This article is a guest contribution by James Paulsen, Chief Investment Strategist, Wells Capital Management.

Just a quick thought to noodle over this morning.....

After rising by its strongest annual growth rate since the early 1 960s during the first quarter of this

year, nonfarm productivity declined in the second quarter. Could this be a catalyst for the job market?

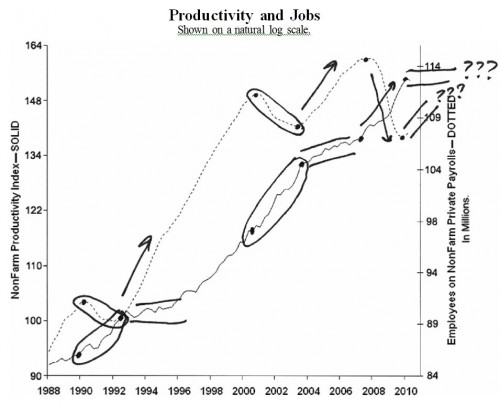

The accompanying chart overlays the productivity index with the level of nonfarm private payroll employment. In each of the last two economic recoveries, job creation was a no show “until” productivity growth slowed. Although the early-1990s recession ended in March 1991, it was not until the beginning of 1993 (once productivity growth waned) that job creation finally took off. Similarly, the early 2000 recession ended in November 2001 but job creation was absent until the latter part of 2003 when productivity growth finally slowed.

As occurred during both the 1991 and 2001 recessions, productivity surged during the last recession as companies raced to “rightsize” their organizations to a new reality. Also similar to the past, this survival mentality has persisted in the last year even though the recession has ended. While rising productivity certainly plays an important role in recoveries helping restart the profit cycle, replenish business cash flows, and improve company balance sheets, it has also tended to be a job destroyer in the early part of the last few recessions.

Could the second quarter represent the beginning of a downshift in the pace of productivity gains which, like it has in the last two recessions, also finally mark the beginning of a healthy period of job creation? Just something for investors to ponder....................................................................................

Copyright (c) Wells Capital Management