Commodities in Portfolio Construction

by Alfred Lee, CFA, DMS

Vice President & Investment Strategist

BMO ETFs & Global Structured Investments

BMO Asset Management Inc.

alfred.lee[at]bmo.com

Monthly Strategy Report March 2011

Over the last decade, commodity and commodity-related investments have gained significant popularity with both institutional and retail investors. Given their sizable returns over the last ten years, historical low correlation to traditional asset classes and emerging markets soaking up much of the supply, it should not come as much of a surprise. Coming out of the credit crisis, major central banks around the globe, most notably the U.S. Federal Reserve (Fed), were focused on reflating the global economy.

The co-ordinated easy monetary policies, government stimulus measures along with quantitative easing were largely a positive for broad commodities which tend to be used as a hedge against declining currency values and particularly a falling U.S. dollar. Essentially, investors benefited from merely having exposure to a broad basket of commodity and commodity related investments.

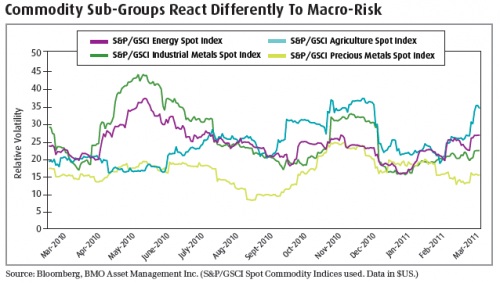

With global stimulus and the second instalment of quantitative easing1 (QE2) moving further into the rear-view, the reflation trade should be less of a driver in global commodity prices going forward, especially considering the Fed is anticipated by some to remove QE2 stimulus this summer. Independent supply and demand fundamentals as a result should play a more important role in driving commodity prices going forward. In addition, with political turmoil in the Middle East and now the unfortunate tsunami in Japan, these issues will have different macro factors on the varying commodity sub-groups.

Commodity Differentiation

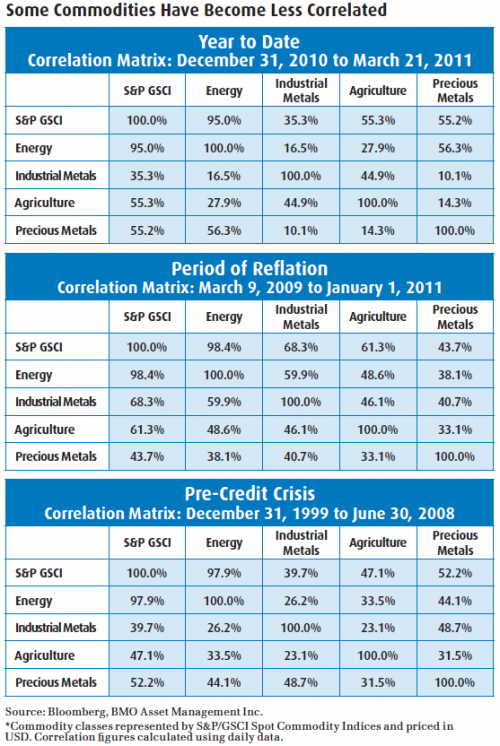

With that in mind, investors may want to consider commodity differentiation at this point in their portfolio construction process. As global economic fundamentals slowly improve, correlation between assets and within assets such as commodities should naturally decrease (as detailed in the correlation matrices on the following page) in an economic thawing process. Moreover, as previously mentioned, the negative headlines will have varying impacts and ramifications on each of the commodity groups. Investors should therefore focus on commodities that have the best risk-adjusted returns and those which will further optimize their overall portfolio.

As many investors are aware, the proliferation of exchange traded funds (ETFs) and exchange traded products (ETPs)2 have allowed investors to efficiently implement commodity exposure to their portfolios in a number of different ways. Through ETFs and ETPs, investors can access commodity futures, commodity related companies and in some cases, spot prices. Investors should however first be cognisant that different commodity sub-groups react differently to macro-economic events and each also has its own fundamental and technical trading patterns. Secondly, how each ETF or ETP structure reacts to these same macro-events can also be different based on how it is accessing the specific underlying commodity (ie through spot, futures or equities).

For further information on the advantages and disadvantages of each commodity ETF/ETP structure, please see the “Gaining Commodity Exposure Through ETFs” on our website. In the following pages, we will outline our fundamental and technical outlook on four major commodity subgroups: agriculture, base metals, energy and precious metals.

- Agriculture. As we mentioned at the beginning of the year in our BMO ETF 2011 Outlook Report, food price inflation will be a topic du jour this year, with global population anticipated to hit seven billion and the rising wealth in the emerging nations continuing to place upward pressure on soft commodity prices. Furthermore, extreme weather patterns over the last year in Australia and Latin America will lead to tighter supplies. Already this year, we have seen the

future contracts of a number of soft commodities such as wheat hit its limit up3 in trading.

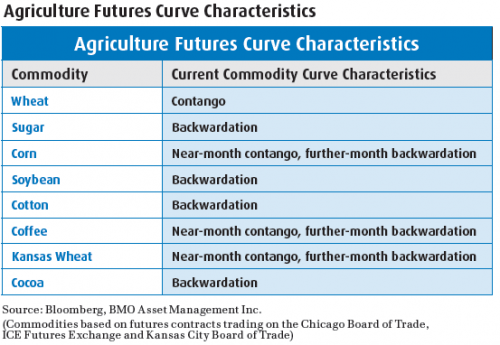

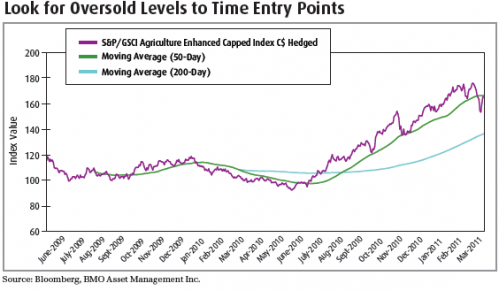

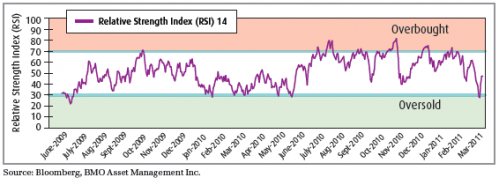

Now with a number of agriculture commodity contracts such as wheat, corn and soybeans currently trading in backwardation4 or in mild contango5, we prefer attaining soft-commodity exposure through futures based ETFs/ETPs. Some agriculture related companies may experience expansion at the middle portion of their income statements should they not be able to pass full grain cost appreciation to consumers. As a result, futures may provide a more pure exposure to higher agriculture prices considering the current characteristics of the commodity curve. We would caution however, that with the strong run up in many of the agriculture contracts, we would look at technical indicators such as RSI6 and MACD7 for entry points.

Potential Investment Opportunities:

- BMO Agriculture Commodity Index ETF (ZCA)

– on pullbacks.

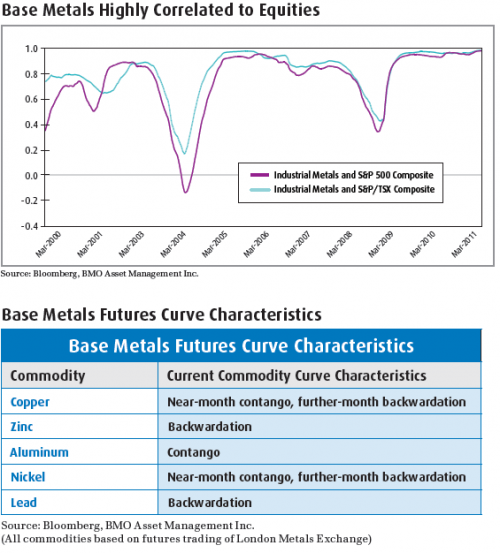

- Base metals. Base metals as a group saw very sizable returns in 2009 with the S&P/GSCI Industrial Metals Spot Index gaining 91.2%. As copper, zinc and nickel are largely tied to industrial production, prices in these metals are rather sensitive to economic expansion. In addition base metal prices are highly correlated to stock market sentiment, given equity values on a whole are also a leading macro-economic indicator. In 2010, volatility in equity market sentiment with

investors switching frequently between the “risk-on” and “risk-off” trade, led base metals as a group to lag other commodity groups. We are the least favourable on base metals when looking for assets to best optimize a portfolio’s risk/return characteristics because of the high correlation between copper, zinc and other industrial metals to equity prices.

Moreover, as we see equity market volatility shocks to be a common theme this year, base metal future trades should be utilized more for higher-beta momentum trades based on timing than portfolio construction building blocks. For investors looking for base metal exposure, we do however currently favour futures based ETPs over equity-based ETFs as base-metal related companies have run significantly against the S&P/GSCI Industrial Metals Spot Index. The futures curve characteristics for base metals are mixed with a number of contracts recently moving to a steeper backwardation. Nevertheless, products incorporating a “smart-roll” feature that look to reduce roll effects should be considered by those desiring exposure in this area.

Potential Investment Opportunities:

- BMO Base-Metals Commodity Index ETF (ZCA)

– for momentum based trades.

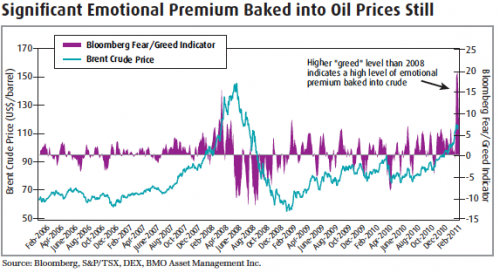

- Energy. Energy prices remain one of the wildcards in the revival of the global economy. Should Brent crude prices and, to a lesser extent, West Texas Intermediate (WTI) defy gravity for a sustained period of time, it could potentially put the brakes on the global recovery as higher oil prices would increase everything from costs of production inputs to transportation. However, much of the recent rise in crude prices is also a result of the markets pricing in a risk premium and an emotional element, seen through a widening gap between implied and realized volatility on crude.

Investors with an extremely short-term horizon may want to consider futures-based energy ETPs. Though we wouldn’t be surprised to see the price of Brent crude and WTI rise further, it comes at a higher risk/reward trade-off given the sizable amount of emotion that is currently priced into oil. Last month, when rumours that Libyan leader Muammar Gaddafi was shot broke out, the emotional premium in oil prices quickly dissipated before rapidly recovering after the news was declared

false. This demonstrated the excessive level of political premium currently built into crude prices. An investment in crude through futures is therefore an indirect bet that turmoil in the Middle East will continue. Additionally as we had forecasted back in January, higher crude prices would come at higher volatility levels this year. As such, we believe oil related companies have a better risk/reward trade-off at this point, even if they have lagged crude prices as they show a more stable trend and have exhibited lower volatility levels.

Potential Investment Opportunities:

- BMO Energy Commodity Index ETF (ZCE)

– Shorter-term investors

- BMO Junior Oil Index ETF (ZJO)

– Longer-term investors

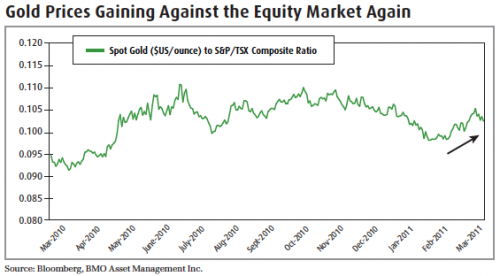

- Precious Metals. Of the four commodity groups mentioned, precious metals have shown to be the least correlated to broad based equities. The non-correlation to both the S&P 500 Composite Index and the S&P/TSX Composite Index is largely the affect of the market’s utilization of precious metals, such as gold, as a multi-purpose hedge. Last year, the sovereign debt crisis and concerns of a global currency war led to the use of precious metals as a hedge against fiat currencies. This year, with food and commodity prices rising, money is slowly transitioning out of the former trade as an alternative currency and into a hedge against inflation concerns.

On a technical level, gold prices have recently shown strength particularly against the equity market and base metals. Within the precious metals sector, small-cap gold companies, which we were extremely bullish on throughout 2010, have recently been gaining relative strength against large-cap gold companies. Investors looking for portfolio diversification may want to consider bullion or ETPs that track gold through bullion or futures, whereas investors looking for ways to generate portfolio alpha should consider junior gold companies.

Potential Investment Opportunities:

- BMO Precious Metals Commodity Index ETF (ZCP)

– Investors looking for portfolio diversification

- BMO Junior Gold Index ETF (ZJO) – Investors looking

to generate portfolio alpha

In conclusion, we believe commodity exposure will remain an instrumental building block for both institutional and retail portfolios. However, with correlations between commodity sub-groups on the decline, investors should first consider the sub-group of commodities that will best optimize their investment strategy and then determine the investment structure that is best suited to execute their objectives. With the possibility of the removal of QE2 stimulus by the Fed quickly approaching, investors will also need to consider individual supply and demand fundamentals of each commodity since the reflation trade will be less prevalent in keeping all commodities afloat.

Footnotes

1 Quantitative easing: An unconventional monetary policy used by some central banks when traditional measures have not produced the desired effect. Money supply is typically increased in an effort to promote increased lending and liquidity.

2 Exchange-traded products (ETPs): A broader categorization of exchange-traded funds that also include products that hold commodities, futures and other asset types.

3 Limit up: The maximum amount by which the price of a commodity futures contract may advance in one trading day. Some markets close trading of these contracts when the limit up is reached; whereas others allow trading to resume if the price moves away from the day’s limit. If there is a major event affecting the market’s sentiment toward a particular commodity, it may take several trading days before the contract price fully reflects this change. On each trading day, the trading limit will be reached before the market’s equilibrium contract price is met.

4 Backwardation: When the futures price is below the expected future spot price. Consequently, the price will rise to the spot price before the delivery date.

5 Contango: When the futures price is above the expected future spot price. Consequently, the price will decline to the spot price before the delivery date.

6 RSI: Relative Strength Index is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset. A reading of 30 or less is generally considered oversold, whereas a reading of 70 or more will be considered overbought.

7 MACD: Moving Average Convergence Divergence: A trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD, called the “signal line”, is then plotted on top of the MACD, functioning as a trigger for buy and sell signals.

For more information on BMO ETFs, please visit our website bmo.com/etfs or contact your financial advisor.

To be added to the distribution list for our Monthly Strategy Report and Trade Opportunities Report, please visit our homepage at bmo.com/etfs to subscribe or email alfred.lee@bmo.com with title: “Add to distribution list.”

Standard & Poor’s®, S&P® and S&P GSCI® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and have been licensed for use by BMO Asset Management Inc. BMO Agriculture Commodity Index ETF, BMO Base Metals Commodity Index ETF, BMO Energy Commodity Index ETF, BMO Precious Metals Commodity Index ETF are not sponsored, endorsed, sold or promoted by S&P or its Affiliates and S&P and its Affiliates make no representation, warranty or condition regarding the advisability of buying, selling or holding units of the ETFs.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing. The funds are not guaranteed, their values change frequently and past performance may not be repeated.

This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment.

BMO ETFs are administered and managed by BMO Asset Management Inc., a portfolio manager and a separate legal entity from the Bank of Montreal.

® Registered trade-marks of Bank of Montreal.