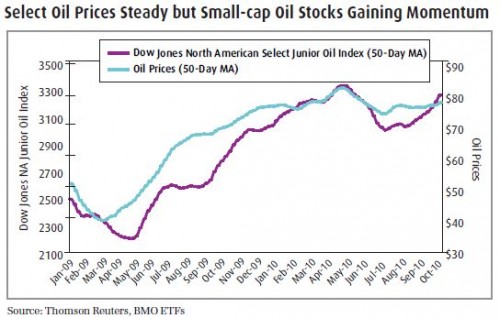

Oil prices, in our opinion, should also benefit from a falling U.S. dollar. However, instead of seeing the strong run-up in prices we witnessed in the beginning of 2008, we believe oil prices will trade at higher but tightly range-bound markets as already evidenced by the flattening of both the 50- and 200-day moving average (MA) of oil prices. We therefore prefer oil related companies over the commodity itself at this point, as higher oil prices will lead to wider profit margins for these companies as a whole, all things remaining equal. Investors wishing to get exposure to oil related investments may want to consider the BMO Junior Oil Index ETF (ZJO), which is comprised of 59 North American small-cap oil related companies. As of late, the 50-Day Moving Average of the Dow Jones North American Junior Oil Index has begun to gain momentum.

From a fundamental perspective, natural gas may also be attractive at this point. As we outlined in our recently published “Investing in Natural Gas Without Getting Rolled,” late October tends to be a period during which natural gas supplies drop. Although we have not yet seen this drop, the weather temperature has just begun to decline. At the time of this report, the market is still anticipating weekly injections in the U.S. Department of Energy’s inventory numbers. Therefore if the survey starts reporting draw downs, the price of natural gas could potentially appreciate. As natural gas is not a storable commodity, some of the ETFs providing access to this commodity tend to use future contracts.

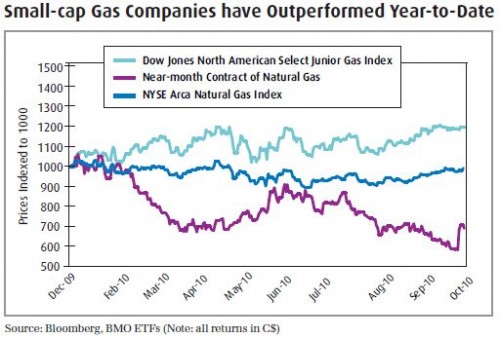

However, natural gas is currently in a state of contango so futures-based ETFs will likely exhibit decay over the long-term due to a negative roll yield. Investors may therefore want to consider the BMO Junior Gas Index ETF (ZJN), which does not contain futures but is instead comprised of 31 small-cap North American companies involved with gas-related activities. Year-to-date, the Dow Jones North American Select Junior Gas Index, which is the index that ZJN tracks, has outperformed both the front-month contract of NYSE natural gas and the larger-cap NYSE Arca Gas Index in Canadian dollars.

In summary, we believe the easy monetary policies, further quantitative easing and the global currency war are accommodative for small-cap commodity companies. The three BMO Junior ETFs are an efficient way in which investors can access a basket of small-cap companies specific to each of gold, oil and natural gas. By investing in an ETF, investors can minimize company specific risk while maintaining the strength of the small-cap sector.

Footnotes

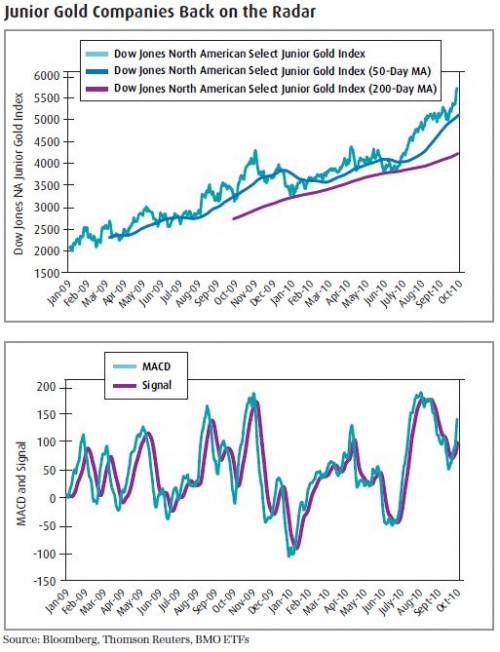

1 MACD: The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD, called the “signal line”, is then plotted on top of the MACD, functioning as a trigger for buy and sell signals.

2 Contango: When the futures price is above the expected future spot price. Consequently, the price will decline to the spot price before the delivery date.