Non-Farm is Non-Exciting

Gareth Watson, CFA - Vice President, Investment Management and Research, Richardson GMP

Week of February 7, 2011

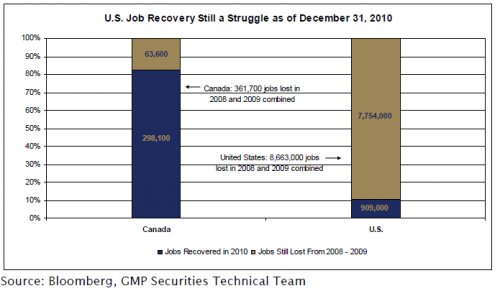

Jobs, jobs, jobs! Canada has managed to gain back all the jobs lost during the recession, but the U.S. continues to struggle with job creation even though its unemployment rate fell on Friday following the release of the January Non-farm Payroll report. You would think that the market would be troubled by America’s inability to create jobs and thus create wealth; however, U.S. equity markets shrugged off the lack luster job print and actually closed higher on Friday. It’s hard to believe that the U.S. has only recovered about 10% of the jobs lost in 2008 and 2009. Job creation is the key to the U.S. recovery, so don’t expect a substantial acceleration of economic growth until many of those 7+ million people who are still out of a job find their way back into the workforce.

Perhaps investors were still enthused by positive economic prints from earlier this week, such as the ISM Manufacturing and Non-Manufacturing Indices which easily beat expectations or the strong ADP Employment report which suggested that private jobs are still being created. Then again, we also had Federal Reserve Chairman Ben Bernanke make some comments on Thursday reminding investors that the U.S. is still not out of the woods and the recovery process is slow, albeit improving.

It’s unfortunate to admit, but unrest in the Middle East tends to benefit Canadian equity investors thanks to the TSX’s high weighting in energy stocks. This past week would be no different as rising oil prices led to strong TSX returns by Friday, even if oil futures had settled down from their mid-week highs. However, while oil prices were top of mind, we cannot ignore the positive contributions witnessed from Canadian banks and Materials stocks in the base metal and fertilizer space.

With a stronger than expected employment report in Canada, a lower than expected Non-farm Payroll print in the U.S., and continued strength/support for commodity prices, we are not surprised to find the Canadian dollar higher by over a full cent from last week relative to the greenback.

Chart of the Week

U.S. Job Growth Slow and Sluggish

The chart above shows that as of the end of 2010, Canada had regained over 80% of the jobs lost during the recession while the U.S. was faring much worse. Today’s 69,200 January employment gain for Canada means that we’ve regained all the jobs lost while the 36,000 gain in the U.S. is a rounding error compared to the 8 million + jobs lost from 2008 to 2009. At the current rate of employment creation, it would take another 8 years for the U.S. to recapture all the jobs lost. Millions, if not billions of dollars have been spent in the U.S. to create new industries and jobs as it’s widely recognized that some of the jobs lost during the recession will never come back.

The Trading Week Ahead

Earnings in Canada will move to the forefront next week as a large number of large cap blue chip names will release their Q4/2010 earnings reports. So far it has been the U.S. earnings calendar that has moved the market, but Canada’s earnings releases traditionally become more frequent a couple of weeks after the U.S. Earnings Season begins. On deck in Canada we’ll hear from telecom heavyweights BCE Inc. and TELUS; life insurers Great-West Lifeco and Manulife; Shoppers Drug Mart from the Consumer Staples sector; and natural gas giant Encana Corp.

As earnings move to the forefront in Canada, economic releases will take a back seat as there are few influential economic prints on which investors will be able to lean to move the markets. If anything, next week’s market performance may be influenced more by a reflection on today’s employment reports as investors digest what was really a disappointing report over the weekend.

Copyright (c) Richardson GMP

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Earnings in Canada will move to the forefront next week as a large number of large cap blue chip names will release their Q4/2010 earnings reports. So far it has been the U.S. earnings calendar that has moved the market, but Canada’s earnings releases traditionally become more frequent a couple of weeks after the U.S. Earnings Season begins. On deck in Canada we’ll hear from telecom heavyweights BCE Inc. and TELUS; life insurers Great-West Lifeco and Manulife; Shoppers Drug Mart from the Consumer Staples sector; and natural gas giant Encana Corp.

Earnings in Canada will move to the forefront next week as a large number of large cap blue chip names will release their Q4/2010 earnings reports. So far it has been the U.S. earnings calendar that has moved the market, but Canada’s earnings releases traditionally become more frequent a couple of weeks after the U.S. Earnings Season begins. On deck in Canada we’ll hear from telecom heavyweights BCE Inc. and TELUS; life insurers Great-West Lifeco and Manulife; Shoppers Drug Mart from the Consumer Staples sector; and natural gas giant Encana Corp.

As earnings move to the forefront in Canada, economic releases will take a back seat as there are few influential economic prints on which investors will be able to lean to move the markets. If anything, next week’s market performance may be influenced more by a reflection on today’s employment reports as investors digest what was really a disappointing report over the weekend.