Also exacerbating the oil-gasoline differential is the flooding of the Mississippi River, which is causing pipeline closures and fuel transportation disruption in tankers and barges. Nearly 15% of total US refining capacity is located in regions affected by the flooding. In addition (and unfortunately for those of us who drive cars), gasoline prices at the pump typically react a lot faster to spikes in oil prices than to declines.

Good for stocks?

The weakness in oil and other commodities has caused some rough sledding for stocks, too. One would think a reprieve in commodity prices would improve economic prospects, and in turn the outlook for stocks. But recently the correlation between commodities and stocks has been high. That's partly a function of the risk-on/risk-off environment and the "dollar carry trade," which involves selling the US dollar in order to buy riskier asset classes, including both commodities and stocks.

You can see the huge spike in the correlation between crude oil and the S&P 500 that began in late-2008, when risk-on, risk-off trading first began in earnest. It's been our view that this elevated correlation was not to be long-lasting, and as you can see, the correlation has begun to ebb. We may not be there yet, but we do believe stocks can and should decouple from commodity prices at some point.

Correlation Between Oil and Stock Market Finally Coming Down

Click to enlarge

Source: FactSet and Ned Davis Research (NDR), Inc. (Further distribution prohibited without prior permission. Copyright 2011 (c) Ned Davis Research, Inc. All rights reserved.), as of May 13, 2011.

Dollar gets a lift

Another reason for the move from risk-on to risk-off trades has been the strength in the dollar. Much as sentiment about stocks acts as a contrarian indicator, so does sentiment on currencies. In the recent past, when I've suggested sentiment toward the dollar had become too one-sided and that a rally could occur, it's been met with surprise. Frankly, I've never seen sentiment so one-sided on any asset class or investment theme.

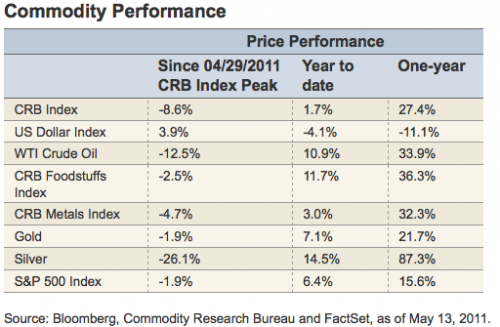

Well, the trade-weighted dollar index is up 4% since commodities topped out at the end of April. They're related as traders have been covering short positions in the dollar and selling long positions in commodities.

You can see an interesting NDR dollar sentiment chart below and the accompanying performance table. Sentiment toward the dollar has just ticked up, albeit marginally. In the table you'll see that the best time to be long the dollar is when sentiment moves up into the neutral range from extreme pessimism. I think we're likely to see that again in short order.

Sentiment Still Pessimistic About Dollar … but Improving

Click to enlarge

Source: Ned Davis Research (NDR), Inc. (Further distribution prohibited without prior permission. Copyright 2011 (c) Ned Davis Research, Inc. All rights reserved.), as of May 13, 2011.

According to NDR, the weakness in the dollar accounted for about one-third of the commodity price rise in this cycle. The action in the US dollar and crude oil will probably hold the key for all commodity markets in the near term. If the dollar has embarked on a sustained upward move, that would be negative for oil and likely many other commodity futures markets.

Square the circle?

In the longer term, the global demand story is largely intact and commodities may continue to behave as a bellwether for global growth. But we're beginning to see a story of demand destruction unfold where rising commodity prices choke off some economic growth.

In those countries that experience troubling inflation spikes (like in emerging economies recently), monetary authorities will need to step on the brakes, thereby slowing growth and weakening demand. It's circular and could mean periods of elevated volatility.

We may not be there yet, but I do think stocks can resume their upward move without commodity leadership. In fact, if the stock market were to regain its upward momentum solely because of resurging commodity prices, that would be a warning sign.

Let's not forget that during the 1980s and 1990s, the global economy was strengthening and stocks did quite well, but we had nearly uninterrupted weakness in commodity prices. In other words, the two don't always move in tandem. A retreat in commodity prices due to speculators' exit, and not a significant global growth slowdown, should ultimately benefit the economy, stocks and longer-term investors.

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Copyright © Charles Schwab & Co., Inc.