Anticipating Volatility and the Rise of Emerging Markets

By Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investors

Life is about managing expectations and we believe understanding market cycles helps investors navigate through the volatility of their investments. We often remind investors to “Anticipate Before You Participate” and I strongly urge you to read through our special presentation on managing volatility. Read the presentation here.

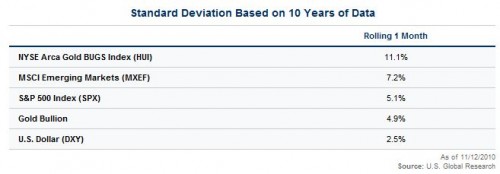

This table shows the monthly volatility based on 10 years of data for a number of different investments. You can easily see each asset class has its own unique DNA of volatility.

For gold stocks, it’s a normal event to see a positive or negative move of 11 percent over just one month’s time. For emerging markets, it’s just over 7 percent. Understanding this volatility is essential to removing emotional reactions and making the best investment decisions.

Recently, I’ve noticed many new faces on business television commenting about a bubble forming in commodities due to the Federal Reserve’s Quantitative Easing (QE2) policy and resulting weakness in the U.S. dollar. Both of these are a part of the commodity equation but focusing on them omits several long-term factors driving commodities.

I do not see a bubble at this time but our quant models are showing we are due for a short-term correction. Investors need to anticipate this correction and not lose sight of the long-term trend.

We believe government policies are a precursor to change, and as a result, we monitor and track the fiscal and monetary policies of the world’s largest countries both in terms of economic stature and population.

This table shows the population size and economic stature of the emerging world—represented by what we like to call the E7—versus the developed world—the G7.

You can see that the emerging world currently holds roughly half of the world’s population but less than one-fifth of its economic clout. Already we are seeing a tremendous transformation of the emerging world and we don’t think this imbalance will remain the case for long.