The following is from the Wall Street Journal, March 11, 2009.

“Deleveraging has more to go. Just how far could become clearer when the Federal Reserve releases fourth-quarter flow-of-funds data Thursday. The third quarter marked the first decline in household debt since recordkeeping began in 1952, fueled by a record 2.4% drop in mortgage debt.

“Debt likely shrank even faster in the fourth quarter. According to already-released Fed data, non-mortgage consumer credit fell at a 3.2% annual rate. Another decline in mortgage debt, which is four times as big as non-consumer debt, is almost certain, given the collapse in sales and home-equity extraction, as well as surging loan delinquencies and defaults.

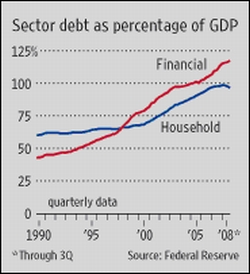

“Shedding more debt would be a healthy thing, since household debt levels in the third quarter were equal to 96% of gross domestic product and 130% of disposable income.

“The trick is figuring out just how far this deleveraging should go. There is ‘no magic number’, suggests T. Rowe Price chief economist Alan Levenson, but one benchmark could be 1998, when foreign savings began to rise. Back then, the percentage of household income spent satisfying creditors was less than 12%, in line with the long-term average, compared with a near-record 14% now.

“Household debt was just 66% of GDP in 1998; and returning to that level would entail a 30% plunge in debt. That may be too extreme, particularly if the US homeownership rate keeps a floor under mortgage debt, despite declining from its 2005 peak.

“Suffice to say that consumer debt ratios will likely keep falling. An income boom would do the trick painlessly, but that seems unlikely. Otherwise, consumer spending will slow, keeping pressure on the financial sector, which is shedding debt much more slowly than households.”

Source: Jeff D. Opdyke, The Wall Street Journal, March 11, 2009.

Hat tip: Investment Postcards