Gold's bear market is now finishing its 4th year...

Source: Short Side Of Long

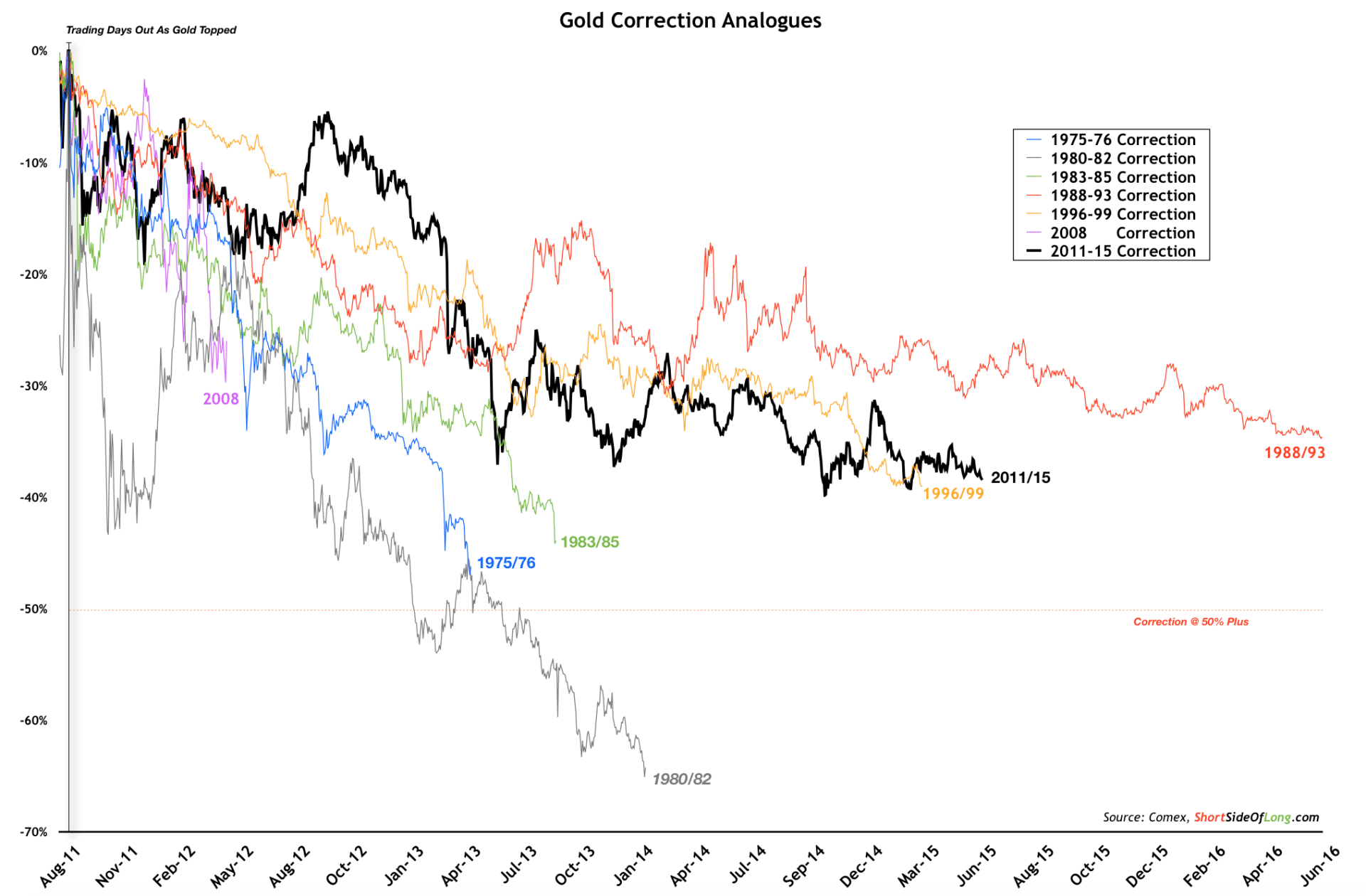

Final chart of the day is a classic Short Side of Long chart, which has been posted many times before. Basically, we are tracking the progress of Gold's current bear market, which started in September 2011 at $1,920 per ounce and remains intact. History can sometimes be a guide.

Interestingly, this is now the second longest bear market in Gold's forty five year history. However, what bulls have failed to realise, is that after 12 annual gains leading into 2011 top, this also one of Gold's softest bear markets. Some of us have been expecting Gold to decline at least 40% if not more, similar to the 1974-76 correction.

On a side note, there has only been one bear market that has pushed the price of Gold down more than 50% and that occurred from 1980 into 1982 low.