Schwab Sector Views: Tactical Tweaking

Brad Sorensen, CFA, Director of Market and Sector Analysis,

Schwab Center for Financial Research, Charles Schwab & Co., Inc.

October 28, 2010

Schwab Sector Views reflect a three- to six-month outlook and are appropriate for investors looking for tactical ideas. We typically update our views every two weeks.

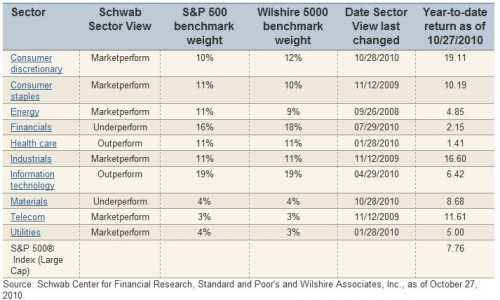

We believe the time has come to make a couple changes to our current sector recommendations. At times, we make large-scale changes due to shifts in the business or economic cycles that we perceive may be occurring; other times, we make smaller changes to adjust to subtler shifts in the environment—this is one of those times.

Materials

The materials sector has had a good run during the past few months, as the combination of renewed confidence in the global economic expansion—especially continued robust growth in China—and the weakening US dollar has buoyed the group. We believe the enthusiasm may be a bit overdone and that now’s an appropriate time to take some profits in the group as some underperformance may be in store in the near term.

The dollar seems to be due for at least a short-term bounce because the weakening in expectations of another round of easing by the Fed seems to be largely priced in. Additionally, China recently boosted interest rates (though only by a token amount), indicating further attempts to achieve a sustainable, more-moderate growth rate. Both of these developments contribute to our reduction of the materials sector rating to underperform.

Consumer discretionary

Offsetting this move, we’re boosting the rating of the consumer discretionary sector to marketperform from underperform. While there are still many headwinds facing consumers, we believe the general trend of unemployment will head lower in the coming months, helping boost consumer confidence. Additionally, retailers have done a good job controlling costs and inventory and they could start to achieve at least a small measure of pricing power that’s long been absent. Note that we aren’t overly optimistic on the sector because challenges do remain, but we believe the group will perform roughly inline with the market in the near term.

With these two moves, combined with our continued recommendations of information technology at outperform and financials at underperform, our overall risk exposure remains roughly the same, because our view of the larger economic picture remains largely intact. But we believe that these tweaks can help align a portfolio better with current conditions we’re seeing in the market.

As a client, you can use the Portfolio Checkup tool to help ascertain and manage your sector allocations.

Consumer discretionary: Marketperform

Although we’re still not overly bullish on the outlook for American consumers, we do believe there are enough positive developments to lift our rating on the group to marketperform from underperform. We believe that the unemployment rate will drift lower during the next year, (though not as fast as we would hope), giving consumers marginally more confidence in their ability to spend.

The ending of the uncertainty about the November 2 elections should help, as businesses should get more clarity following the outcome, enabling them to make future plans with more confidence. Additionally, we believe that at least the majority of the tax cuts will be extended in the “lame duck” session following the elections, alleviating concern that discretionary incomes might be cut by tax hikes. Also contributing to our more-positive view on the sector, retailers have been able to pare costs and keep inventories under control, which could help them attain at least some improved measure of pricing power.

As mentioned, headwinds remain, and we aren’t advocating an overly bullish stance. Unemployment remains high, housing struggles continue and competition among retailers is fierce, compressing profit margins. But we believe the positives and negatives are roughly equal at this point, and expect that performance in line with the market is most likely.

Clients can see our top-rated stocks in the consumer discretionary sector.

Positive factors for the consumer discretionary sector:

- Inventories remain relatively lean, which could provide retailers with some pricing power as activity picks up. We're watching this closely, however, as some inventory levels have been rebuilt.

- Retailers have aggressively cut costs, which should continue to support profits.

- The Federal Reserve remains quite accommodative, which could help support consumers.

- Productivity gains, robust through the first half of the year, have started to ease, indicating that companies may need to start hiring in order to meet increased demand.

Negative factors for the consumer discretionary sector:

- The unemployment rate is relatively high, and although leading indictors have shown signs of improvement, they've stalled lately.

- Revolving credit limits have been reduced, which will likely reduce consumers' ability to spend.

- Wage gains remain weak, which could put pressure on how much consumers can increase spending.

- Government stimulus measures are ending this year and tax hikes have been proposed, which could stymie consumer spending.

- Credit standards remain tight, although there are signs of slight easing.