Irish Eyes Are Simply Not Smiling

David Andrews CFA, Private Client Strategist, Richardson GMP Ltd.

There’s a well worn joke that asks, “What’s the difference between Iceland and Ireland?” The cheeky punch line used to be “one-letter and a solvent banking system” but recent developments in the credit markets suggest Ireland’s banking system may be about to follow the path of the

There’s a well worn joke that asks, “What’s the difference between Iceland and Ireland?” The cheeky punch line used to be “one-letter and a solvent banking system” but recent developments in the credit markets suggest Ireland’s banking system may be about to follow the path of the

Nordic nation which saw its banks default in 2008. Hard times and mounting debt levels in Ireland have bond investors running for cover as they dump government debt triggering a second wave of European sovereign debt fears. The yield on 10-year Irish bonds has surged to 9%; a level not seen since the advent of the Euro in 1999. Credit Default Swaps for Irish banks (the cost of insuring against bond default) hit record levels with the majority of global investors betting the Irish government will have no choice but to let its banking system default within the next 18 months. Germany raised the ire of investors by suggesting holders of Irish bonds would have to take the haircut and write down the value of their investment rather than getting bailed out by the EU. European leaders attending the G20 in Seoul, South Korea diffused an increasingly tense situation by issuing a statement of EU solidarity and their willingness to aid Ireland. Irish bonds rallied on the statement but the situation reminded investors the European situation has not yet been fully resolved.

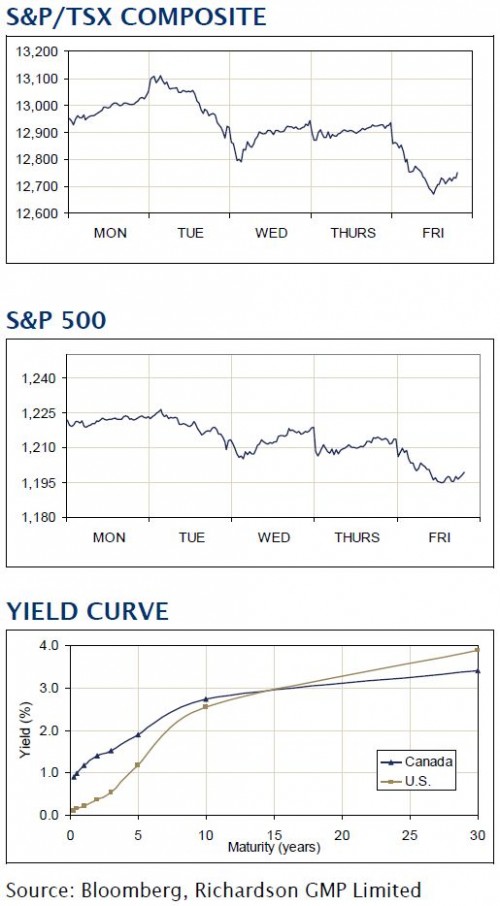

A confluence of bad news items this week included the European debt situation, as well as a hostile G20 meeting where countries took the U.S. to task for their unilateral launch of QE2. Sentiment soured further with Cisco Systems poor quarterly earnings release on Wednesday which resulted in the tech company’s shares sinking 17 percent on the results.

The U.S. dollar index jumped 2% this week on Euro weakness and news that inflation in China reached a 25 month high. The speculation was further monetary tightening (China raised reserve requirements this week) and Yuan appreciation would occur in the weeks and months

ahead. The thought of China raising interest rates spooked commodity markets in general this week. Gold and silver retreated from new highs

this week as the combination of new rules for entering silver futures contracts and the retreat from commodities in general weighed on precious metals.

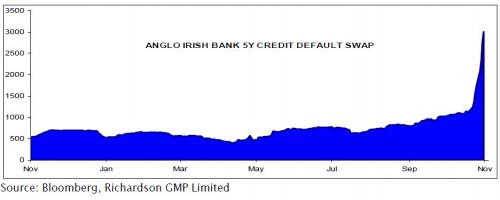

Priced for Default

The chart of the week shows the dramatic rise in the cost of insuring debts owed by Irish banks. The market clearly no longer believes bankers’ denials that problems exist in the banking system. Similar to the U.S. real estate situation, loans made by Irish banks over the past few years are increasingly not being repaid and the collateral on which those loans were based is increasingly suspect.

Looking Forward

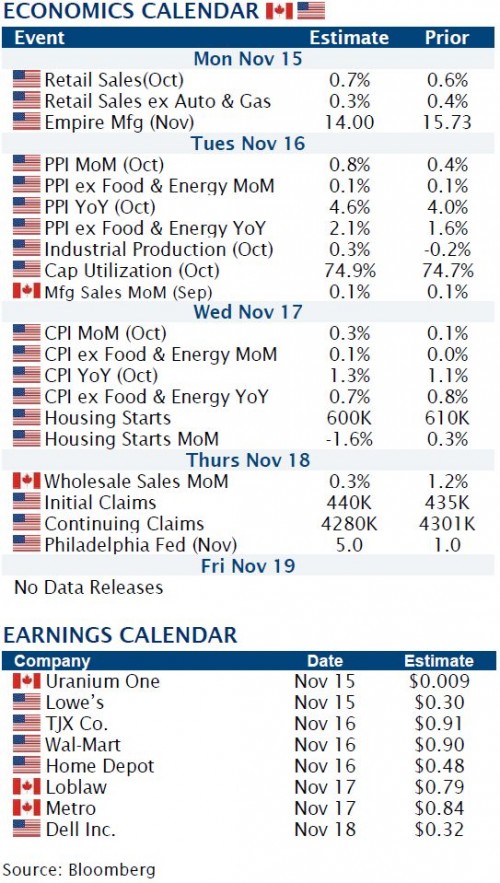

Thank goodness the North American economic calendar ramps up again in the week ahead. Investors had virtually no domestic data to counteract the negative sentiment surrounding the G20 meeting, China’s inflation concerns, and Ireland’s debt problems. U.S. inflation may have edged slightly higher in October and housing starts may show a modest stabilization in the moribund real estate sector. Third quarter results from the retail sector including Wal-Mart, TJX Companies, Lowe’s, and Home Depot may give us some insight in to how consumers are behaving as we head into the critical holiday season. Just two years after a taxpayer bailout salvaged General Motors, some of the largest retail brokerage firms are apparently being shut out of what is poised to be a lucrative investment opportunity as the auto company goes public next week. The lack of available shares is a disappointment to some potential retail investors, who are frustrated that, after taxpayer bailout funds helped a struggling GM in the depths of the financial recession, they may not be able to participate in what is expected to be a lucrative money-making opportunity. Europe and the Euro currency will remain in focus and possibly under intense pressure due to sovereign-default rumors in the week ahead. European markets got a lift from the G20 statement and a successful Italian government bond auction where they sold most of the planned €8.25 billion. Spain will auction long and ultra-long government bonds next Thursday. Greece will sell €300 million of 13-week T-bills the same day. Portugal will auction €750 million of 12-month T-bills on Wednesday.

Copyright (c) Richardson GMP Ltd