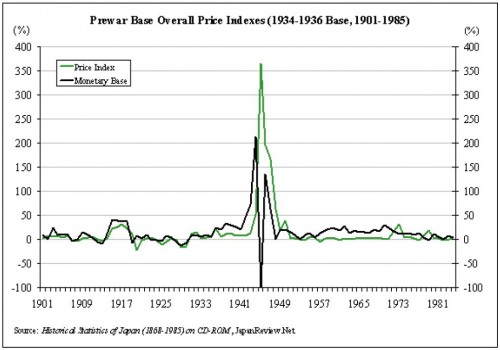

This can go two ways. It can set in motion a deflationary austerity drive to restore cost competiveness. This is where Japan is at now; enormous productivity measures are being implemented by the exporters to offset the currency's move to the low 80s versus the dollar. However, there is a tail risk that the currency spikes higher, especially if events in Europe deteriorate further, and I fear that this could produce political and monetary mayhem. One likely result could be the repudiation of the economy's debts through hyperinflation. Remember that despite its domestically financed sovereign debts in the 1940s, Japan chose to renounce its war debts through its government's abuse of currency issuance which saw them experience an annual inflation rate of 568% in 1945. Profound crisis have the ability to turn one sector of the domestic economy against another. This time around the battle may be staged by the elderly versus the young salary man.

Turning micro once more, it is my contention that all of the ingredients are in place for a binary change in the profitability of the Japanese steel industry. They have effectively given their Asian customers a free put option. Remember they are not obliged to take expensive steel from Japan indefinitely. Already the steel producers are struggling with price competitiveness and the Korean group, Hyundai, is very close to commencing production at its new eight million ton mega blast furnace plant which will represent almost 10% of Japan's total steel output when it is running at full

tilt. It will change the competitive landscape dramatically: Korea, Japan's largest overseas steel market, will go from a net importing country to a modest net exporter.

What if JFE and Nippon Steel have to confine themselves to their domestic market? In early 2009 the financial crisis briefly saw their utilisation levels drop into the low fifties. Their smaller domestic competitors fell into the low thirties. I have good protection here. These smaller guys typically run just one sub-optimal blast furnace; they exist owing to the good grace of others. But should these huge steel titans, JFE and Nippon, return home, the higher and less flexible cost base of the domestic producers will bankrupt them. Remember their biggest customers are the car manufacturers, the ship builders, electrical goods manufacturers and the construction industry. When the rest of Asia does not want Japanese steel, I can assure you that domestic Japanese demand will not take up the slack. The delta is potentially huge; like Ireland they have the ability to shift from hero to zero in an extraordinary short period of time. The beleaguered salaryman will not be best pleased by such a savage turn of economic events and displaced from the warmth of his iron steel furnace, he may turn his fury on the gilded pensions of his elders.

Eat Bitterness

I do not think it is an exaggeration to suggest that modern Japan has increasingly come to resemble the final years of the Second World War. Back then of course it was the Japanese military elite that had gone berserk, leading the country to certain disaster, while powerless civilian governments in Tokyo formed and fell every few months. Political turmoil is already a reality with the country on its sixth prime minister and eighth finance minister since Koizumi saw out his five year term in 2006. Although no faction has yet to formally declare "Tora! Tora! Tora!" I fear that should we see further yen strength, and the bankruptcy of a major industrial sector (such as the steel industry), then one of Japan's warring factions could be persuaded to show its hand.

Worryingly, we found out recently that I am not so

alone in this heretical currency view that I first

expressed in May's letter. Toshiba's Chief Exective

was recently quoted speaking of his plans to deal with 70. "People" he said, had assured him that, "the yen would never go to that level when we came up with this plan last October, but looking at the weakness of the dollar and the strength of the now, that may not be too far from reality." But what if goes to 60 or into the 50s?

Perhaps Japan needs a good hanging?

It was Samuel Johnson who noted that when a man knows he is to be hanged in a fortnight, it concentrates his mind wonderfully. In a similar vein the recent special report on Japan published by the Economist noted that it might, "take bankruptcy to change attitudes in Japan, but that would be a good thing." Like them, I agree this would be a good thing. Back in the 1930s it was the politicians that were bumped off. The former prime-minister

Takahashi Korekiyo is the only president of the Bank of Japan to have appeared on a Japanese banknote. But the military killed him in 1936 after he attempted to reduce their budget. This time around I reckon it will be the politicians that stick the knife in and bankrupt the country's ageing and rich retirees who like the deflationary status quo. I reason that should the currency appreciate to levels previously thought unimaginable, and jeopardise the viability of the country's export model, the workers could unite to press for dramatic institutional change.

And so I end where I began. Should a grotesque series of debilitating financial events, from disarray in Europe to a growth shock in Asia, set the yen racing below 70 to the dollar, it could establish the pretext for a truly gigantic monetary intervention. It is conceivable that the Bank of Japan would be nationalised and with the politicians galvanised by public fears and recriminations an era of hyperinflation would surely beckon. Inflation would indeed be a monetary phenomenon.

Conclusion

The truth is I couldn't guarantee it...Neither of us should have tried to predict the future.

Tony Blair, A Journey (2010)

The world of investment has parallels with theology. Repetition and the passage of many years, especially a decade, can transform the rational into the fanatical. I think we are approaching the end of a chapter that began with much cynicism directed towards China and commodities and is closing with fervent devotion. As an example, the gold price has risen more than fourfold since 2002 and has climbed every single calendar year for the past decade; only the twelve year sequence of consecutive up years from 1978 to 1989 in the Nikkei can beat it. I have no beef about gold, but how likely is it to be the next big trade?

Comments are closed.