“The Conversation”

by Jeffrey Saut, Chief Investment Strategist, Raymond James

February 7, 2011

“The Conversation,” except in this case I am not referring to the 1974 movie about a paranoid surveillance expert who has a crisis of conscience when he deduces that the couple he is spying on will be murdered, but rather an unbelievable 40-minute conversation I had with a portfolio manager (PM) last week. Unbelievable because it sounded like Jeff Saut talking to Jeff Saut; or as another Putnam person on the call opined, “It sounded like Nick talking to Nick.” The PM in question was Nick Thakore, who has captained Putnam’s Voyager Fund (PVOYX/$25.01) after associating with that organization in November 2008. Combining Nick’s current performance record, with that in a previous life, shows that he has outperformed in 11 of the past 13 years.* Voyager Fund was also the best performing fund over the trailing three-year basis in Lipper’s Large Capitalization Peer Group (+26.63% versus -1.42%). Obviously, such numbers indicate this is a pretty smart guy. Thus the conversation begins.

Nick commenced by stating that he was very constructive on equities because we are in a cyclic economic recovery despite a secularly changed world. Yet, everyone is aware of those secular changes like continuing above trend unemployment levels. However, over the long cycle it is all about earnings, and he (as do I) remains confident about earnings. Indeed, the investment equation is 90% about earnings, then comes valuations followed by earnings yields (earnings ÷ share price) compared to bond yields. After examining those metrics Nick looks at free cash-flow yields on individual stocks. He further opined that President Obama has moved to the middle (I think he’s actually run way past the middle, but have learned while living in D.C. to watch what they do not what they say). He concluded his opening remarks by noting that Washington’s mindset is not as anti-business as it was six months ago.

From there we began to discuss sectors. Eerily his favorite sector currently is the Financials. “That’s amazing,” I interrupted, “Because after 10 years of avoiding the banks I started using them when the Financials began to outperform the S&P 500 (SPX/1310.87) in November 2010.” Sheepishly I asked him, “I know why I like the banks, why do you like them?” Well, much of the government’s regulatory “push” is in the rearview mirror, loan growth is returning, net interest margins have expanded, the mortgage “put back” issue should look better next year, and the banks are WAY under-owned institutionally. Accordingly, if institutions decide to bring their portfolios up to a market weighting, the buying pressure would put the wind at the back of the Financials.

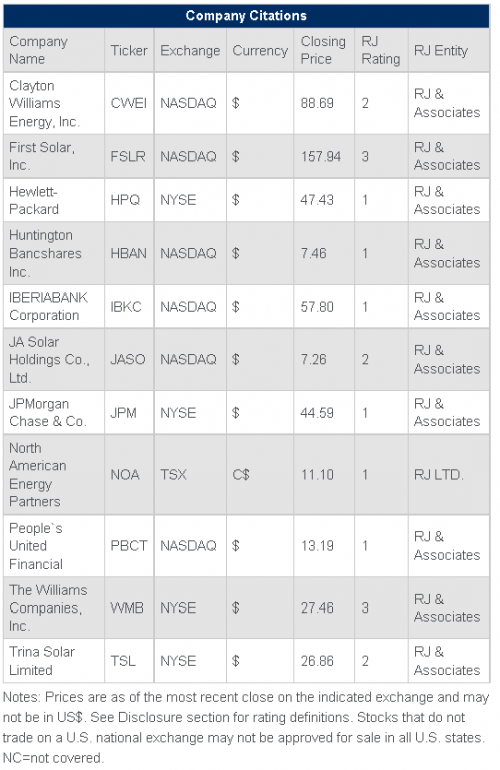

We spent the next few minutes talking about various banks. While Nick favors the big cap names like JPMorgan Chase (JPM), which he thinks has more than $6 per share in earnings power, I tend to favor the smaller regionals, such as IBERIABANK (IBKC), Huntington Bancshares (HBAN), and People’s Financial (PBCT). We also discussed insurance stocks as second derivative Financials plays. Both of us agree that cyclical names should be embraced over staples. Technology was also favored as it is attractively valued relative to the overall stock market. When I asked Nick for his favorite tech name, his response was Hewlett-Packard (HPQ) because it should earn more than $6 in 2012 and the shares should trade at least 10x earnings. From there the conversation focused on special situation stocks. Names I mentioned were companies like North American Energy Partners (NOA), Williams Companies (WMB), and Clayton Williams (CWEI), to name but a few. Nick offered First Solar (FSLR) because it has lowered its costs so much that it should be first to grid parity (Grid parity is the point at which alternative means of generating electricity is at least as cheap as the current electric grid power). And that was the only point of disagreement in our conversation. It is also why FSLR is such a controversial stock, as well as why it is so heavily shorted. I am neither bearish nor bullish, but the bear story goes like this.

FLSR is indeed the lowest-cost solar manufacturer, but its relative advantage is gradually shrinking as the cost of conventional (crystalline) panels is coming down more rapidly due to intense Chinese competition. Here's how the math works:

- FSLR has a production cost today of about $0.75/watt.

- Leading crystalline manufacturers – let’s use Trina Solar (TSL) as an example – are close to $1.10/watt.

- Because FSLR's panels have a lower conversion efficiency, they are priced typically $0.20 below crystalline.

- So, effectively, the "apples to apples" cost delta is only $0.10-0.15 ($0.75+$0.20 vs. $1.07).

- That delta was as high as $1.00 in 2008, when crystalline panel prices were above $4.00 because of high polysilicon costs.

- Over the next year, I would expect that delta to, at best, stay flat, and possibly get even closer to zero.

- Therefore, First Solar's progression toward grid parity is actually almost the same as for crystalline manufacturers.

With that in mind, the issue becomes valuation. FSLR currently trades at 17x earnings if we use the high end of company guidance. By contrast, practically all of the crystalline companies – JA Solar (JASO) and TSL included – are in the single digits, typically in the 6x to 8x range. I look at FSLR's valuation premium as difficult to sustain over time, especially as competition in the thin film arena becomes more visible. As a side bar, the solar sector looks like it should be bought.

We concluded our conversation with Nick expressing his worries. Will the Egypt Eruptions become a broad middle-east event? Rising oil prices are clearly a worry with $120/bbl. price point potentially being the economic breaking point. His final worry was about rising inflation in the Emerging Markets if it doesn’t get contained. He also believes economic growth will slow in 2012, yet 2011 continues to look good. As for me, I couldn’t agree more; indeed, it was like hearing Jeffrey talking to Jeffrey.

Turning to the equity markets, January 2011 goes into the record books as registering some of the best monthly gains since 1997. Those outsized gains, however, were recorded by the DJIA and the SPX while other indices, like the Russell 2000 (RUT/800.11), generated a loss. I have been commenting on such divergences for nearly four weeks, often noting that the Buying Power Index was losing its momentum and that the Selling Pressure Index was gaining strength. As the good folks at the Lowry’s organization opine – while the weatherman can’t make it rain, he can tell his viewers that the dark clouds are increasing and the wind is picking up. Regrettably, the divergences continue to mount. Speaking to divergences, I have never seen such a divergence between the employment surveys (household vs. payroll) in my life with the unemployment rate plunging to 9.0% (from 9.4%) while payrolls increased a modest 36,000. As our economist, Dr. Scott Brown, writes:

“Bottom Line: Confusing; but, let’s try to sort it out. The payroll figure was weaker than expected, but there were likely weather effects and seasonal adjustment adds to the uncertainty. Manufacturing payrolls and hours rose, which is consistent with the story that fell out of the GDP report – that is, lean inventories should lead to production gains in early 2011. The unemployment rate fell sharply again and not all of that can be explained by a drop in labor force participation. The employment-to-population ratio improved only modestly. The two surveys paint somewhat different pictures, but the establishment survey data (which yields the payroll figure) is fuzzy in January and the household survey results are bizarre. Investors should take it all with a grain of salt. Information beyond this report suggests that the rate of job losses is trending very low and that new hiring is starting to pick up – that’s good. The bigger test of the labor market will come in March to June, when the unadjusted payroll numbers climb sharply. The drop in the payroll tax will boost disposable income in 1Q11, supporting consumer spending growth, and the inventory story is consistent with strengthening manufacturing activity. On balance, the economic outlook is brightening. Job growth should be above trend in the next several months. The bond market seems to have figured this out. The stock market still seems a bit confused.”

The call for this week: Well, I’m in California so these will be the only strategy comments of the week. Nevertheless, I believe that we have been in a “stealth correction” since the beginning of this year. While it’s true the DJIA and SPX have made new reaction highs many of the other indices have not (read: divergence). In addition, many emerging markets are declining, stock leadership continues to narrow, the MACD indicator has been negatively configured since January 18th, Lowry’s Buying Power Index is falling and Lowry’s Selling Pressure Index is rising, the 30-year Treasury Bond’s yield is about to break out above a spread triple top (read: higher rates) and the list goes on. Meanwhile, the top gaining sector since last November has been the Financials, but over the past few weeks the Financials have weakened noticeably. All of this continues to keep me cautious (but not bearish) as we enter February, which historically has been a down month.

*Versus the S&P 500 while at Fidelity and the Lipper Large Cap Peer Group while at RiverSource.

Copyright (c) Raymond James