The Influence of Fear

Gareth Watson, CFA – Vice President, Investment Management and Research, Richardson GMP

For some time now, market forecasters had been calling for some form of market consolidation considering that many global indices had been rallying since September. The unfortunate disaster in Japan last week created the opportunity for that consolidation and investors acted accordingly. As we approached market close last Friday, little did we know how extensive the damage was in Japan, nor did we understand the nuclear problems that would send global markets lower on Tuesday in particular. The lack of concrete information coming from the Fukushima Daiichi nuclear facility forced many investors to hit the panic button. Trading off of fear causes us to sell first and think later. However, once the initial panic selling transpired, there was a recognition in a number of markets that such a broad based sell off had created some buying opportunities. While many markets finished the week lower, they did manage to regain lost ground as the week progressed. The TSX Index was fortunate enough to post a weekly gain.

Without a doubt Japan dominated market activity this week and will likely top headlines again next week. However, we did see other events develop across the globe including an escalation of tensions in Bahrain while the U.N. Security Council created a no-fly zone in Libya. Europe was still topical as Portugal was downgraded after last week’s downgrade for Spain, the United States bought itself more time to pass a budget, and Parliament returned to Ottawa before next week’s budget/confidence vote which could send our country into an election.

Commodities were on quite a roller coaster ride as the events in Japan caused some investors to sell and hold cash while other investors feared that global demand for resources could decline as Japan is the third largest national economy in the world. Yet, some commodity prices rebounded mid-week as the emerging market growth story is still largely intact and geopolitical events in the Middle East and Libya helped boost speculative premiums in the energy space.

With the volatility of commodity prices increasing, we also saw similar trading patterns for the Canadian dollar which lost just over a cent on the week, but was down almost 2.5 cents at one point on Tuesday.

What's Going On With the Japanese Yen?

Considering what’s happened to Japan over the past week, it would be normal to assume that its currency, the Yen, would weaken since so many aspects of the Japanese economy have been

impaired. However, the complete opposite happened as the Yen appreciated against the U.S. dollar after the earthquake and tsunami struck. The Yen strengthened even after the Central Bank of Japan poured billions of dollars into Japan’s financial system to weaken the Yen and help exporters by making Japanese products cheaper. The strength is likely a result of the expectation that Japan may have to repatriate a lot of foreign holdings in order to have the money required to rebuild the country. Friday’s material weakening of the Yen was a result of G7 Central Banks coming together to sell Yen holdings while buying baskets of other currencies.

The Trading Week Ahead

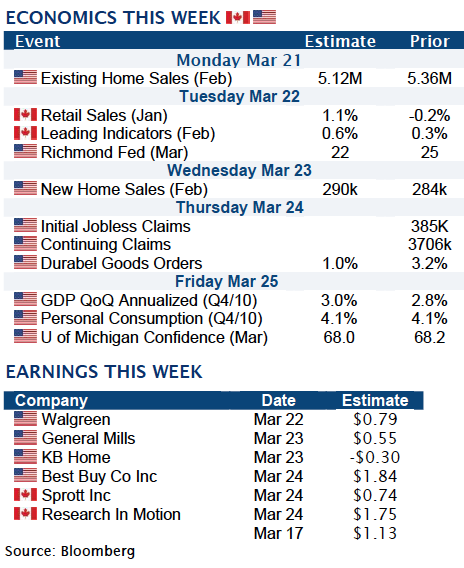

There is no doubt that Japan will be a driving factor for investor sentiment next week as officials try and get the upper hand on the nuclear situation. However, the introduction of a no-fly zone in Libya and other stirring tensions in the Middle East could certainly see this region return to the front pages and have a material influence on crude prices. Next week will be quiet with respect to economic releases in Canada. However, we will see some meaningful data in the U.S. pertaining to GDP growth, consumer confidence and the housing market.

As the vast majority of earnings season has come and gone for the quarter, we won’t see many earnings releases amongst large cap companies in North America in the coming days. One exception is Research in Motion which will report its fiscal Q4/11 earnings on Thursday after market close. Investors will be anxious to see results from Christmas sales but will also be looking for more details concerning the launch of the long awaited Playbook tablet device which has been rumoured for release on April 10.

While certainly less significant from a global perspective, the Conservative Government in Canada will table a budget on Tuesday and as usual there is all kinds of speculation that we could be headed for an election. Regardless of the outcome, we would not be surprised to see the Canadian dollar weaken slightly if an election is called, unless investors don’t expect Canada’s political landscape to change. In this case, the loonie may not be affected at all by domestic politics.