Breakdown: Commodities Tumble … For Good?

Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.

May 16, 2011

Key points

- "When in doubt, get out" has become the mantra for commodities traders the past couple of weeks.

- Sentiment had become too one-sided (and may need to ease even further).

- Is risk-on, risk-off trading finally coming to an end, and can fundamental analysis prevail?

We've written a lot about the "risk-on, risk-off" trading environment prevalent over the past several years. Risk on is basically when investors have been feeling better about the global economy and about the markets, so they buy and embrace more risky assets. Then, when fears rise—either longer-term fears or short-term fears driven by headlines—investors essentially avoid all risk—risk off.

In a turn toward "risk-off," commodity markets have taken it squarely on the chin the past two weeks, while stocks have had a tougher go at it as well.

We've been consistent in our view recently that commodity markets were at risk of a pullback. There are five key reasons it was triggered:

- Sentiment was tipped massively toward bullishness—a contrarian indicator suggestive of many "crowded trades" (silver was certainly one).

- Ultimately high commodity prices typically sow the seeds of their own destruction via their negative impact on demand.

- Monetary tightening in many emerging economies is pushing economic growth—and hence demand—lower.

- On May 5, European Central Bank President Jean-Claude Trichet failed to use the words "strong vigilance" in a talk, which in the past has been a consistent hint of a coming interest rate hike. As such, expectations for a near-future hike by the ECB virtually disappeared. The euro promptly tumbled against the dollar, with the dollar's strength contributing to the plunge in commodities.

- There's been a recent wave of margin requirement increases amid the volatility and price surges in several key commodities.

On that last point, many hedge funds and other large speculators have grown increasingly concerned not only about margins, but also time horizons. As pointed out in last weekend's Barron's "Commodities Corner," even with the advent of exchange-traded futures—where instruments can act like commodities but are actually equities—it's very difficult to make bets based on assumptions that take more than a year to play out. For retail investors, it's even less realistic … few investors are willing to venture beyond the 2012 contract months. This certainly is not an environment for the buy-and-hold type of investor.

The speculative fervor seems to have turned on a dime: The mantra has become, "when in doubt, get out." This has clearly not sat well with speculators on the long side of the commodities trade. In particular, confidence was shaken when it was divulged that the world's largest commodity hedge fund had losses of $400 million (relative to $5 billion in client assets) as a result of the collapse in crude oil prices.

But the decline can also be seen as healthy for the US and global economy, and ultimately the US stock market as well. The meaningful decline in oil, grain and textile prices is particularly positive for the emerging world given that tighter monetary policy was triggered largely due to these price escalations.

However, some are concerned that we're experiencing 2008 again, a year in which commodity prices spiked (to $143 in the case of crude oil) and then got crushed along with stock prices in the fall and winter of 2008-2009. Comparisons are being made between the subprime crisis then, which was ultimately not "contained," and the eurozone debt crisis today. We don't think it's an apples-to-apples comparison and that the global economy will not get taken down by the eurozone crisis; however, risk is certainly elevated.

Why the breakdown?

Let's focus on energy: Markets adjust themselves when prices reach extremes. High prices do two things: they depress demand while also accelerating supply increases, as producers ramp up production to capitalize on higher prices. On top of that, the killing of Osama bin Laden took the geopolitical risk premium in energy prices down a significant notch. This event also had the knock-on effect of boosting confidence in a near-term exit of Muammar Gaddafi from Libya, another source of increased geopolitical risk premium.

The price of West Texas Intermediate crude futures hit $114 per barrel at the end of April and plunged to the high-$90s over the past two weeks—the biggest drop in crude oil prices in more than two years. As per the aforementioned supply/demand reaction functions, the US Energy Department showed last week that US inventories of crude oil were up nearly 3.8 million barrels to a little more than 370 million. US gasoline inventories increased nearly 1.3 million barrels to just less than 206 million, the first gain in three months. US crude inventories are now at their highest level since May 2009, when crude oil prices were less than $60 per barrel.

In addition, growth is slowing in China. If you assume that China's energy consumption will be in line with assumptions in its recently-released five-year plan, China's oil demand will grow much more slowly than was the case following the prior five-year plan's release.

Effect of speculators

The sharp tumble in prices was enough to trigger a five-minute halt in trading of crude oil, heating oil and gasoline futures for the first time in more than two years on May 11 on the Chicago Mercantile Exchange. The chart below is telling if you're wondering about the role of speculators in the oil futures market. According to Ned Davis Research (NDR), open interest in crude oil futures is greater than peak 2008 levels. And, net speculative length (a fancy phrase describing the net long or net short position of large speculators), seen below, is well above peak 2008 levels … even accounting for the latest drop.

Parabolic Speculation in Oil Futures

Click to enlarge

Source: NDR, Inc. (Further distribution prohibited without prior permission. Copyright 2011 (c) Ned Davis Research, Inc. All rights reserved.), as of May 13, 2011.

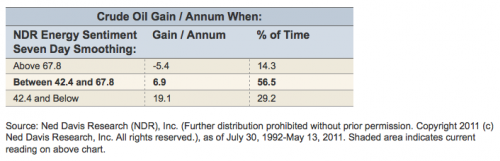

The bottom line is that if speculators continue to lose interest in being long oil futures, prices could fall even further. The drop in prices has finally started to damp sentiment toward oil, another recent warning sign. As you can see below, NDR's Crowd Sentiment Poll for Energy Futures shows investors' optimism has just come off the boil, but remains well above a level that would suggest a better environment for another oil rally (see accompanying table).

Energy Optimism Coming Down

Click to enlarge

Source: Ned Davis Research (NDR), Inc. (Further distribution prohibited without prior permission. Copyright 2011 (c) Ned Davis Research, Inc. All rights reserved.), as of May 13, 2011.

Cheaper to fill our gas tanks?

For those looking for an immediate reprieve in prices at the pump or a boost to the stock market, you may have to be patient. Crude oil accounted for about 68% of the price of a gallon of gasoline as of March 2011, according to the US Energy Department, with both crude oil and gasoline prices typically moving in tandem on similar market fundamentals. However, although crude oil and gasoline inventories have ticked up, gasoline inventories are still more than 21 million barrels lower than a year ago, and could dip below the normal range before the summer driving season begins.