By Michael Nairne, Tacita Capital

As Shakespeare noted, the past is always a prologue to the future. Hence, investors should not have been surprised by the paltry 1.4% annualized return from U.S. stocks over the past decade. Lengthy spans of moribund or even declining prices have always followed periods of rapid ascent in stock prices, as was experienced from 1982 through 1999. This is illustrated in the following graph that depicts the cumulative appreciation in large company U.S. stock prices since 1825. The eight periods of price stagnation are highlighted with dark lines.

Prior to World War II, bull markets typically ended in ferocious bear markets trigged by financial panics and recessions. The market's recovery to the previous cycle high was always lengthy. For example, the Civil War stock boom was followed by the Panic of 1873 and it wasn't until 1879 that stock prices exceeded their prior 1864 high. Similarly, the Panic of 1893, that was caused by railroad overbuilding, dicey financing and bank defaults contributed to an 18-year price plateau that ran from 1881 to 1899. History is replete with such examples; the U.S. housing bubble is just the latest culprit.

More recently, the post WWII stock market boom reached a plateau in the late 1960's and was followed by over a decade of price stagnation before the bull market of the 1980's. By historic standards, the duration of the current period of moribund prices is still somewhat below norm; patience is likely still in order.

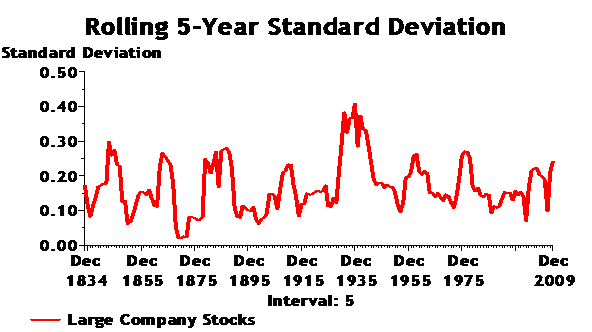

History's lessons on market volatility are also instructive. The reputedly "unprecedented" market volatility of the last decade is in fact a recurrent phenomenon. As illustrated in the following graph depicting the standard deviation – a measure of volatility – of large company stocks, the market has always oscillated between periods of relative calm and extreme instability.

Whether volatility remains elevated for a longer period as in the late 1870's to 1880's and the 1930's or ebbs away as in most cycles has yet to be seen. The longest and deepest economic contractions on record occurred in the 1870's and the 1930's. The relatively fast, albeit subpar, recovery to-date, so long as it is not derailed by an economic shock, suggests that a moderation in volatility may be in the cards.

One important lesson from history is that another lost decade is unlikely. Since 1825 there has never been a case where returns have hovered in the 0% range for two sequential decades (see Appendix I). On the other hand, a roaring bull market is improbable unless investors lapse into another manic state. Today's market valuations are simply not low enough to fuel a prolonged period of double-digit returns. Asset bubbles will occur – they always do – but are likely to be concentrated in specific assets (e.g. precious metals and commodities) and specific markets (e.g. emerging economies).