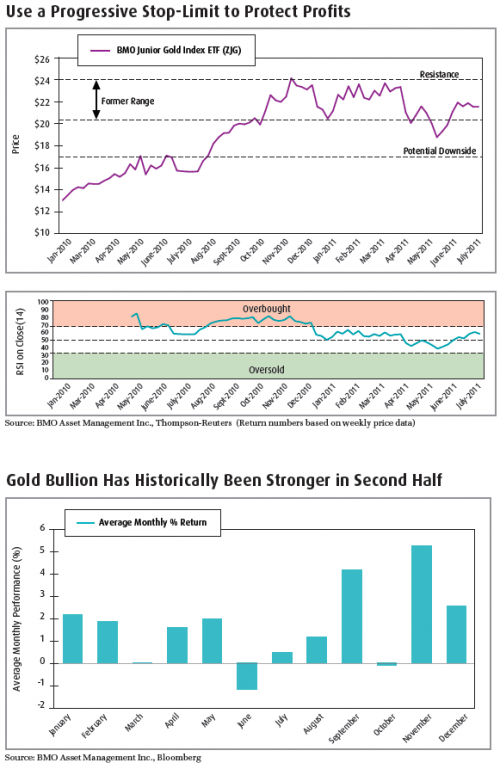

We would like to stress that gold bullion and gold related equities are not one in the same. The risk profile between the two can be extremely different at times. As highlighted in our July 5th Trade Opportunities report entitled Bullion and Gold Equity Divergence, gold bullion gained between the period of May 5 to July 1, whereas gold equities fell. Although gold equities have a tendency to lead gold itself, we believe in this case, the divergence of the gold bullion to gold stocks pair ratio (the “Ratio”) was driven by equity market risk. Since that report, where we recommended the BMO Junior Gold Index ETF (ZJG) to play a potential convergence of the Ratio to its 52-week MA, ZJG has gained 8.4% compared to gold bullion’s 6.3% gain (in C$) over the same time period. As we view $24 as ZJG’s prior resistance level, we would be closely watching how it reacts around that price. Whereas we recommended using a 10% stop limit below its entry price for those readers who acted quickly, we would now be instead using a progressive stop, raising the stop limit to 5% below its current trading price to protect profits already made. By doing so, investors can mitigate their downside while keeping the upside potential.

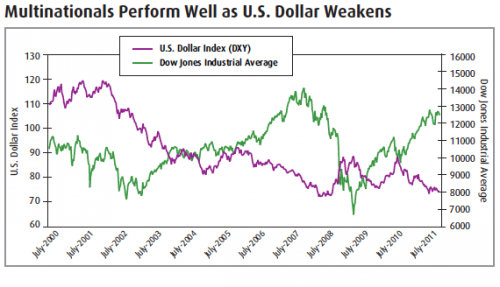

Weak Greenback Favours Multinationals

The major equity allocation call we made coming into the new year was paring back emerging market equity exposure in favour of U.S. equities. Given major emerging markets such as China and India are focused on taming inflation, we believe this will continue to cause headwinds for the equity markets of developing economies. With the People’s Republic recently reporting CPI at 6.8%, a three-year high, we expect further monetary tightening to come; particularly considering its recent GDP number came in at 9.6%, considerably higher than its soft target of 7% that was verbally mentioned earlier in 2011 by Premier Wen Jiabao. The ongoing concerns of Chinese reverse take-overs (RTO’S) may also lead some investors to decrease their exposure to China. Although we remain bullish on emerging market economies over the long-run, we continue to be less positive of their equity markets for the time being. Many U.S. firms on the other hand remain very healthy. Despite the ailing public sector, the American private sector remains solid with high cash levels. We continue to prefer larger multi-national companies, as a growing portion of their revenues are derived from non-U.S. countries and the growing middle class in emerging market economies. In addition, we expect the U.S. dollar to be in a secular decline, regardless of the decision on the U.S. debt ceiling. Since some of these multinationals have costs in U.S. dollar but revenues in other currencies, this should further assist larger U.S. blue-chip companies to improve their bottom line.

Potential Investment Opportunity:

- BMO Dow Jones Industrial Average Hedged to CAD Index ETF (ZDJ)

Despite the lack of consistent trends in asset markets, one market characteristic that has become reliable has been volatility and frequent sentiment changes. We unfortunately see this condition persisting for much of the second half of 2011 as we do not expect much of this uncertainty to be resolved in the near future. The European sovereign debt issues look far from over and with an aging demographic placing further strain on its balance sheet through social security programs, this will place further strain on the U.S.’s debt position. In the coming months, investors will likely see sharp rallies and sell-offs. As a result, rather than trying to trade momentum, which has been successful in recent years, slow and steady should win the race as investors focus on lower volatility and higher yielding strategies to mitigate constant market sentiment changes.

Copyright © BMO ETFs