Silver Lining Fades

David Andrews, CFA – Director, Investment Management and Research, Richardson GMP

Up until this week, Canadian stock market investors had been relatively immune to the confluence of risks developing in the world around them. No matter what, it always seemed, there was a positive that would neutralize or offset a negative. Rising crude oil prices, due to Arab world uncertainty was generally good for a stock market largely influenced by energy producers. The rising threat of global inflation in turn supported the share prices of the Canadian gold miners and just when the thrill of another strong earnings season was about to wane, the Canadian banks followed up with strong performances of their own. This week, it appears our luck and our timing turned for the worse.

The TSX fell for three consecutive days for a weekly decline of 4.06%. The index began the week well above the 14,000 level but crude oil prices declined following an the 8.9 magnitude earthquake and subsequent 7-metre tsunami that washed over parts of Japan and closed many of the refineries of the world’s third largest consumer of crude. In addition, Friday’s ‘Day of Rage’ in Saudi Arabia turned out to be anything but ‘raging’. Brent crude had its first weekly loss in the past seven weeks.

Gold had its first weekly loss since January, declining from its March 7th all time high of $1444.95/oz. Profit taking, falling crude oil prices and a stronger U.S. dollar weighed on Gold this week. The escalation of ongoing hostilities in Libya could help gold get back to setting new all time highs very soon.

Economic data was poor this week with higher than expected unemployment gains in the U.S. and a February trade deficit for China souring the economic outlook. Moody's cut Spain's credit rating by another notch, escalating the ongoing debt crisis in the Eurozone. Spain's rating was downgraded to Aa2, Moody's third highest rating, as the agency warned that the country had under- estimated the cost of rescuing its banking sector.

The Canadian dollar touched its lowest level in two weeks as Canada added fewer jobs in February than the prior month and crude oil, our biggest export, fell below $100 after the earthquake in Japan. The Loonie closed the week at U.S.$1.0280.

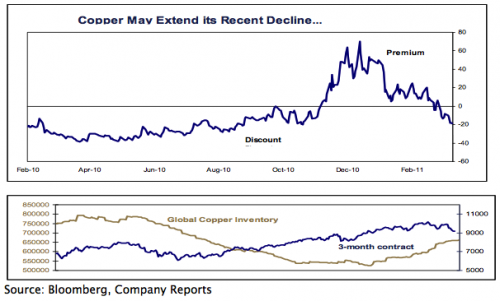

Is Copper a Canary in the Mine?

Gold is often viewed as a store of value and a hedge against economic Armageddon, but "Dr. Copper" is said to be the metal with a Ph.D. in economics for its ability to presage the future of the global economy.

Prices have moved from a steep premium to a discount recently. February copper shipments into China fell 35% from one month earlier; the lowest level in 2 years. Stockpiled inventory is 16% higher so far in 2011.Prices will likely continue to slide until the Chinese buyers return. After such a steep fall, many began to wonder if the metallic professor is warning of trouble. Fortunately, this doesn't appear to be the case. The current slide appears to be a temporary setback, presenting those on the sidelines with a chance to get in on the action.

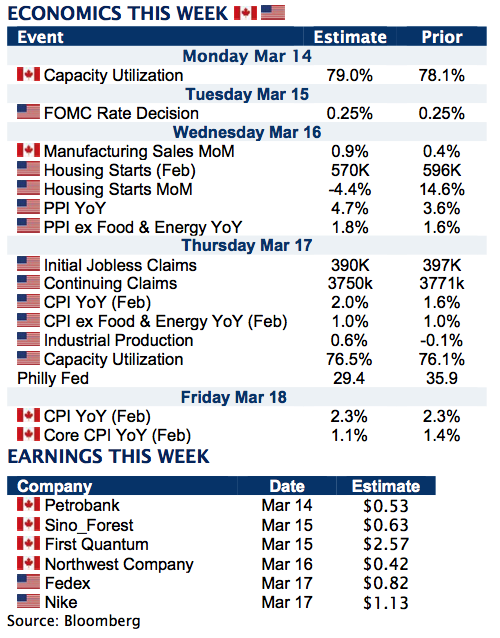

The Trading Week Ahead

Trading volumes may indeed be a little lighter than usual with the peak of the March Break vacation season upon us. Many institutional trade desks will be have lighter staffing than normal as many traders will be off enjoying the renewed purchasing power of the strong Canadian dollar. Notwithstanding, investors will have the latest inflation data to consider as the week unfolds. Rising commodity prices and energy costs are expected to show signs of building which could potentially pressure corporate profit margins. Investors will gauge to see how fast these costs are rising and to see if businesses have begun to pass these rising costs on to their customers.

The Federal Open Market Committee congregates but no major news is expected to emerge in the statement on Tuesday. The FOMC is expected to maintain the Fed Fund Rate between 0 and 0.25% and will announce the continuance of the asset purchase program, or QE2 as originally planned. The Fed may indicate in the statement the improvement in economic activity in early 2011, especially as regards the labour market, and the increase in inflationary pressures. However the latest data are not likely to force the Fed to remove the expansionary monetary policy anytime soon.

The Middle East and North Africa are expected to push volatility higher once again next week. Energy and precious metals will continue to be a main focus and will give directional cues to equity and bond markets.

Earnings announcements are few and far between this week with only Federal Express likely to be market moving. Fedex is a proxy and measure of general business activity for both North America and Europe.