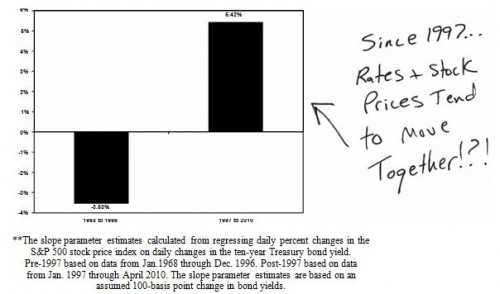

Exhibit 3

Estimated Percent Change in the U.S. Stock Market Due to a 100-Basis Point Increase in the

Ten-Year Treasury Bond Yield** Pre-1997 vs. Post-1997

When deflation is the predominant financial market focus, (i.e., when the stock/bond correlation is positive), rising interest rates simply are not as damaging to the stock market as they are when the market is primarily focused on inflation risk. An inflation-minded stock market associates rising yields with accelerating inflation, whereas a deflation-focused market connects higher yields with improved real economic growth prospects. For this reason, the Fed should consider the stock/bond correlation in assessing appropriate interest rate policies and investors need to incorporate the inflation/deflation mindset of the market when assessing overall market or sector weightings decisions. This analysis suggests the impact of yield changes on the economic cycle and on stock market performance depends critically on the “sign” of the stock/bond correlation.

Watching for a Stock/Bond Correlation Sign Change???!

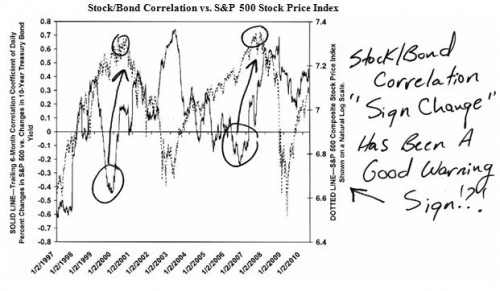

As Exhibits 2 and 3 illustrate, if the stock/bond correlation were to switch negative again, an array of unintended results from policy actions would result and the risk profile of the stock market would be significantly altered.

Exhibit 4 emphasizes why stock investors should monitor a potential sign change in the stock/bond correlation. This exhibit overlays the stock/bond correlation since 1997 with the S&P 500 Stock Price Index. While the stock/bond correlation has been mostly positive since 1997, it did turn negative during two extended periods, and in both cases, preceded a major stock market decline. It first moved below zero in 1999 preceding the dot-com stock market peak in early 2000. Although the correlation was mildly and briefly negative again in 2004 and 2005, it became significantly negative at the start of 2006 and provided an early warning signal for the 2008 crisis.

Exhibit 4

Stock/Bond Correlation vs. S&P 500 Stock Price Index

Summary

Appreciating whether the contemporary financial market mindset is inflationary or deflationary is important in understanding the likely impact of various economic policies and the sensitivity of the stock market to interest rate changes. Changes in inflation expectations have a very diverse impact on future economic activity, bond yields and stock prices depending on the central focus of the financial markets.

The stock/bond correlation provides a good indication of the financial market inflation/deflation obsession and whether this focus is about to change. Policy officials and investors need to consider the level and direction of inflation expectations within the context of the contemporary inflation/deflation obsession and should also be mindful of potential relationship changes and financial market risks that may result when this mindset shifts.