Schwab Sector Views: Commodity-Rise Impacts

Brad Sorensen, CFA, Director of Market and Sector Analysis, Schwab Center for Financial Research

February 24, 2011

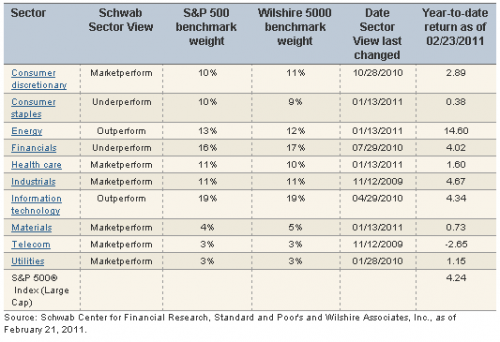

Schwab Sector Views reflect a three- to six-month outlook and are appropriate for investors looking for tactical ideas. We typically update our views every two weeks.

Commodity prices have received a lot of attention during the past several months: from oil and gold, that have been multiyear stories, to the more-recent rise in food-related commodities that has helped fuel unrest in the Middle East. As a reader of our sector views, which are more tactical in nature, you may wonder if there are some near-term sector implications of the rising commodities complex.

Let me unequivocally say … maybe. As we've noted before, investing is never a one-factor model and this case is no different. However, we must pay attention to the recent rise in commodity prices, because it can certainly have an impact on our sector calls.

For example, we recently upgraded both energy and materials on our view that economic growth would continue to fuel rising oil, natural gas and metals prices. Now we have to start looking at the other side of the ledger, because the rise in some prices has been so severe that it could threaten the performance of some sectors.

Let me first note that we don't want to overreact and aren't making any changes in recommendations this week, but we are watching the following closely for their potential impetus for changes in our views.

For sectors including consumer discretionary, consumer staples, materials and industrials, we're watching not only the sustainability of the higher input costs, but also the ability of companies in these groups to pass their increased costs on to customers.

Companies have largely been unsuccessful in raising prices during the past couple of years, so margins could be at risk if both the high commodity prices and inability to pass those costs on continue.

For now, wage growth remains stagnant, and given that labor is often the major expense for companies, this helps management maintain profitability. However, we'll watch for potential changes there.

Additionally, we're watching the reaction of global central banks to the rise in commodity prices as tightening measures are already being put in place. The danger, of course, is that central banks overreact, pushing the global economy back into recession—which would vastly change our sector outlook. We're not predicting that will occur, as policymakers are aware of the risks of aggressive tightening, but as global unrest rises, it's not something we can discount.

Finally, a word of caution about investing directly in commodities. While there may be situations when it's appropriate, it can also be tricky. First, remember that often when everyone is clamoring to get into something, that's often a decent time to move the other way.

Second, there are many products designed to provide direct commodity exposure, but many have little track record and can get complicated pretty quickly—plus, liquidity can be an issue in some. If you insist on investing directly in commodities, we strongly suggest doing so with caution and with the appropriate due diligence.

For details on our sector views, please read the expanded analysis below for each sector. As noted above, our recommendations can and do change quickly at times as we continually monitor economic progress and specific factors influencing individual sectors, so check back often.

Consumer discretionary: Marketperform

Bad weather through much of the country throughout the first part of the year continues to make it more difficult to get a good read on what the consumer is doing. However, the personal consumption component of fourth-quarter gross domestic product, along with a couple of consumer sentiment surveys, indicates that the moribund American consumer is a thing of the past—at least for now.

However, that doesn't mean that spending has returned with abandon—the savings rate remains above 5% and companies continue to point to the price discrimination of consumers as a continuing challenge.

Additionally, unemployment remains stubbornly high, credit standards remain tight, and, as noted, consumers still seem to be intent on saving more and spending less. Combine these issues with the margin-squeezing discounting mentioned above that many retailers had to institute in order to entice shoppers, and you still have a challenging retail environment, leading us to continue to hold the discretionary group at marketperform.

Also, we're becoming more concerned with the rise in commodity prices, which threaten to not only squeeze margins as passing costs on to customers remains difficult, but also to crimp customers' ability to spend on discretionary items as more money is spent on such things as food and energy.