All Aboard the Earnings Train!

April 18, 2011

Gareth Watson, CFA – Vice President, Investment Management and Research, Richardson GMP

It was a tough week for North American markets as earnings season in the U.S. started off with Alcoa reporting results on Monday. Unfortunately Alcoa, along with other companies that reported this week such as Google and Bank of America, did little to impress the market as all of those stocks finished the week lower. Next week will be even more eventful on the earnings front as many U.S. bellwethers will report results.

The news flow in Europe continued to be troublesome as Portugal remained front and center amongst the headlines while Moody’s cut Ireland’s sovereign rating by 2 notches and maintained its negative outlook. The Euro region also announced its March inflation rate was 2.7%, a greater increase than expected, and a further signal that more rate hikes in Europe are inevitable.

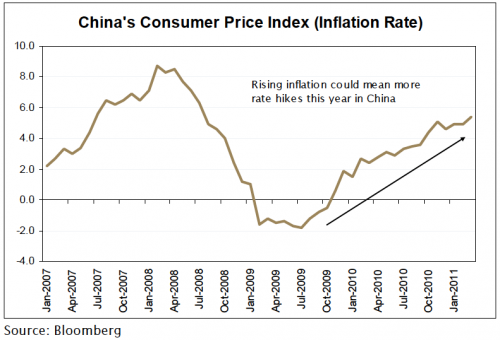

Speaking of rate hikes, China was in the news again. Last week, the People’s Bank of China raised interest rates and this week the government informed investors that inflation for March was higher than expected at 5.4%. Other data indicated that money supply and loan growth were also higher than expected which will likely lead to further tightening in China. Even with these ongoing concerns, China posted a Q1 GDP growth rate of 9.7%, which was higher than the 9.4% expected, but lower than last quarter’s 9.8%.

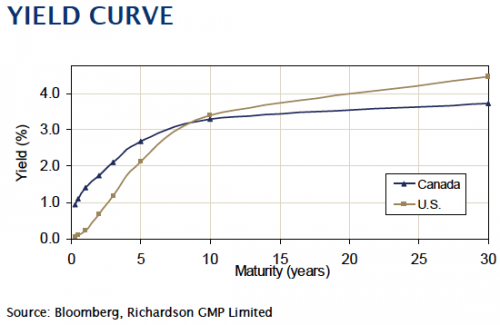

Monetary policy was also topical at home as the Bank of Canada kept interest rates unchanged at 1.0% and indicated that the higher Canadian dollar could offset some inflation concerns going forward. As such, many investors don’t expect rate hikes in Canada until the second half of the year at the earliest.

A call from Goldman Sachs for investors to lock in short term commodity profits sent oil prices on a wild ride this week, finishing lower overall. But gold and silver prices benefitted from a lot of uncertain news flow as gold reached a new record high and silver reached its highest level since the market was cornered in 1980. Even with some downward pressure on energy prices, the Canadian dollar managed to stay above the US$1.04 level after reaching a recent high of US$1.0497 last Friday.

Chinese CPI, from the bottom left to the upper right…

Last week, we showed you the historical path of interest rates in China as the People’s Bank of China raised rates for the fourth time in seven months. This week, the Chinese Government released its monthly data that showed a 9.7% Q1 GDP growth rate, but also showed an inflation rate of 5.4% year over year. This print was above consensus expectations of 5.2% and last month’s 4.9% print. It’s evident that with consumer prices, money supply, and loan growth moving higher the Chinese Government will have to take further steps this year to reverse or contain these upward trends. Such moves could include increases to the bank reserve ratio requirements or further interest rate hikes. Canadian investors monitor these policy decisions carefully as increasing rates in China tend to cool off commodity prices and that has consequences for the Energy and Materials subindices here at home.

The Trading Week Ahead

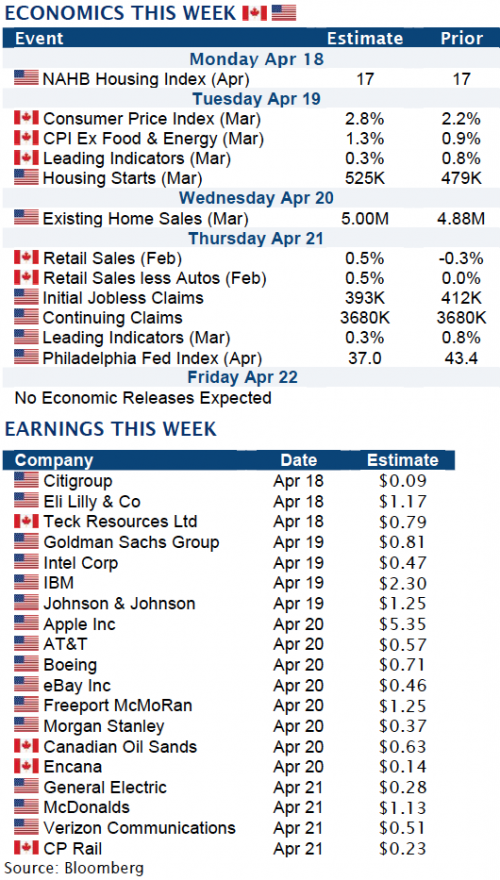

If corporate results didn’t steal the headlines this week, they’ll certainly have many opportunities to do so next week as a large number of U.S. equity heavyweights will report quarterly earnings from Technology leaders such as Apple, Intel and IBM to Financial giants such as Citigroup, Goldman Sachs and Morgan Stanley. Dow Industrial components AT&T, Boeing, General Electric, Johnson & Johnson, McDonald’s, United Technologies and Verizon will also flood the market with quarterly numbers. Needless to say, it will be a busy week in the U.S., but not as busy in Canada where Teck Resources will start off an earnings season that isn’t expected to ramp up until the end of the month.

While economic data may take a back seat to earnings, the consumer will certainly be in focus as we’ll see retail sales data on both sides of the border along with a number of housing related prints in the United States. Housing continues to be messy and we don’t expect that situation to change any time soon. We’ll also get a chance to see if Governor Mark Carney was correct in stating that the higher Canadian dollar could offset inflationary pressure as we’ll see Canadian Consumer Price Index prints on Tuesday.

Even though it strengthened on Friday, the U.S. trade weighted dollar fell for yet another week and will likely remain in focus for a couple of weeks as we quickly approach the next Federal Reserve meeting on April 27. Investors will be looking for indications of monetary policy to come once QE2 is wrapped up at the end of June. Furthermore, while U.S. lawmakers managed to come to a budget agreement last week, they are now dealing with the ongoing debt ceiling debate as the Treasury department announced that the U.S. debt ceiling could be breached by mid- May. The ceiling can only be increased with approval from Capitol Hill and lawmakers are expected to take a two week spring break at the end of this month.

With the U.S. dollar struggling, expect to see continued volatility in commodity markets next week, especially amongst precious metals if it looks like negotiations amongst Republicans and Democrats are going nowhere.

And as usual, with volatile commodity markets comes volatility for the Canadian dollar. However, investors will also keep their eyes peeled to Canadian inflation data on Tuesday which could have a material impact on the loonie depending on the size of the print.

Copyright © Richardson GMP