Is Elevated Stock Market Risk Premium a Secular or Cyclical Change?

by James Paulsen, Chief Investment Strategist, Wells Capital Management (Wells Fargo)

May 31, 2011

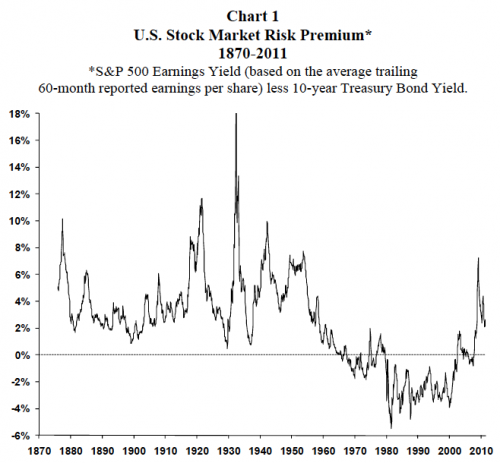

During the 2008 crisis, the risk premium associated with U.S. stocks (i.e., the difference between the stock market’s earnings yield and the 10-year Treasury yield) exploded and has since remained significantly higher compared to its range during the last 40 years. Many believe backto- back crises during the last decade have led to a permanent reassessment of risk or an enhancement in the return required by investors from the stock market relative to safer assets. Indeed, until the last 40 years, the risk premium associated with the stock market was persistently higher than it has been in recent decades. Therefore, today's elevated risk premium may represent a return to a range which was normal throughout most of U.S. history. In our view, however, the recent rise in the stock market risk premium represents a cyclical phenomena rather than a secular shift. It appears importantly tied to the destruction of U.S. confidence during the “Great Recession” and will likely persist only for as long as confidence remains near recession-like levels.

Whether the newly elevated range of the equity risk premium proves enduring or temporary is important for investors. If it has been permanently boosted, the stock market may already be nearing a full valuation. If the elevated risk premium proves temporary, however, the stock market probably offers compelling prospects since future returns can be enhanced simply by a slow but steady revitalization in economic confidence.

A History of the U.S. Stock Market Risk Premium

Chart 1 illustrates the history of the equity risk premium since 1870. Prior to the late 1960s, the earnings yield was usually at a healthy premium to bond yields. Indeed, between 1871 and 1965, the average stock market risk premium was 4.1 percent.

In the late 1960s, however, the risk premium dropped below its range of the previous 100 years and established a new trading range whereby bond yields typically exceeded the earnings yield. Between 1965 and 2007, the average risk premium was -1.5 percent. Only since the 2008 crisis, has the equity risk premium again undergone a watershed shift in its trading range, returning to the much higher range commonplace prior to the late 1960s.

Why has the equity risk premium undergone such radical changes in its trading range? The explanations are probably numerous. First, U.S. recessions occurred much more frequently prior to the 1960s then they have since. Second, prior to WWII, the Consumer Price Index changed little (bursts of inflation were typically offset by longer periods of mild deflation), but beginning in the late 1960s, consumer prices embarked on an unprecedented uninterrupted advance lasting several decades. Third, bond yields rose to all-time U.S. record highs in the 1970s and remained elevated above historic norms for most of the next three decades. Finally, the post-war era ushered in an economic policy approach which has since been much more supportive of economic expansions and much more aggressive in fighting recessions.