"The Sweet Spot"

By Michael Nairne, Tacita Capital

February 28, 2011

Investors face the challenge of funding decades of retirement in an environment of low interest rates and lacklustre stock valuations. For many, earning market returns alone will not suffice. Hence, thoughtful portfolio construction needs to incorporate asset classes that have higher long-term expected returns. In this regard, small company or small cap value stocks – the stocks of smaller companies that are low priced in relation to earnings, dividends and book value – have a critical role.

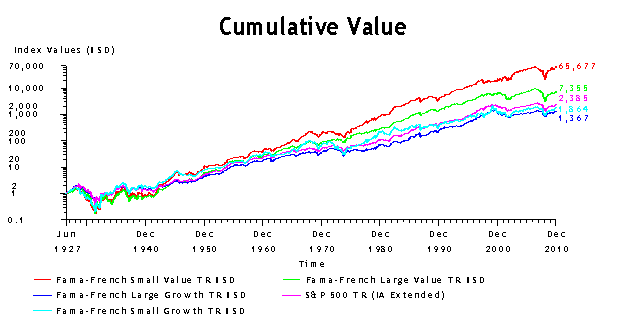

Based on long-term historic indices, small company value stocks have returned a significant premium to the overall market as well as to small company growth and large company growth and value stocks. This premium is illustrated in the following graph which illustrates the growth of $1.00 U.S. invested in small cap value stocks (in red) compared to the other indices from July 1927 to December 2010.

The investment in small company value stocks grew to $65,677 - nearly twenty-eight times the $2,385 of the S&P 500 and nearly nine times the $7,355 of large company value stocks. Contrary to the popular conception that growth is the place to be, growth stocks, both large and small, lagged their value counterparts.

The historic outperformance of value stocks in general is a well-documented global phenomenon. Until recently, however, research on small cap value stocks has tended to focus on performance in individual countries. For example, the small cap value premium has been found not only in the U.S. but the U.K. A comprehensive analysis on the performance of small company value stocks globally has been lacking until the recent publication of sweeping study by Professors Fama and French. Encompassing 23 countries for the period November 1989 to September 2010, they found that the value premium is larger for the stocks of small companies versus large companies in North America, Europe and Asia Pacific. Only Japan was the exception.

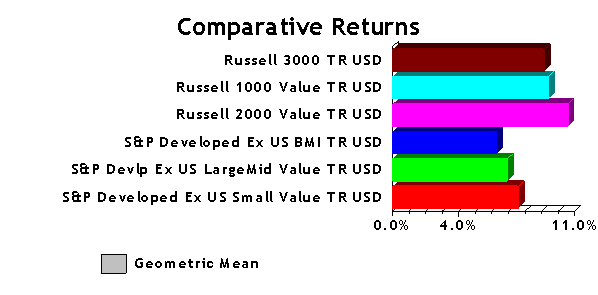

These findings are consistent with a review of major indices for the period July 1989 through January 2011. As illustrated in the following graph, small cap value stocks in the U.S. (in pink) outperformed large cap value stocks (in light blue) and the market overall (in brown). In the balance of the developed world markets, small value (in red) also outperformed large and mid cap value (in green) and the total market (in dark blue).

Accessing the superior performance of small company value stocks, however, requires a much greater tolerance for risk. Small companies typically lack the financial strength of their larger counterparts and their stocks are more thinly traded. They are also much more volatile. Since 1927, small company value stocks have been over 60% more volatile than the total market.

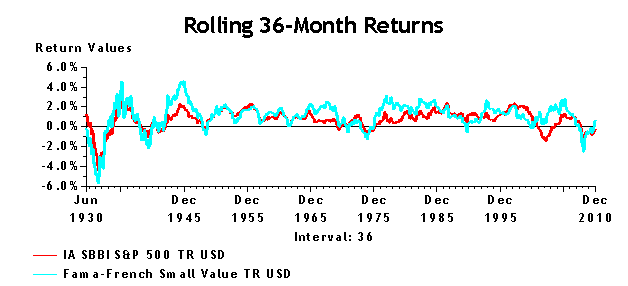

Second, there can be prolonged periods where small company value stocks underperform the overall market. As illustrated in the following graph, small company value stocks (in blue) lagged the market (in red) during the early 1930's, the early 1950's, the late 1960's and early 1970's, the late 1980's and the mid to late 1990's.

Investment managers face serious hurdles in capturing the small company value premium. Because transaction costs are much higher than for large company stocks, high stock turnover can erode results. Also, the superior return of small company value stocks occurs primarily as a result of a limited number of stocks experiencing robust growth and from a handful of take-overs or mergers at premium stock prices.

Hence, it is not surprising to find that the performance of active small cap managers is not persistent. Outperformance tends to be fleeting and random. Unless an investor has a strong and proven qualitative and quantitative basis for selecting an active manager, they are best advised to use indexed solutions.

Small company value stocks are in the sweet spot when it comes to enhancing long-term portfolio returns. However, their volatility and "streaky" performance requires that portfolio allocations must be judicious.

February 28, 2011

Tacita Capital Inc. ("Tacita") is a private, independent family office and investment counselling firm that specializes in providing integrated wealth advisory and portfolio management services to families of affluence. We understand the challenges of affluence and apply the leading research and best practices of top financial academics and industry practitioners in assisting our clients reach their goals.

Tacita research has been prepared without regard to the individual financial circumstances and objectives of persons who receive it and is not intended to replace individually tailored investment advice. The asset classes/securities/instruments/strategies discussed may not be suitable for all investors and certain investors may not be eligible to purchase or participate in some or all of them. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Tacita recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor.

Tacita research is prepared for informational purposes. Neither the information nor any opinion expressed constitutes a solicitation by Tacita for the purchase or sale of any securities or financial products. This research is not intended to provide tax, legal, or accounting advice and readers are advised to seek out qualified professionals that provide advice on these issues for their individual circumstances.

Tacita research is based on public information. Tacita makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to inform any parties when opinions, estimates or information in Tacita research changes.

All investments involve risk including loss of principal. The value of and income from investments may vary because of changes in interest rates or foreign exchange rates, securities prices or market indexes, operational or financial conditions of companies or other factors. There may be time limitations on the exercise of options or other rights in securities transactions. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized. Management fees and expenses are associated with investing.