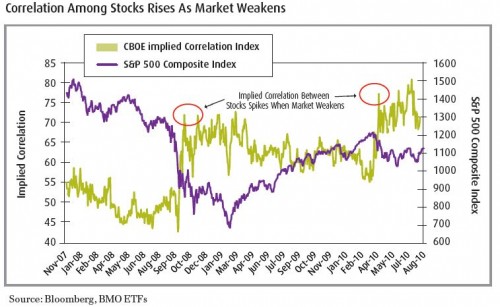

In financial theory, it’s often debated how many stocks are required to be in a portfolio for true diversification. Benjamin Graham, most recognized as the father of value investing, concluded that a portfolio of 15-30 stocks was adequate to eliminate non-systematic risk. Other academic studies have since gone on to contend that to truly eliminate non-market risk, an investor must purchase the entire market. With the development of exchange-traded funds (ETFs), access to low-cost beta (or buying the entire market) became easily achievable. We argue however that owning the market or diversifying with a basket of global equity ETFs is no longer sufficient for even the most aggressive investor. In the chart below, we take a look at the CBOE Implied Correlation Index1. Notice that in times of market weakness and especially during times of financial crises, the correlation among stocks is particularly high. This suggests diversification amongst stocks provides very limited, if any, downside protection. Given the current market, where it’s a tug-of-war between good and bad news or better put “the risk-on, risk-off trade,” we believe the correlation among stocks will likely remain high. The low interest rate policies from several key central banks continues to encourage carry trades1 which will further exacerbate the intra-correlation among stocks.

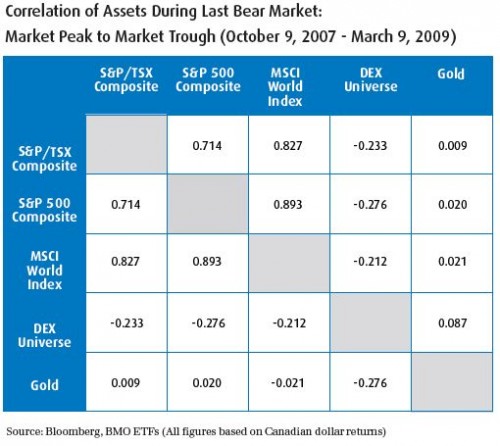

Although the addition of non-Canadian stocks may provide added returns to a portfolio, when markets contract, equities tend to move in unison. While the theory of decoupling garnered much investor attention during the last bullmarket, it was quickly put to rest after the most recent financial crisis, when we learned that increased globalization has resulted in more correlation amongst international markets, not less. As a result, we believe it’s important for investors to take a holistic view of their portfolios and be diversified across asset classes. As our readers are aware, we remain bullish on gold and gold-related investments, especially with the U.S. Federal Reserve hinting at another bout of quantitative easing3. While fixed income investments may not provide the same yields as they once did, we urge investors not to abandon them. Their non-correlated returns with other asset classes are much needed from the perspective of total portfolio construction and can provide benefits to even the most aggressive investor.

Opportunity:

Heading into 2010, it was expected that the Bank of Canada (BoC) would tighten monetary policy by raising its key interest rates, as the health of the global economy and particularly Canada’s had drastically improved

from early 2009. At that time, reducing a portfolio’s sensitivity to interest rates or lowering the duration of the fixed income portion of a portfolio was a critical tactical allocation call. However, now with the BoC possibly taking a break before raising rates again, we would recommend investors consider venturing further out the yield curve. With no signs of inflation and the economy still weak, we would view more than one rate hike before the end of the year as a surprise. With Mark Carney, the Governor of the BoC, going on record to say that global economic conditions should be considered in addition to Canada’s own, it’s reasonable to conclude that a further succession of rate hikes would come only after the market becomes more confident that sovereign debt concerns are behind us and the global economy stands on more solid footing.

Furthermore, a higher relative interest rate to the U.S. and potentially against China, depending on how quickly China’s currency-peg is loosened, would ultimately cause the Canadian dollar to strengthen. This would come as a risk as the US and Chinese economies are the main destination for Canada’s exports.

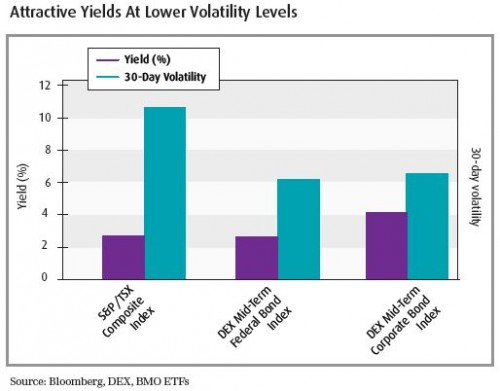

For investors wishing to reallocate their fixed income positions further out the yield curve, ETFs are an efficient way to do so. In an environment in which yield and income are tough to come by, we believe extending

duration and adjusting credit quality can be especially important. BMO Exchange-Traded Funds has two ETFs that investors may want to consider to execute this strategy. The first is the BMO Mid Federal Bond Index

ETF (ZFM) which is suitable for more conservative investors concerned about credit quality. This ETF tracks the DEX Mid Term Federal Bond Index, an index made up of fixed income securities issued by the Government of Canada with a credit rating of AAA and a minimum size of $50 million per issue. The yield of the index is currently 2.5% consisting of Government of Canada bonds with an effective term to maturity between five and ten years.

A second ETF investors may want to consider is the BMO Mid Corporate Bond Index ETF (ZCM) which is suitable for those looking for an increased yield since the index is currently yielding 4.0%. This ETF tracks the DEX Mid Term Corporate Bond Index with an effective term to maturity between five and ten years and a credit rating of BBB or higher. It’s worth noting that these bonds are Canadian investment grade corporate bonds and not of the U.S. junk bond quality. At the moment, the yield on the DEX Mid Term Corporate Bond Index is 140 bps higher than that of the S&P/TSX Composite’s 2.6%. Since corporate bonds have higher priority than equities in a bankruptcy, we view this as attractive value, particularly for those investors preferring to avoid the volatility inherent in equities.

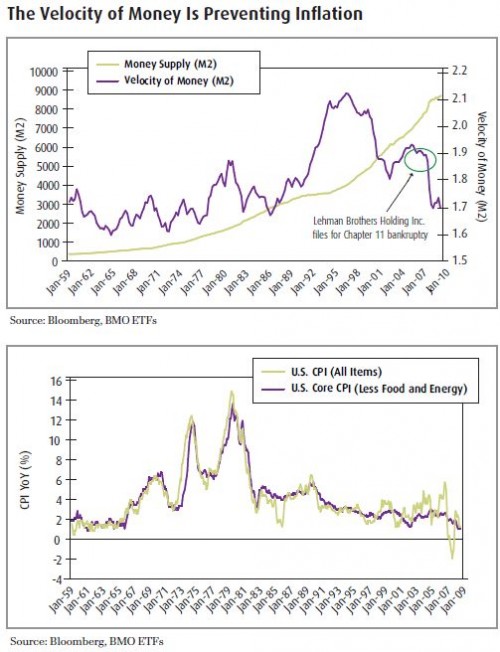

While the collective quantitative easing policies enacted by the global central banks to circumvent the collapse of the global financial system was necessary to bring liquidity back to the system, there is a common concern that the increased money supply will lead to inflation. As the amount of money has increased according to the measure of M2 money supply4, the amount of goods available for sale has remained relatively fixed. In that scenario, fixed income investments are disadvantaged because the buying power of a dollar is eroded while invested assets remain relatively fixed. Though inflation could potentially be an issue down the road, the immediate concern is deflation.

The reason the excess money supply has not caused inflation or hyper-inflation is due to the lack of lending at the bank level. With unemployment still high, in the US in particular, and the lack of opportunities in the weak business environment, the need for loans is significantly decreased. This is clearly indicated by the steep decline in the Velocity of Money5 (M2) measure experienced after September of 2008, the same month Lehman Brothers Holding Inc. filed for Chapter 11 bankruptcy and caused a modern day run on the bank.

At this point, business conditions and employment would have to improve to encourage bank loans which would cause the velocity of money to increase. As our readers are aware, we have professed the benefits of holding gold in a portfolio all year long. However, investors should also consider Canadian issued bonds in a portfolio for their downside and deflationary protection. While the previous ETFs mentioned in this report are two that we particularly like at the moment, BMO Exchange-Traded Funds has developed instruments that not only allow investors to fine tune their fixed income maturity profile in their portfolio but also to precisely assign capital based on the credit quality of

the specific issues.

Footnotes

1 The CBOE Implied Correlation Index is a measure of the expected average correlation of price returns of S&P 500 Index components, implied through SPX option prices and prices of single-stock options on the 50 largest components of the SPX. The data used in our chart was blended between

two indices with maturities of January 2010 (“ICJ Index”) and January 2011 (“JCJ Index”).

2 A carry trade is a strategy in which an investor borrows money at a low interest rate in order to fund investments in assets that are likely to provide a higher return. As the price of the asset sells off, investors may be forced to liquidate the position causing the correlation of assets to increase during times of market weakness.

3 Quantitative easing is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

4 M2 is a category within the money supply that includes M1 in addition to all time-related deposits, savings deposits, and non-institutional money-market funds

5 Velocity of money is the rate at which money circulates, changes hands, or turns over in an economy in a given period. Higher velocity means the same quantity of money is used for a greater number of transactions and is related to the demand for money. It is measured as the ratio of GNP to the given stock of money.