by Robert Arnott, Chairman, Research Affiliates

September 2010

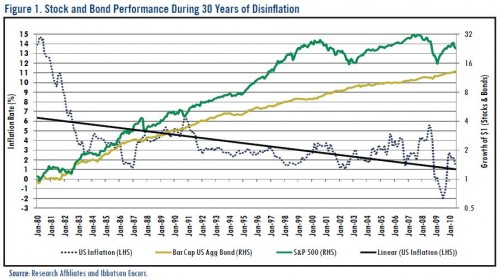

In 1981, the first 401(k) [RSP (Canada) in 1957] plan was created, a major step in the transition from a paternalistic defined benefit system to an era of personal responsibility in retirement savings. Fortunately for 401(k) [RSP] participants, a 30-year disinflationary high economic growth cycle provided a tremendous tailwind for capital market returns. Even after the “Lost Decade,”1 the 30-plus year period from 1980 through June 2010 witnessed U.S. stocks and bonds returning 10.8% and 8.8% respectively, delivering a 10.3% annualized return2 for the prototypical 60/40 investor (see Figure 1). While this return was achieved by a scant few (a topic for another issue of Fundamentals!), this was an environment in which even bad decisions could lead to reasonably good outcomes.

Unfortunately for 401(k) [RSP] investors, the future is likely to be less benign. Yields are down for stocks, bonds, and alternatives, setting the stage for lower returns. And the economic backdrop is likely to see reflation, not disinflation, compromising our ability to earn solid real returns and compromising the spending power of our eventual withdrawals. In this issue we show that defined contribution investors are ill-prepared for inflation. This will be a common and costly mistake.

Real Return Strategies: The Glaring DC Plan Hole

For most of us, our own investment experience—and the opportunity set that is presented to us—will dictate our 401(k) [RSP] allocations. We tend to believe that whatever worked well for the past 30 years should work well going forward. And, when presented with a wide array of stock market strategies and a smattering of bond, money market, and balanced strategies, we’ll wind up with a 401(k) [RSP] portfolio dominated by stocks and bonds. The evidence supports this: investors hold between 55–75% in stocks and 25–45% in short-term fixed-income and bonds.3,4,5 Most 401(k) [RSP] plans have a money market or stable value option, and one or two bond funds providing fixed-income exposure. But, on average, only 5 of the typical 18 investment choices are non-stock funds! With stock funds comprising 70% of our available choices, it’s no coincidence that the average 401(k) [RSP] investor has roughly 70% of their 401(k) [RSP] in stocks.

We’re building our retirement homes on two pillars: stocks provide participation in the growth of the macro economy, and bonds provide steady income while tamping down the volatility of our stock holdings. In a reflationary world, characterized by inflationary jolts that deplete the purchasing power of our portfolio and of our retirement income, neither will serve us well. Inflation triggers higher interest rates, which hurts our bonds, and creates economic crosscurrents and uncertainty, which drives down the valuation levels for stocks.

We need a third pillar that can help us during inflationary shocks and can afford us an opportunity to diversify away from stocks and bonds. The vast majority of 401(k) [RSP] programs offer nothing of the sort, apart from a brokerage option that requires employees to do their own homework and make their own choices. Inflation hedging and real return asset classes such as TIPS (Treasury Inflation-Protected Securities), commodities, or REITs (Real Estate Investment Trusts) are rarely offered. Nor are allocations away from the dollar (what is inflation, if it’s not dollar debasement?), such as emerging markets stocks and bonds. Even fast growing, targetdate funds—which make asset allocation decisions for participants—rarely include inflation hedges.