Canada Market Cheat Sheet (February 28, 2011)

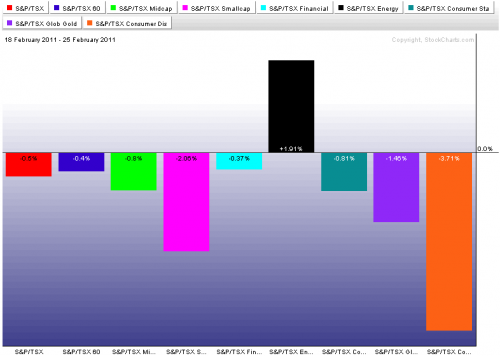

TSX and Subgroups - Week Ending February 25, 2o11

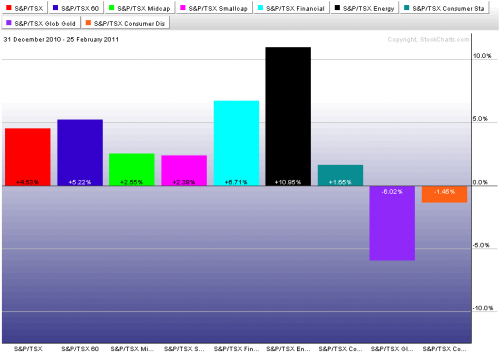

TSX and Subgroups - YTD to February 25, 2o11

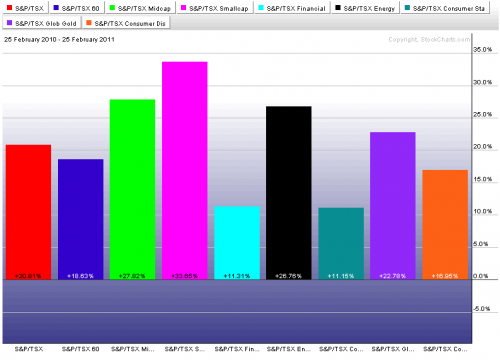

Past One Year to February 25, 2011

Strengths

Canada Economic Growth Rate Accelerates to 3.3% in 4th Quarter on Exports - Canada's economic growth rate accelerated more than forecast from October to December on the biggest jump in exports since 2004 and faster consumer spending. [Bloomberg]

OMERS pension fund reports 11.5 perecnt gain for 2010 - Ontario Municipal Employees Retirement System (OMERS), one of Canada's largest pension funds, said on Monday the value of its net assets rose 11.5 percent last year to C$53.3 billion ($54.9 billion), helped by stronger global financial markets. [Reuters]

Can Canada's economy keep up its solid pace of growth? The economy grew by 0.5 per cent in December, The Globe and Mail's Tavia Grant reports today. In the fourth quarter, gross domestic product increased at an annual rate of 3.3 per cent. Both readings were better than economists expected, with December's pace the best in nine months. Statistics Canada also revised its reading for the third quarter, bringing the pace to 1.8 per cent from its earlier estimate of 1 per cent. Consumer spending also helped pump up the economy in the fourth quarter, according to the federal statistics gathering agency. [Globe and Mail]

Weaknesses

Canadians urged to change spendthrift ways - For the past 15 years, Canadians haven't been saving money, in large part because there was no pressing need. Rising home prices made people feel richer, and saving for a rainy day was a low priority. But that economic era is fast coming to an end. A new report to be released Monday shows the toll that years of passive savings is taking on the financial picture of Canadians. Having relied overwhelmingly on their homes to build personal wealth, the report says the average Canadian consumer now socks away considerably less than their U.S. neighbours, and will have to start saving more as housing prices moderate. [Globe and Mail]

Household debt surpasses six-figure mark - The average household debt figure at the end of 2010 was $100,879, with the debt-to-income ratio at a record 150 per cent, the report says. That means for every $1,000 Canadian families earn after tax, they now owe $1,500. Mortgages account for two-thirds of that debt at $63,000 per household. The other third is made up of personal loans and credit card debt.

Opportunities

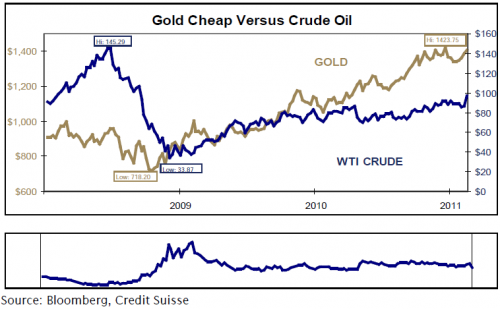

IS Gold Set To Rally? - Despite the fact that Gold is trading near its record high, some suggest that Bullion will outperform Oil as surging inflation will underscore the metal’s role as an investment hedge. The chart to the left shows the price of both Gold and Oil since 2008. The chart below is the ratio of Gold to Oil, or how many barrels an ounce of gold will buy. At its peak in late 2008, an ounce of gold bought you about 28 barrels of crude oil. Currently, oneounce buys about 15 barrels. Notwithstanding OPEC’s spare production capacity, energy markets have priced in a considerable risk premium. If tensions ease and or production comes on stream, oil prices could drop rather quickly. Gold has fallen 1.6% this year following a 30% rally in 2010. Crude is up about 5% this year following last year’s 15% rise.

Trimming Gas: Decreasing Gas Exposure In Favour of Gold (Lee) - For investors wanting to maintain some small-cap commodity exposure, we view gold as having a better risk/reward profile at this point, with bullion recently bouncing off support at US$1310/ounce on January 27, 2010. Small cap gold companies through the BMO Junior Gold Index ETF (ZJG), is an alternative for investors looking for opportunities that have a higher sensitivity to gold bullion prices. For investors wishing to maintain only an equity exposure, we recommend investors consider the BMO Dow Jones Industrial Average Index ETF (ZDJ) given both its technical strength and attractive valuations relative to other major global market indices. (Price-to-earnings ratio of 14.2x and dividend yield of 2.4%)

Auto sector to shoulder big chunk of GDP gains - Forget about the thriving oil patch, booming condo markets across the land or the arrival of the new RIM PlayBook next month: An old standard will give the Canadian economy a major boost in the first quarter – the auto industry.

As the industry recovers, the ripple effects of two companies gearing up to produce two new models in the manufacturing heartland of Southern Ontario are already being felt across the region.

Seeing the big picture with small-cap companies - Michael Decter is a Harvard-trained economist, a former backroom organizer for the New Democratic Party and a former public servant. That background isn't typical for a Bay Street fund manager, but then neither are his recent returns. The secret of Mr. Decter's success? A knack for aggressive trading, an emphasis on looking at the big picture, and a strong preference for Canadian stocks. "Canada is a great play on Asia" because of this country's strength in commodities, says the 58-year-old chief executive officer of Toronto-based LDIC Inc., and author of Ten Good Reasons: Why now is the right time to invest in Canada, published in 2008. "The growth is not just China and India, but 44 Asian nations growing at over 8 per cent a year." [Globe and Mail]

Threats

Strong Canada growth adds pressure for rate hike - Canada's economy revved back to life in late 2010 after a period of lackluster growth, supporting expectations of official interest rate hikes by mid year and pushing the Canadian dollar to a three-year high. [Reuters]

"All told, the last quarter of the year erased the disappointment of a sluggish summer, and points to a healthy start to the new year," said CIBC World Markets chief economist Avery Shenfeld. "Look for a more hawkish line from the Bank of Canada tomorrow that sets the stage for a rate hike in [the second quarter]. Bearish for bonds, bullish for the [Canadian dollar]." [Globe and Mail]