Time To Buy Mortgages?

by Anthony Valeri, Fixed Income and Investment Strategist, LPL Financial

KEY TAKEAWAYS

· Mortgage-backed securities (MBS) may offer a way of boosting bond returns when yields are range bound.

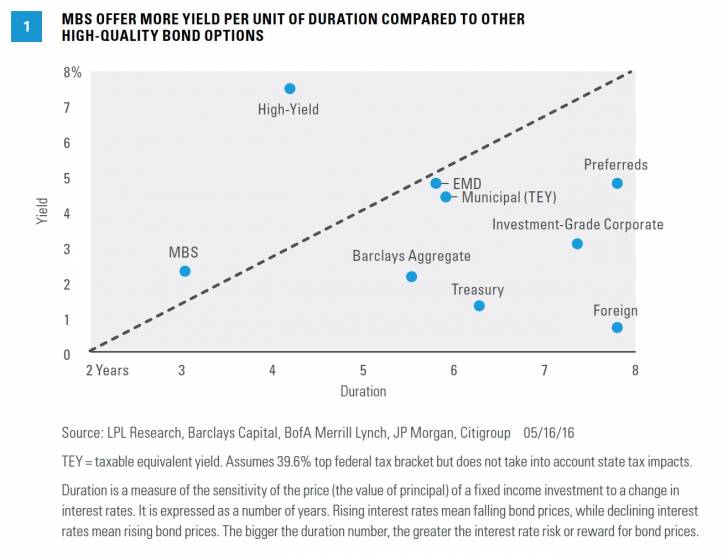

· MBS valuations are near the post-recession average, but the asset class offers more yield per unit of duration than other high-quality options.

Mortgage-backed securities (MBS) may provide opportunity in a challenging bond market environment. High-quality bond prices remain near 2016 highs, and yields on Treasuries, investment-grade corporate bonds, and municipal bonds remain near the low end of recent ranges. MBS are in a similar situation but offer attributes that may present incremental value.

The potential value of MBS in a low-return environment for bonds can be illustrated by yield per unit of duration (a measure of interest rate risk) and scenario analysis.

YIELD & DURATION: FAVORABLE FOR MBS

We expect intermediate- and long-term yields to remain largely range bound in the near term, but investors still need to make sure they are being compensated for potential interest rate risk. Yield received per unit of duration helps quantify this compensation, and based on this measure, MBS are attractive versus other high-quality options [Figure 1]. Receiving more income while keeping interest rate sensitivity low can provide a buffer should interest rates rise.

High-yield bonds and emerging markets debt (EMD) also score relatively high on maximizing yield per unit of duration but come with different risks. Both sectors are economically sensitive, and therefore, could witness price declines should economic growth slow. MBS are primarily issued by government entities; thus, they are high quality and not sensitive to growth fears. Both high-yield bonds and EMD have enjoyed a strong start to 2016, and further price gains seem unlikely absent an additional catalyst. Conversely, MBS lagged during the first quarter due to their reduced interest rate sensitivity, and valuations (as measured by the average yield spread) are slightly cheaper compared with the start of 2016, versus more expensive valuations across other bond sectors.

ASSESSING POTENTIAL VALUE

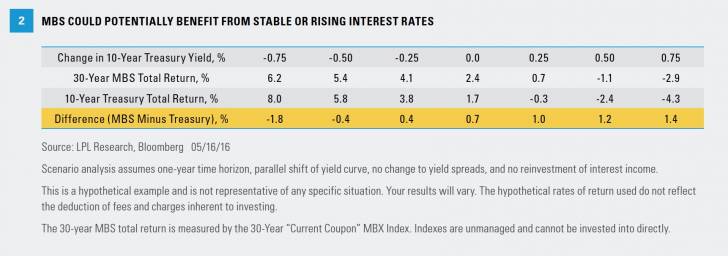

Scenario analysis can help assess the potential value of MBS under different interest rate paths. Specifically, what happens to MBS if yields move higher, stay stable, or resume moving lower? A hypothetical scenario analysis shows MBS outperforming Treasuries in two of the three scenarios: stable or higher interest rates [Figure 2].

If interest rates are unchanged, MBS might outperform Treasuries by 0.7% over the coming year. That difference may not seem like much, but it is notable in a low-yield world. Note that even if interest rates fall slightly (by 0.25% on the 10-year Treasury), “current coupon”[1] MBS may still manage slight outperformance before lagging if rates fall further. If the 10-year Treasury yield rises, the possible performance disparity is noteworthy and shows that MBS offer protection against rising rate risks.

However, MBS would likely underperform if rates fell, as prepayment risk would increase and keep a lid on price appreciation compared with Treasuries. Treasury yields already near the bottom of their recent range may help lower the risk of this scenario, but it highlights that investors seeking even greater protection in the event of an economic downturn may wish to consider more interest rate sensitive securities such as longer-term Treasuries.

TRADITIONAL VALUATION MEASURES ARE ONLY AVERAGE

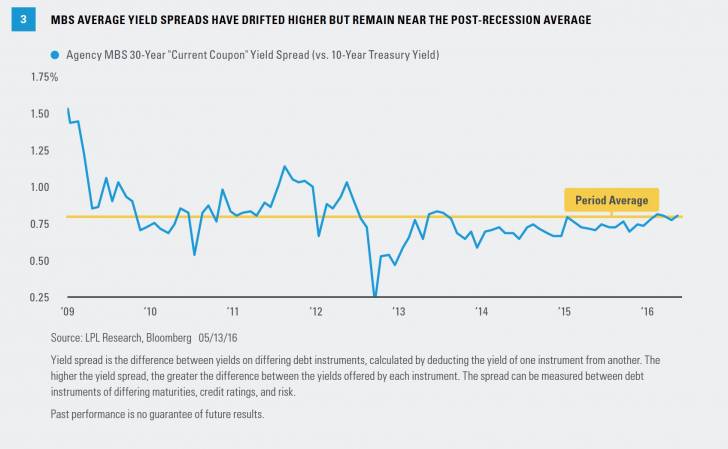

The average MBS yield spread to comparable Treasuries is below the 20-year average of 1.1% but is in-line with the post-recession average [Figure 3]. MBS valuations are average. However, in a range-bound interest rate environment where coupon clipping becomes important, the higher yield offered by MBS may provide a stronger total return opportunity than other high-quality bond sectors, but with less downside risk than credit-sensitive sectors like high-yield.

Traditional valuation metrics are important, but they are only one facet of investing. The scenario analysis outlined earlier helps assess the potential portfolio impacts.

CONCLUSION

MBS are fairly valued but offer the potential for additional yield relative to duration when compared with other high-quality options. In a low-return environment, extra yield is hard to come by, and may have a larger relative impact on portfolio performance than it has in recent years. These factors, along with our belief that MBS may outperform comparable Treasuries if rates stay range bound or rise slightly, make MBS an attractive consideration for suitable investors looking to add high-quality bond exposure to their portfolios.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Mortgage-backed securities are subject to credit, default risk, prepayment risk (that acts much like call risk when you get your principal back sooner than the stated maturity), extension risk, the opposite of prepayment risk, and interest rate risk.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

High-yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

INDEX DESCRIPTIONS

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

The Barclays U.S. Corporate High Yield Index measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below, excluding emerging market debt.

The Barclays U.S. Corporate Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate, taxable corporate bond market.

The Barclays U.S. Mortgage Backed Securities (MBS) Index tracks agency mortgage backed pass-through securities (both fixed rate and hybrid ARM) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC)

The Barclays U.S. Municipal Index covers the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds.

The Barclays U.S. Treasury Index is an unmanaged index of public debt obligations of the U.S. Treasury with a remaining maturity of one year or more. The index does not include T-bills (due to the maturity constraint), zero coupon bonds (strips), or Treasury Inflation-Protected Securities (TIPS).

The Citi World Government Bond Index (WGBI) measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGBI is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. The WGBI provides a broad benchmark for the global sovereign fixed income market. Subindexes are available in any combination of currency, maturity, or rating.

The JP Morgan Emerging Markets Bond Index is a benchmark index for measuring the total return performance of international government bonds issued by emerging markets countries that are considered sovereign (issued in something other than local currency) and that meet specific liquidity and structural requirements.

The BofA Merrill Lynch Preferred Stock Hybrid Securities Index is an unmanaged index consisting of a set of investment-grade, exchange-traded preferred stocks with outstanding market values of at least $50 million that are covered by Merrill Lynch Fixed Income Research.

The 30-year “Current Coupon” MBS Index is comprised of recently issued agency mortgage-backed securities priced closest to par in the secondary market. The current coupon index reflects a weighted average price and yield to maturity.

Copyright © LPL Financial