THE ECLECTICA FUND

Manager Commentary, December 2010

by Hugh Hendry, Eclectica Asset Management

There Are No Policy Remedies for Debt Deflation

"He became a surgeon because he was afraid of knives. He got married because he was afraid of women. He had a child because he was afraid of responsibility. Now his marriage over and his child no longer speaking to him, he turned off all the lights in the house because he was afraid of the dark."

Michael Ventura, The Zoo Where You're Fed To God: A Novel

Michael Ventura made me write. He confronted me with uncomfortable questions that have no answers. Do I write because I'm afraid of writing? Did I become a hedge fund manager because I'm afraid of risk? Is Bernanke set to wreak economic havoc in the twenty-first century because he misunderstands the malaise of the early twentieth century? In truth, the quote emanates from a book that I bought over the summer when I mistakenly read its title as "The Zoo Where The Fed Is God," I thought it sounded like a contemporary narrative on today's risk markets. But it has succeeded nonetheless in motivating me to share my thoughts with you once more. However, I must warn you that my views have not changed. Therefore some of you may wish to look away now.

I Sing The Body Eclectic?

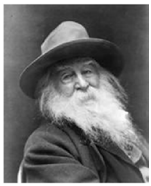

As you know, I have not written at length for some time. You need to understand that my timing is heavily influenced by both the push and the pull of Robert Prechter and Walt Whitman. Prechter because he recommends that one should write more when certain and less when uncertain. Like I said, nothing has really changed and consequently I have been in no rush to repeat myself. To me Whitman is influential because he spoke like a hedge fund manager ought to: "all faults may be forgiven of him who has perfect candour," "be curious, not judgemental," and my personal favourite, "have you learned the lessons only of those who admire you, and were tender with you and stood aside for you? Have you not learned the great lessons from those who braced themselves against you, and disputed passage with you?" But the clincher, for me at least, was his life-long endeavour, a book of poems he entitled Leaves of

Grass, which he periodically updated, republished and embellished as he grew older and wiser. Think about it: one book, one life. I would like to think these investment letters are written in the same spirit.

Described as a courageous attempt to weave, "the muscle of the male and the teeming fibre of the female," Whitman's poems succeeded, of course, only in shocking their prudish late nineteenth century audience. I fear that just as Whitman's musings on sex and sexuality seem rather tame to the modern eye, a later generation might feel the same way about our squeamish reaction to the Fed's initial stab at quantitative easing. They might guffaw, "two trillion dollars, how quaint. And they thought that might produce inflation!?" For a not so distant future generation may bear witness to far greater monetary debauchery.

This has been my argument in April 2009. Given the impediment of such a large quantity of private sector indebtedness, I speculated that should the global economy suffer a further debilitating setback over the course of the next two years, the Fed and especially its acolytes at the Bank of Japan would print much, much more paper money. And only under such dramatic economic circumstances would we establish the pretext for a truly gigantic monetary intervention which would surely undermine the fiat system.

Today, however, we are learning that additional money, perhaps $600bn, is to be printed even without the occurrence of a serious crisis. This has come as something of a surprise to me. I had thought that intense scrutiny and political discontent from the US Congress would have tempered the ardour for such intervention. The QE

announcement has also produced a rise in the risk premium associated with term structure. The yield on the ten year Treasury has shot up from just under 2.5% in August to almost 3% in November. Yields on government bonds with shorter tenors (where we have directional exposure) have also been dragged up as the market factors in a heightened probability that QE2 will lead to a rise in policy rates sooner than had the Fed shown greater restraint. This has proven detrimental to the Fund's short term performance. Yet despite it all, I remain persuaded by the argument that the additional proposed easing is not a tipping point and accordingly on its own is unlikely to do much to alter the course of US or western inflation. Perhaps I have some explaining to do.

War!

Evidently there is an all-out war being waged between what we might refer to as the Fed's fiat money (the ability to increase dollar banking liabilities), and the private sector's debt-based money (the willingness of the private sector to hold dollar banking assets). The market favours the prospect of fiat printing winning. Perhaps the outcome is a foregone conclusion. However, I continue to argue that the odds seem stacked against this outcome occurring in the short term.

Comments are closed.