The Absolute Return Letter May 2011

The Case for Human Ingenuity

“When you buy commodities, you’re selling human ingenuity.”

Dylan Grice on why investing in commodities for the long run is a bad idea (SocGen Cross Asset Research, December 2010)

“This faith in the human brain is just human exceptionalism and is not justified either by our past disasters, the accumulated damage we have done to the planet, or the frozen-in-the-headlights response we are showing right now in the face of the distant locomotive quite rapidly approaching and, thoughtfully enough, whistling loudly.”

Jeremy Grantham on why the world is facing a paradigm shift on commodities (GMO Letter, April 2011)

Before I do anything else, please allow me, on behalf of Tricia, to thank the many of our readers who supported her during her recent marathon challenge. Tricia completed her very first marathon in 3:55 which we are all very proud of although, Tricia being Tricia, she thought she should have done better. More importantly, though, because so many of you chose to support her, she blew right through her target and ended up collecting over £3,000 for Breast Cancer Care. She has asked me to mention how much this meant to her and how grateful she is for your support.

On 1st March 2004 we published what I still consider the most controversial letter I have ever written. In the letter I predicted that oil prices would exceed $100 per barrel within the next decade (you can see it here). That morning (Brent) oil prices were hovering just over $33, and $100 oil prices seemed a ridiculous prospect to most people. Almost exactly four years later, on 29th February, 2008, the $100 barrier was broken for the first time.

The End of the Oil Era I don’t think I have ever written a letter which provoked more reaction, much of it of the kind that is not suitable for re-production. And, no, I am not reminding you of this fact just to cover myself in glory. In fact, it was not even my own idea; the logic behind the outrageous forecast came from our economic adviser, Woody Brock. The reason I bring it up now is that, after careful consideration, I have decided to reverse my long-standing bullish view on oil prices, as I believe we are approaching the end of the oil era - and this time Woody Brock has nothing to do with it, so don’t blame him if I turn out to be wrong.

There are essentially three reasons why I think oil prices will go through a rather dramatic correction over the next several years:

1. Many investors who, in recent years, have added commodities to their portfolios as a hedge will ultimately be disappointed by the lack of diversification this asset class offers;

2. Governments and regulatory authorities, both in Europe and the United States, have effectively declared war on commodity speculators, and the area will become subject to a lot more scrutiny and regulation in the years to come;

3. A number of new alternative energy forms are in much more advanced development than many investors realise and will, over the next 3-5 years, become serious alternatives to oil, particularly as far as transportation is concerned.

There is enough material on this subject for a book, let alone a newsletter. I always try to limit myself to no more than 7-8 pages, as anything longer than that is likely to end up in the trash bin. For that reason, I will only touch briefly on the first two subjects in this letter and then pick up on them at a later stage. Most of this letter will instead focus on the third and final point listed above.

Don’t go short (yet) Before you short everything that contains the letter sequence OIL, let’s pause for a reality check. The current lack of stability in the MENA region and the recent killing of Osama bin Laden certainly increases the probability of short term supply disruptions and hence higher oil prices. Hence I wouldn’t be at all surprised, if oil prices actually rise further before they come down quite spectacularly. Furthermore, given crude oil’s versatility (it is the key ingredient in lubricants, plastics, certain types of fabrics and asphalt to mention but a few), the world is not likely to run out of ideas on how to find uses for oil anytime soon.

However, that is not required for oil prices to collapse. The oil market is a finely balanced creature characterised by inelasticity on the supply as well as the demand side. With just over 60% of the 89 million barrels consumed every day going towards transportation, all you need is for one or two of the groundbreaking new technologies to come through, and the wind will come out of the oil price.

On an equally pleasant note (I am in my optimistic mood today), it could also mean the end of current day geopolitics, where we are forced to suck up to the tyrants who run many of the oil rich countries. What a delightful thought!

Commodities a diversifier? I first wrote about the growing importance of financial investors in commodity markets in the May 2010 Absolute Return Letter and concluded that there is a strong link between the rapidly growing interest in commodities from the financial community and the rise in commodity prices.

Financial investors have fallen in love with commodities for at least three reasons – (i) they are considered an effective hedge against inflation, (ii) they are perceived to be an excellent diversifier in a traditional portfolio due to the low historical correlation with bond and equity returns, and (iii) they are seen as a play on the growing dominance of emerging market economies.

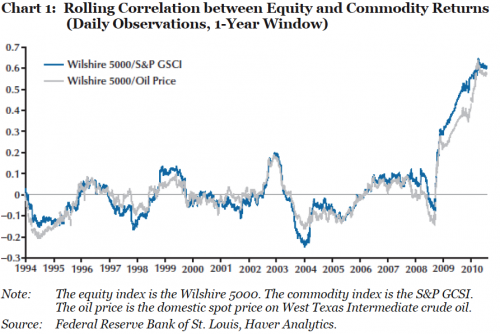

Commodities certainly used to be a great diversifier, but that was before financial investors invaded the space. Now, as investors look to gain exposure to emerging economies through commodities, investing in this asset class has become a risk trade rather than a risk diversifier. A recent study conducted by the Federal Reserve Bank of St. Louis1 highlights the problem as demonstrated by chart 1. My prediction is that there will be more than a few disappointed commodity investors when we go through the next significant equity bear market and commodities don’t offer investors the protection they used to.

It has been obvious for several years now that demand for commodities from the financial sector has been on the rise but, at the same time, there is no denying that so has commercial demand (mainly due to sharply rising demand from China and other emerging economies). What remains unclear is precisely how much comes from one source and how much from the other.