This commentary is a guest contribution by Jamie Horvat and Charles Oliver, Sprott Asset Management.

Sprott Opportunities Hedge Fund Strategy

Market Review and Strategy Update

originally published February 26, 2010

Email this article | Print this article

The market appears to believe in the continuation of a Goldilocks economy - one that is neither too hot nor too cold, but where a sustained economic recovery and growth takes hold during a period of sustained low inflation and loose/accommodative monetary policy. It has been argued by many who believe in 'cost push' inflation that deflation remains the main concern as we have a sustained high unemployment rate and underutilized productive capacity.

However, we have argued in past market reviews that stagflation and potentially hyperinflation should be on investors' minds. Money growth and inflation is a wellseated economic phenomenon first uttered by Thomas Joplin (1826) when he stated, 'the general scale of prices existing in every country is determined by the amount of money which circulates in it'. More than a century later, Milton Friedman (1992) reiterated this view when he said that 'inflation always and everywhere is a monetary phenomenon'. Quite simply, if you print enough money and force it into the system by expanding the monetary base, you cheapen this fiat currency versus all hard assets and real things. Governments can always create inflation - all they have to do is print enough money, or in today's instance, hit a few computer keys.

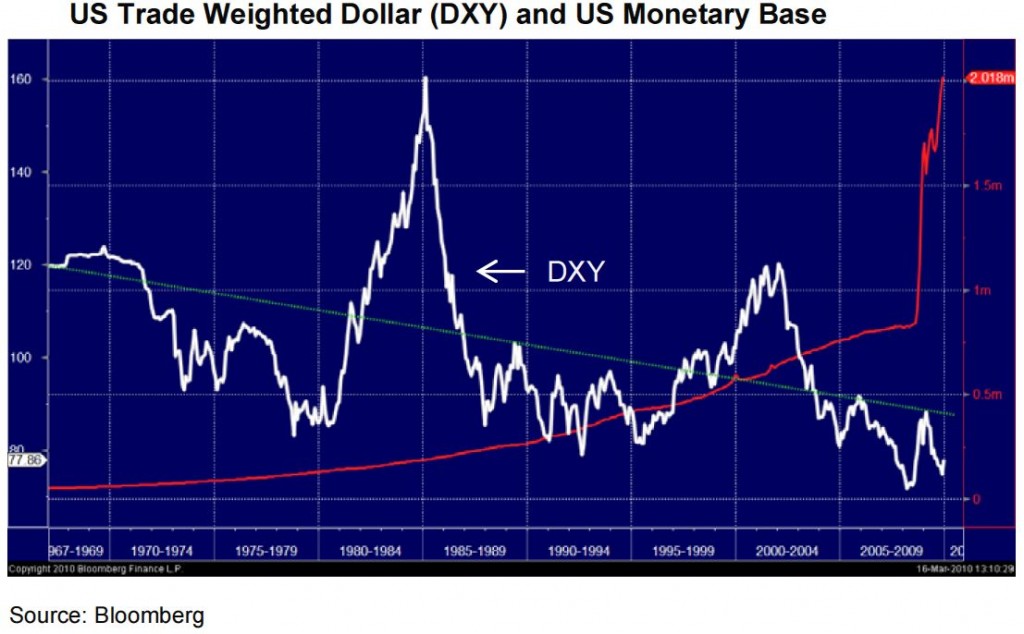

Nothing shows the effect of the expansion of money supply on the value of a currency as simply as a chart of the US Trade Weighted Dollar against the backdrop of the expansion in the US Monetary Base.

Using Bloomberg data for both the trade weighted dollar (synthetically derived prior to the creation of the Euro through a legacy basket) and the US Monetary Base, we can witness a simple relationship. Although currencies are relative to each other and are cyclical through various periods of economic growth, the fact remains that as you expand the monetary base you cheapen fiat currency against all hard assets and real things. What is troubling is the recent explosion of the US monetary base over the past 18 months and the potential resultant effect it may have on the value of the US dollar as a medium of exchange and fiat currency.

Historically, there has been a 1 to 1 relationship between the monetary base and money supply - as all the money printed and created eventually finds its way into the system to be lent and spent. If the banks refuse to lend this money, the governments simply institute various programs to provide this money directly to the end consumer. We continue to believe that the US and various other governments have no other tool at their disposal other than the printing of money and the ongoing expansion of the monetary base in order to force spending and inflation back into the system.

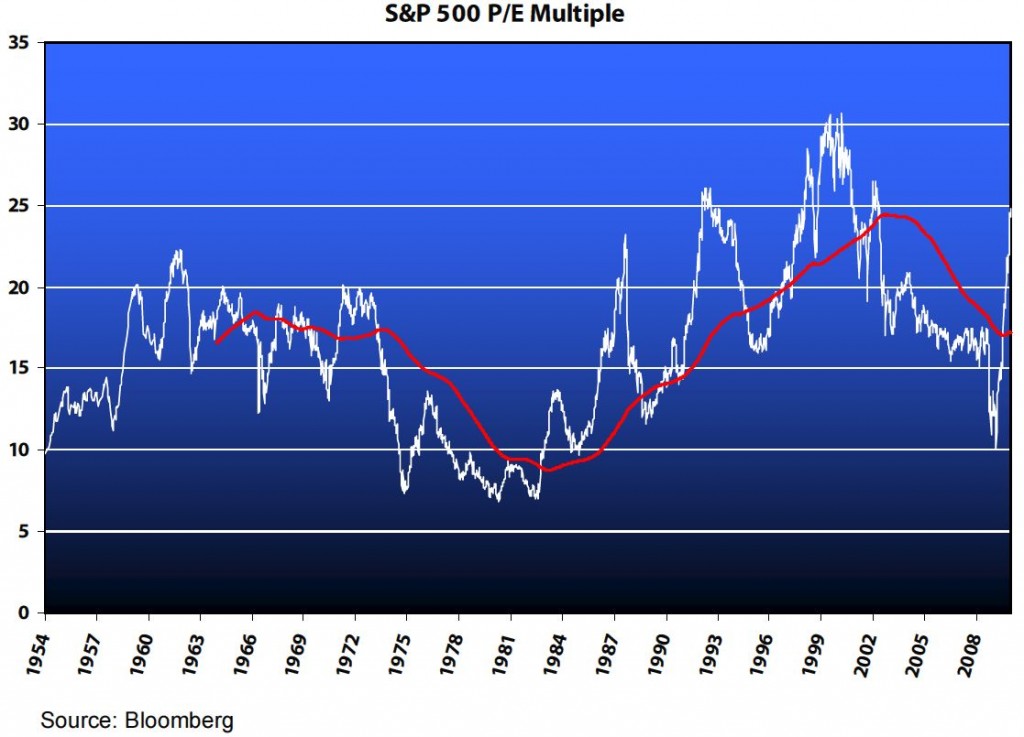

In an environment where we continue to experience high levels of un- and under- employment, where foreclosures and underwater mortgages continue to mount, we continue to witness investors who are willing to pay staggering multiples for the potential of many years of sub-par earnings growth. As witnessed by the following chart, the S&P 500 had recently attained new highs in the forward P/E trading multiple.

Witness the 10-year rolling average multiple paid through long term trends of inflation and relatively low and/or stable inflation. We believe the peak of the Dot-com Bubble represents another turning point from financial, paper-based and levered assets to hard assets as a store of value. As you can see from the price chart of the S&P 500 below, the market has been both above 1,400 points and below 900 points twice since the peak in 1999.

By considering the prior two charts together, one can quickly realize that the market rally that has been unfolding since March of 2009 continues to be one based on multiple expansion rather than underlying strong company fundamentals. Similar to many prior periods of financial leverage, easy credit and excess, we do not believe that we are in a Goldilocks economy. The losses from excess leverage, easy credit, toxic securities, derivatives and potential sovereign defaults will continue to be socialized and dealt with through the creation of new money. This is essentially an attempt to ‘cheapen’ these obligations and push them onto the backs

of future generations, so that the ongoing debt super-cycle can continue. These are typically not 1 to 3-year events, but rather 15 to 20-year events of correction before the next new investment bubble emerges – similar to the sideways markets of 1900-15, 1930-50, 1965-80 and 1999-20??.

Given the volatile sideways nature of the marketplace, the S&P 500 has the potential to be above 1,400 points and below 900 points at least one more time over the next 3 to 6 years. To date we have witnessed two bear markets with gyrations of approximately 47% and 56%, and would expect at least one more bear market to arrive before it may be safe to fully venture out unprotected in the woods again. Our objective remains focused on moving on the margin to preserve capital and take advantage of this volatility as opportunities arise.

Strategy Review

Currently, the market appears to be anticipating difficulties during the back half of 2010. There seems to be an increasing fear among investors over the sustainability of the ongoing market rally for several reasons… 1) the sustainability of China and its lending/spending programs; 2) increased consumer leverage (household debt to income levels at all time highs once again) and consumer spending without government support; 3) the end of government stimulus programs and; 4) potential for sovereign debt defaults. During the month of February, however, all of the concerns seemed to be forgotten as the market staged a broad rally with the S&P 500 up approximately 3.1%. Thus, while our strategy largely outperformed the index in January, the earlier tightening toward a 10% net long position caused us to give these gains back as the short portfolio was negatively impacted by market strength. In particular, performance seemed to come from the retailing segment in such names as our short position in Macy’s. We question the sustainability of the strength in the market and the retailer segment with consumer confidence falling to its lowest level since April 2009 and the outlook for jobs continuing to diminish - fewer people spending more?

Within the long side of the portfolio, defensives, such as consumer staples and technology names, continued to add value. Further, the energy sector continued to benefit from positive momentum. Arcan Resources released positive initial well results that were viewed positively by the market place, while Iteration Energy announced its intent to seek strategic alternatives for the company (putting itself up for sale being potentially one of them). In addition, energy services continued to perform well with talk of increasing day rates that may now be snuffed out by an early spring break-up.

The Federal Deposit Insurance Corp. (FDIC) recently stated that the US “problem” lenders list climbed to 702 banks, a 27% increase from 552 banks at the end of Q3’ 09 and the highest level in 17 years. Accordingly, with respect to the short portfolio, we believe our positions in various regional banks and mortgage insurers with increasing loan defaults should benefit the portfolio in the coming months. Furthermore, as new home sales hit a record low along with mortgage applications and sales of previously owned homes unexpectedly dropped within the US, we continue to question whether the federal tax credit for homebuyers has resulted in removing any pent-up demand. Given the ongoing rate of foreclosures (rising 15% in January and topping 300,000 filings for the 11th straight month) and negative mortgages, we are once again reviewing short positions related to the

housing industry. Lastly, with Greece under pressure, fears of a European Union collapse and the AAA ratings of both the United States and the UK being questioned by Moody’s and other ratings agencies, gold continued to shine, as demand for a dollar alternative continued to increase.

Jamie Horvat, Senior Portfolio Manager

Charles Oliver, Senior Portfolio Manager