The 'Crude' Reality of Unrest

by David Andrews, CFA-Director, Investment Management and Research, Richardson GMP

Investor sentiment turned decidedly more cautious this week with major North American indexes retreating amid the growing pro-democracy movement in the Arab world. Following the mostly peaceful demonstrations in Tunisia and Egypt, the pro-democracy rallies in Libya turned ugly as protesters were met with a stiff and inhumane response from pro-Gaddafi supporters. Mercenaries and Militia were reportedly firing on unarmed crowds amidst the incoherent ramblings of embattled leader, Muammar Gaddafi. Gaddafi went so far to suggest the protesters were being drugged and under the influence of Al Qaeda. The unstable situation saw the price of Brent crude oil surge to 2-1/2 year highs near $120 a barrel.

As a result, Canadian commuters felt the sting at the gasoline pumps this week as prices seemed to increase a few cents a litre each night. Stock market investors also felt the pinch with the TSX slipping below the recently attained 14,000 level. Three consecutive down sessions on the holiday shortened week (Canadian and U.S. exchanges were closed Monday) were followed by a Friday reprieve as Saudi Arabia announced it would increase its crude oil production in an attempt to offset any global supply disruption from Libya. The influential Materials and Financial stocks surged and helped boost the index by 1.25% on the day and back above 14,000. For the week, the TSX lost a little more than half of one percent. The major U.S. indexes fell about 2 percent on the week as investors bet higher oil costs may unseat the early stages of the economic recovery.

Speaking of the economy, there were a few positive signs of things getting better with U.S. consumer confidence at 3 year highs in February despite higher food and fuel costs. U.S. weekly employment data also showed fewer Americans filed for jobless claims suggesting the employment situation is continuing the slow process of healing. If employment and confidence are a silver lining, housing continues to be the dark cloud. January new home sales were again below already depressed expectations. In Canada, retail sales in December fell but most of that was due to the auto sector. Ex autos, retail sales were up 0.6% which was expected.

IS Gold Set To Rally?

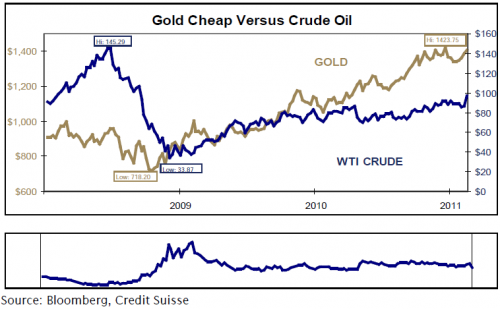

Despite the fact that Gold is trading near its record high, some suggest that Bullion will outperform Oil as surging inflation will underscore the metal’s role as an investment hedge. The chart to the left shows the price of both Gold and Oil since 2008. The chart below is the ratio of Gold to Oil, or how many barrels an ounce of gold will buy. At its peak in late 2008, an ounce of gold bought you about 28 barrels of crude oil. Currently, oneounce buys about 15 barrels. Notwithstanding OPEC’s spare production capacity, energy markets have priced in a considerable risk premium. If tensions ease and or production comes on stream, oil prices could drop rather quickly. Gold has fallen 1.6% this year following a 30% rally in 2010. Crude is up about 5% this year following last year’s 15% rise.

The Trading Week Ahead

Canadian stock market investors are expecting the rest of the Big Banks will be able to follow the solid start to bank earnings season set by CIBC and National Bank. Following a softer second half of 2010, the banks are poised to benefit from better market conditions for their retail and wholesale lending businesses. Investors looking for dividend increases will have to wait on National and Commerce but they may not have to wait on the others. Bank of Montreal reports Tuesday and is followed by TD and Royal on Thursday. (Scotia reports March 8th).

U.S. reporting season has concluded with another upbeat quarter and substantial positive earnings surprises. The biggest positive surprises were in the Materials sector where elevated commodity prices boosted the bottom line. Consumer goods, specifically Automobiles, provided the biggest earnings disappointment in the fourth quarter on the S&P500.

The economic calendar will likely continue with the theme of improving consumer and business confidence but scant signs of improvement in the U.S. housing market. Pending homes sales in January are expected to once again come in lower. The February employment report is released on Friday. For the past three months we have overlooked disappointing results and explained them away by bad weather. We did not have weather issues of significance this month so the non farm payrolls on Friday could be significant.

Commodities prices, specifically oil & gold, will be influenced by the evolving and volatile demonstrations in the Middle East and North Africa. Risk premiums for both oil and gold remain rather elevated helping to push the loonie higher. Watch for no move in policy by the Bank of Canada on Tuesday, but the wording of the statement will be scrutinized for signs of their next move likely around mid 2011.

Copyright (c) Richardson GMP