September to Remember

by David Andrews CFA, Private Client Strategist, Richardson GMP Ltd.

Is this the ‘new normal’ everyone is talking about these days? September proved to be anything but ‘normal’ as U.S. stock indexes capped their best month-of-September performances in seven decades. Investors ignored ongoing economic uncertainty and chose to believe another round of stimulus in the form of Quantitative Easing was in the cards. With the Federal Reserve edging closer and closer to another round of bond buying, stock markets were effectively handed a put option (floor of support) which bolstered sentiment and rewarded risk taking. In a perverse turn of events, it now seems stock markets actually cheer for weaker news on the economy only to ensure the Federal Reserve does launch their QE2. A ‘new normal’ indeed!

The September surge saw the best one month performance by the S&P 500 (+8.8%) since April 2009, and its best quarter (+1 0.7%) in a year. The Toronto Stock Exchange also surged to its own two-year high this week helped by surging investor demand for gold. The TSX rose 3.8% helped along by commodities as we saw by new highs in copper, gold and silver.

Economic data continues to give mixed signals to investors. Consumer confidence slipped again in September, but we also saw fewer U.S. workers filing claims for jobless benefits (453K), easing concerns the world’s largest economy may be retrenching further. Investors also learned the Canadian economy shrank for the first time in eleven months as July GDP fell 0.1%. The economy may have slipped more in the third quarter than the Bank of Canada had predicted this summer. Bank of Canada governor Mark Carney confirmed this week that our economy had indeed lost its momentum due to weaker U.S. demand and the over- indebted Canadian consumers. Traders have since bet that future interest rate hikes are now on hold for the foreseeable future.

Internationally, Chinese manufacturing data showed factory activity expanded at its fastest pace in four months supporting the notion China is gearing up again after its weaker second quarter performance. U.S. lawmakers took steps toward approving a bill designed to protect against Chinese imports. Could a U.S./China trade war be looming? Stay tuned.

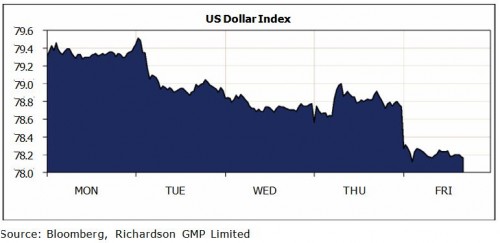

Greenback Woes

An eight month low for the U.S. dollar helped bolster commodity prices this week. Gold is setting all time highs above $1 300/oz and Oil pushed through the $80/bbl level. Continued poor economic data out of the U.S. keeps the prospect of further Quantitative Easing (November) on the front burner for investors.

Looking Forward

We are now in the final quarter of the year. Next week, we have another full economic calendar from which the markets will take direction. All eyes will be on Friday’s U.S. employment situation report for September. Markets anticipate a modest, but positive gain of 5,000 new jobs for the month. In August, payrolls fell a surprising 54,000, so investors will get to see if the U.S. employment situation is at the very least showing signs of stabilizing. With summer over, the unemployment rate is expected to tick higher to 9.7% as more job seekers resumed their search. The smorgasbord of data will also include U.S. Pending Home Sales (Monday), more consumer confidence data (Tuesday), and the regular weekly unemployment claims (Thursday). Markets will take their cues primarily from the U.S. data, but Canada is expected to show (on Friday) it added another 1 0,000 new jobs in September. This follows the surprising gain of 36,000 new positions in August. The Canadian unemployment rate is expected to fall to 8.0%, but sadly this is unlikely to move anyone’s needle.

Third quarter Earnings Season also kicks off on Thursday when Alcoa unveils their most recent earnings results. Standard & Poor’s estimates a 31% increase in corporate earnings versus the same quarter last year. Thomson Reuters expects a more modest 24% increase but either way, Earnings Season should prove mostly supportive of stock prices. However, keep in mind 77 S&P 500 companies have already issued profit warnings; far more than last quarter. This time earnings will be scrutinized to see what effect this summer’s economic speed bump had on sales given the weak employment and housing markets. Companies have continued to focus on cost cutting but it will be interesting to observe what impact soaring commodity prices (wheat, corn, and copper) had on the bottom line. Historic low bond yields have enabled many companies to refinance debt at low rates. Lower interest expenses support higher earnings but growing cash balances also earn next to nothing and become a drag on profitability and return on equity. On a sector basis, Financials are expected to have the greatest year over year earnings growth (+48%). Industrials, Technology, Energy, and Materials are the other four sectors expected to have earnings growth that outpaces the broad index.

Question of the Week

Are Bonds in a Bubble?

A critical question for high net worth investors especially today with ‘cautious’ investors herding into bonds pushing yields to record lows. Bond investors are taking comfort the Federal Reserve (FED) is on their side. That is, the FED is expected to line up as a buyer of bonds when Quantitative Easing 2 (QE2) is launched. Keep in mind, the biggest risk bond investors are taking today is inflation risk. Those who invested in long term bonds in the 60s just before inflation surged actually lost money in real terms over the next 20 years. The goal of Quantitative Easing is to coax economic activity and revive price inflation. Quantitative Easing usually works best when done in large volume ($1 Trillion) so expect the FED to go big if they do in fact launch QE2. So while they may be acting as the bond investors’ friend today, watch out if they achieve their objective of reviving inflation. Bond investors may want to break the silo of bonds are ‘good’, stocks are ‘bad’ and consider dividend paying, blue-chip companies as an alternative.

Copyright (c) Richardson GMP Ltd.