Highlighted below are two charts from Bespoke Investment Group detailing the relative performance of the BRIC Markets (Brazil, Russia, India, China) compared with the S&P500.

Over the last year, the US has performed better than Russia and China, inline with India, and worse than Brazil. Russia's stock market is down the most of the BRIC countries at -68%. China's Shanghai Composite is down 46% and has really seen a nice pickup lately. India's Sensex is down 43%, which is right inline with the S&P 500, and Brazil is down 36%.

The last ten years have been very tough for US equity markets, with the S&P 500 now down 42% on a simple price basis. But even after the suffering that BRIC markets have had over the last year, their ten-year returns remain strong. Russia is down 68% over the last year, but it is still up 689% over the last decade (we had to put its performance on a secondary axis in the chart below). China is up 84%, India is up 136%, and Brazil is up 314%.

Its worth highlighting that during the last decade, markets in Brazil, India, and China, experienced their strong run-ups while adhering to the advice that was given to them by the IMF and World Bank following the Long Term Capital Management fiasco, of fiscal and monetary prudence, and are today in a very sound fiscal and monetary condition. All four have amassed sizable forex reserves, consumers and corporates have under-utilized credit, especially in Brazil and India, banking systems in Brazil, India and China are sound, well capitalized and negligibly exposed to toxic assets from the G6 credit spill. In addition, stocks are cheap with P/E ratios as follows: India 9X trailing earnings, Brazil, 9-10X trailing, China 12X trailing, and Russia at 2.5X (the cheapest by far).

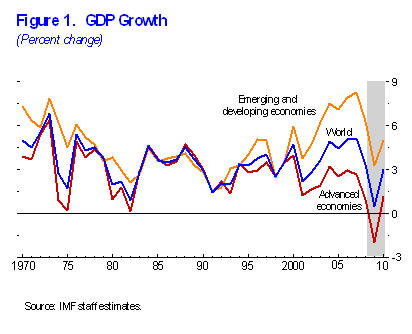

Although they have performed in line with S&P500 during the last year (except for Russia) they are in a much better position to recover given their "cleaner" credit fundamentals and the fact emerging markets are expected to continue to drive almost all GDP growth over the next two years, according to the IMF's January 2009 revision, which calls for a contraction in 2009 GDP growth and a recovery in 2010.

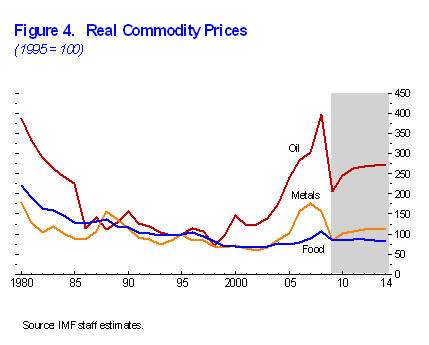

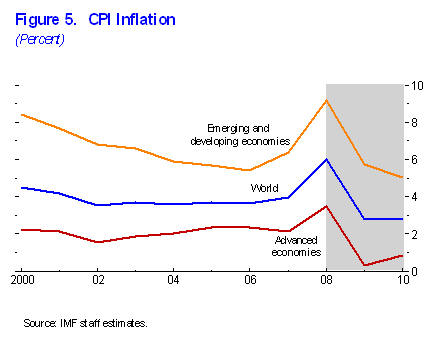

The break in commodity prices during the last year has provided the key consuming countries, India and China, and the rest of the world, for that matter with relief from inflation, and in the case of Brazil and Russia, highlighted the fact that low cost producers of hard and soft commodities will have an unusual advantage as consumption for commodities resumes, given their lower break-evens on production.

The by-product of lower commodity prices and the ensuing global recession is also providing emerging markets central banks the room to aggressively cut interest rates in order to stimulate and accelerate domestic consumption within their own economies. This is a favourable development during a time when foreign capital flows are beginning to rebuild post the credit market crosswind that caused investors to repatriate their investments en masse from emerging markets during the last year. In China's case, its $586-billion stimulus program announced in November, which is set to be spent over the next two years, should not only contribute very significantly to China's domestic growth, and shore up its weakened exports sector, it should indeed provide the world with a boost as well.

Its hard to know which of the emerging markets will have the best performance over the next 2-5 years, but there is a great likelihood, that given that they continue to be the key driver of economic growth over the same period, that they will do very well.

David Swensen, Yale Endowment's Super-CIO, recently revised upward, (this can be found in the right hand column of his recent Yale Alumni Magazine interview) his recommended allocation to emerging markets funds for individual investors from 5% to 10%.

Today, Swensen says, economic conditions might call for a modest revision. He now recommends that investors have 15 percent of their assets in real estate investment trusts, and raise their investment in emerging-market stock funds to 10 percent.

Jeremy Grantham, CIO, and founder of GMO, manager of $81-billion in assets re-entered his emerging markets trades in October-November 2008, after getting out entirely in July 2008. He had been long emerging markets for 12 years prior to the July exit, and was of the opinion that a 40% haircut was a good reason to get back in. You can read or view the interview transcript here.