The quickening of inflation is serving as a warning that the Bank of Canada has to do something to curb pressure with normal monetary policy measures in the coming months, says BCA Research, in its Daily Insight on Canada. Also prefaced is that this development should translate into a stronger Loonie.

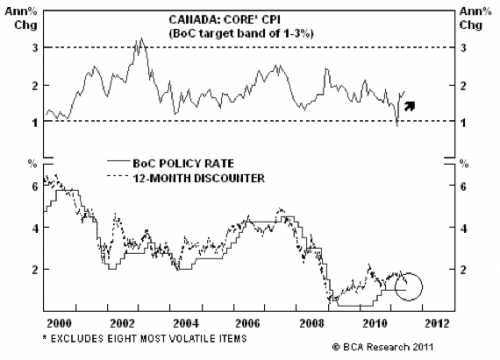

Canada's CPI experienced a greater-than-forecast month-over-month increase of 0.7% during May. Although this monthly increase was led by by food and energy, the core rate CPI rose by a strong 0.5% month-over-month. The underlying rate of inflation as measured by the Bank of Canada accelerated to 1.8% annualized, and this was far greater than the 1.4% forecast made by BoC in the latest Monetary Policy Report. As a result of worries over U.S. growth, Europe's debt crisis, and hard landing fears in China, interest rate futures had all but discounted the need for higher policy interest rates for the next year ahead.

Despite those worries, it appears the Canadian economy is indicating that a tightening of monetary policy is required.

Housing is showing signs of bubbling, and there is pressure on the labour front, says BCA.

Yesterday's CPI report contained warnings that spare capacity within the Canadian economy is nearly used up. Notwithstanding external economic shock, the monetary tightening cycle should be resumed later this year. So long as U.S. Fed policy stands down, spreads between short term interest rates will widen, making conditions favourable for the Canadian dollar and Canadian bonds will underperform its counterpart U.S. treasuries, assuming currency is hedged.

Source: BCA Research