This article is a guest contribution from James Paulsen, Chief Investment Strategist, Wells Capital Management.

Just a short note on jobs and the stock market. Investment concerns remain elevated. The current "risk cocktail" is a mixture of ongoing European sovereign debt concerns, a Chinese economic slowdown, and a soft patch in the U.S. recovery. During the next several months, however, contemporary anxieties will either be augmented or extinguished by the direction of weekly initial unemployment insurance claims.

Since 2000, as illustrated in Exhibit 1, movements in the U.S. stock market have been remarkably similar to the trend of weekly reported initial unemployment insurance claims. This chart suggests the fate of the stock market during the balance of this year may be tied to unemployment claims. They continue to trend sideways at about the 450,000 level (a result that would reinforce the trendless stock market, which has existed since year-end); they may surprisingly sustain a rise back toward 500,000 (a meltdown scenario for the stock market, which would heighten "double-dip" fears and keep

vulnerability to any perceived Armageddon fears at a fever pitch); or they may soon resume a declining trend towards the 400,000 level (a move that could spark a fresh rally in the stock market, probably carrying the S&P 500 to new cycle recovery highs before year-end).

Exhibit 1

Stock Market vs. Unemployment Claims

Note: Both scales shown as a natural log.

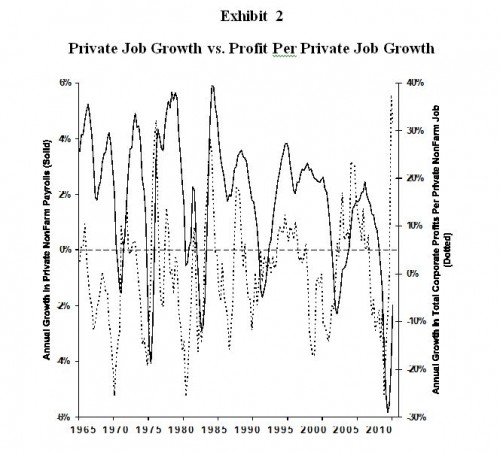

While employment indicators have been somewhat mixed in recent months, we continue to believe job creation is back and expect job conditions to improve during the rest of the year. Exhibit 2 illustrates the primary reason for our optimism on the job market — profits! This chart overlays the annual rate of growth in private nonfarm payrolls with the annual growth rate in profit per private job. In the last year, profit per job has risen by about 35 percent, more than any other time during at least the last 45 years. Why, when labor is more profitable than at almost any time in the last half century, would companies suddenly stop creating jobs?

Initial unemployment claims should soon resume their downward trend and hopefully refocus investors once again on "fundamentals" rather than "fears." So place your bets on Exhibit 1 for the last half of this year, stop worrying over "payroll Fridays" and start paying attention to "Claims Thursday"!

Copyright (c) Wells Capital Management