A Soft Patch RENOVATION

by James Paulsen, Chief Investment Strategist, Wells Capital Management (Wells Fargo)

A string of disappointing economic releases topped off by last Friday’s weak monthly job report have intensified anxieties in the financial markets. The economy is certainly in a soft patch and the stock market has been in a trendless consolidation phase since mid-February. The soft patch, however, appears primarily due to a combination of temporary factors (e.g., abnormally bad weather and Japanese earthquake fallout) and forces which are either ending or reversing (e.g., surging energy prices, higher mortgage yields, and tightening actions of emerging world policy officials). Consequently, although current economic conditions are soft, this slowdown should prove temporary and we expect economic growth to improve again to about 4 percent during the second half of this year.

Rather than get caught up in a summer drama over how protracted this soft patch will prove, investors should instead focus on how much “renovation” is quietly being accomplished during this period of stock market consolidation. Several problems faced earlier this year have largely been arrested and some missing components of this recovery are finally emerging. We suggest investors take note of several positives resulting from renovations quietly taking place amongst all the “soft patch” angst.

Renovation #1: Job Creation Has Nearly Doubled!

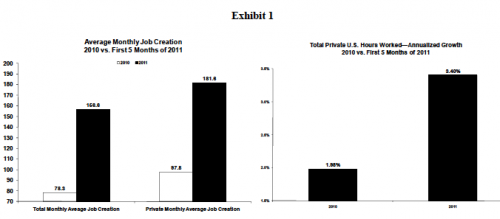

As illustrated in Exhibit 1, despite the recent weak job numbers, the pace of job creation so far in 2011 is nearly double what it averaged in 2010! Moreover, the annualized growth in hours worked is a robust 3.4 percent so far this year compared to slightly less than 2 percent last year. Since hours worked plus productivity growth equals real GDP growth, despite official reports suggesting much slower growth, by this measure, real GDP may be growing by more than 4 percent this year!

Similar to the last two recoveries, job creation during this recovery has been delayed and so far subdued. However, during this period of stock market consolidation and even while attention has turned to a soft patch, the pace of job creation has markedly improved this year. Job reports tend to be highly volatile and are often subject to significant revisions. Perhaps investors are best served by ignoring short-term wiggles and staying focused on longer-term job market trends which seemingly have been successfully “renovated” since year end.

Renovation #2: Credit Creation is Emerging!

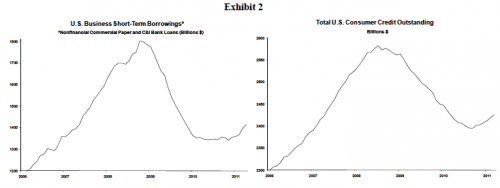

An important missing component of the current recovery—borrowing and lending—has also recently emerged. Exhibit 2 illustrates that business short-term borrowing has been rising steadily since last November. Indeed, during the last six months, C&I loans plus nonfinancial commercial paper has risen at a robust 9.3 percent annualized pace! Moreover, while not nearly as robustly, consumer credit has also started to rise for the first time in this recovery. Total consumer credit has now increased in each of the last six months after declining continuously since January 2009.

Underneath the stock market’s trendless consolidation of recent months is a major improvement in the pace of job creation and the introduction for the first time in this recovery of some credit creation. These “renovations” will probably prove more important for the investment outlook than will ongoing evidence of a summer soft patch.

Renovation #3: Emerging World Soft Landing!

During the last year, many worried emerging world economies were overheating, were increasingly showing evidence of entering a bubble, and were at growing risk of a collapse. Meanwhile, emerging world policy officials were vigorously implementing tightening policies aimed at moderating recoveries and hopefully producing a soft landing. Indeed, the tightening policies employed by emerging officials combined with recent evidence emerging economic recoveries have slowed have contributed to the trendless stock market since February and to the intensifying domestic “soft patch” fears of recent weeks.

However, it appears the emerging economic recovery has achieved a soft landing. Recent economic reports from several emerging economies seem to confirm a notable slowing in economic growth to a more sustainable moderated pace. In China, for example, annual real GDP growth had accelerated to almost 12 percent in March 2010 but has since moderated to slightly less than 10 percent in the last year. So while slower emerging world growth is currently being felt in the U.S. economy, longer-term, by avoiding a potential bubble economy within the emerging world, the sustainability of the U.S. recovery has likely been markedly enhanced.

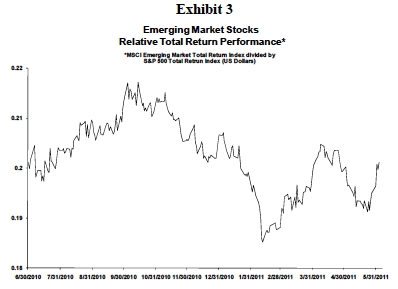

We are particularly encouraged by the recent performance of emerging world stocks. Exhibit 3 illustrates the relative (to S&P 500 Index) total return performance of emerging market equities. These stocks underperformed significantly between September 2010 until March of this year reflecting the tightening of economic policies in these regions and a future expected slowdown in emerging economic growth. Since March and particularly in recent weeks, however, emerging stocks have again been outperforming. Does the stock market perceive a soft landing has been achieved and emerging world policy officials will soon cease tightening?

Renovation #4: Surging Commodity Prices Arrested!

Earlier this year, surging commodity prices and escalating input costs were beginning to pressure profit margins at many U.S. companies, were causing investor inflation expectations to rise forcing long-term yields higher, were weighing on the valuation of the stock market, and finally were increasingly pressuring the Federal Reserve to begin tightening. As Exhibit 4 shows, however, the upward trend in commodity prices seems to have recently been arrested.

Renovation #5: Surging Energy Prices Stopped!

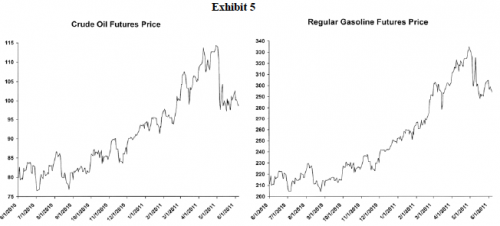

Similar to overall commodity prices, escalating energy prices had become a serious risk for the economic recovery. As shown in Exhibit 5, from last summer to their recent peak, gasoline futures prices rose by more than 50 percent! Certainly, the current “soft patch” in the economic recovery is at least partially the result of both businesses and households adjusting and paring budgets to compensate for higher energy outlays.

Like commodity price trends in general, though, the surge in “pump prices” has recently been stopped! So far, energy prices have declined by 10 to 15 percent from recent highs. Has this “renovation” of the energy and commodity markets set the stage for an economic revival during the last half of this year?

Renovation #6: U.S. “Dollar Dump” Has Paused!

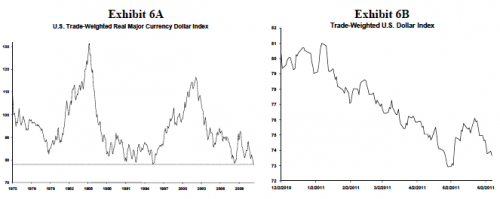

As Exhibit 6A shows, against major currencies, the real U.S. dollar declined to an all-time record low in April. Anxieties about “dollar dumping” has led to a growing perception of a loss of confidence in America which has unsettled investors, muted animal spirits, and raised questions about the leadership of U.S. government and economic policy officials. The chronically weak U.S. dollar also fueled the surge in energy and other commodity prices earlier this year.

Fortunately, the U.S. dollar has also recently been “renovated.” It recent weeks, as illustrated in Exhibit 6B, the persistent declining trend of the U.S. dollar this year has at least been interrupted.

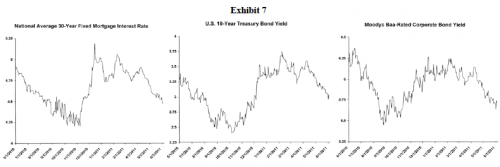

Renovation #7: Declining Bond Yields!

Exhibit 7 shows that between late last year until this spring, bond yields rose across the mortgage, corporate, and Treasury markets. Indeed, both the 10-year Treasury yield and the 30- year national average mortgage rate rose by about 1 percent! This rise in long-term interest rates certainly contributed to the current economic soft patch and has also pressured the stock market.

A quick renovation and suddenly long-term yields now represent a positive force for future economic growth and for the stock market. From their respective early-year peaks, long-term mortgage, Treasury, and corporate bond yields have declined by between 50 to 75 basis points!

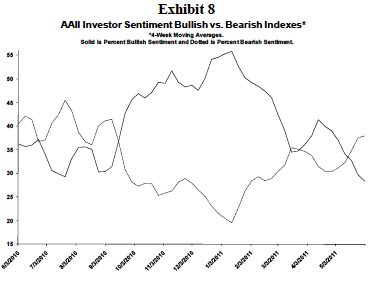

Renovation #8: “Gut-Checking” Bullishness!

During the summer 2010, bearish sentiment exceeded bullish sentiment by about 10 percent providing a solid backdrop for the subsequent rally in the stock market commencing last fall. As shown in Exhibit 8, however, by early spring, bullish sentiment had risen to almost 55 percent while bears had declined to less than 20 percent. Excessively bullish sentiment has caused the stock market to struggle since February.

Fortunately, while more work may yet need to be done, a significant renovation of investor sentiment has already been accomplished. Currently, like last summer, bears once again outnumber bulls by about 10 percentage points!

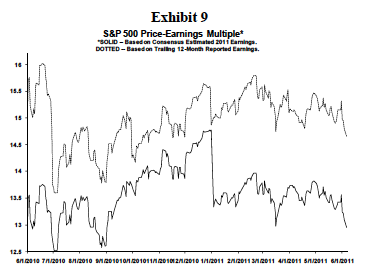

Renovation #9: A Revalued Stock Market!

As shown in Exhibit 9, the stock market has been significantly revalued during this period of financial market consolidation. Late last year, the S&P 500 sold above 15.5 times trailing earnings and close to 15 times one-year forward consensus estimates. Today, the S&P 500 valuation has declined to about 14.5 times trailing earnings and only 12.9 times consensus yearend estimated earnings. Indeed, as shown in Exhibit 9, the price-earnings multiple of the stock market is not that different than it was last summer even though the S&P 500 is almost 20 percent higher.

During this period of consolidation, stock market values have been renovated—prices have trended sideways while trailing and estimated earnings have continued to rise and while competitive bond yields have declined.

Renovation Summary!

No doubt, the economic recovery is in a soft patch and the stock market has accordingly been struggling in a trendless pattern since early February. Perhaps, economic data will remain soft in the weeks ahead and the stock market could be in for a sloppy summer. However, the “renovation process” has been underway for several months. Investors are probably best served by focusing on how these many improvements are likely setting the foundation for yet another cyclical run in the stock market to new recovery highs before the year is over.

Despite the weak jobs report last week, the pace of job creation has nearly doubled this year compared to 2010! While being absent so far in this recovery, lending and borrowing activities are beginning to make a subdued but nonetheless noticeable comeback. Emerging world officials have seemingly orchestrated a soft landing avoiding a potential bubble meltdown. As the emerging world recovery has slowed, commodity price concerns have eased, energy prices have peaked, and the persistently weak U.S. dollar since year end has recently found at least a temporary bid. Finally, bond yields have been renovated lower since February, excessively bullish sentiment has been extinguished and stock market values have been refreshed.

Economic soft patches and periods of stock market consolidations are always frightening. However, investors should not underestimate the eventual positive influence of the many good renovations which are taking place just below the surface of all the headlines of doom.