Worried about a market panic? Let’s look at the data

by John Manley, CFA, Wells Fargo Asset Management

“History repeats itself, first as tragedy, then as farce.” Karl Marx

After two years of frustration, July has been a month of new highs. On Friday, the S&P 500 Index closed at 2,175.03, another record. I thought it would be interesting to put a little context around that. I’m still hearing the buzz that stocks are up too much and that it’s only a matter of time until another 2008 crisis pulls us down. To me, that first assertion is incorrect and the second one—while technically true—gives us no useful timing and provides a lot of tinder for continued appreciation. Sure, someday we will hit the wall (of worry), but I think that we can climb that wall for a while.

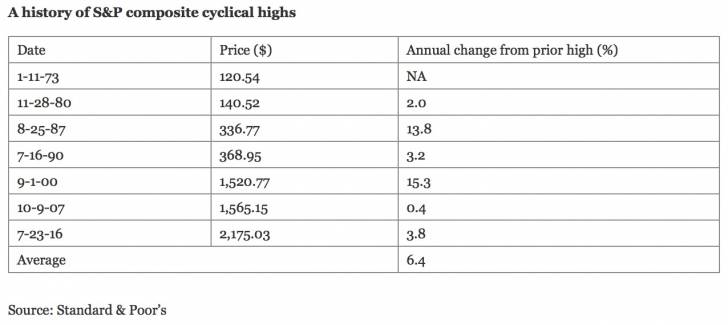

Below is a table that shows the dates and levels of prior cyclical highs for the S&P 500 Index.

It is simple to calculate the annualized appreciation between these cyclical highs. If this past Friday were to have been the market top for this cycle, it would represent a 3.8% annual rate of gain since the prior peak in October 2007. That doesn’t seem very high to me and the statistics seem to imply the same thing. Rather, Friday’s high is somewhere around the middle of the pack, with three instances below it and two strongly above it. That position is not great, but I don’t think it is bad enough to worry about.

I still think that the biggest surprise would be if stocks moved higher over the course of this year. Investors are still very worried about the next panic. I suppose that this situation isn’t helped by a large number of letter writers—perched on the mountain or sprawled on the beach—who have been predicting another 2008 since as early as 2009. But that scenario hasn’t happened despite all of the scares we’ve had. The recent breakout in stock prices (and, possibly, in earnings expectations) may be a sign that people are finally changing their minds and becoming less cynical and fearful and more optimistic. I think this is overdue and far from totally discounted.

Think of the past five years! In 2011, it was a fear that Greece would default and drag the German banks with them. In May of the next year, it was Spain’s turn to scare the stocks out of us. Later that year, in August, we were worried about a U.S. government shut-down and the debt ceiling. Meanwhile, China kept popping up as its government tried to change economic course. In August 2015, oil prices collapsed and there were real—if short lived—fears that oil’s decline was a symptom of a meltdown in China. All of those fears eased, only to return with a vengeance this January. That, too, passed, but, just when things seemed to be getting better, we had the U.K.’s pesky Brexit vote to leave the European Union on June 23. In the wake of Brexit, the world had a 48-hour panic but then caught its breath and realized that this issue, too, could be handled.

We must remember that governments and central banks have learned to anticipate or deal with panics since 2008. The very knowledge of what went wrong may make us more nervous, but it makes them more effective. I can’t help but think that we will put this behind us some day. We did it with the Great Depression. We did it with the Great Inflation. Why not with the Great Panic?

Copyright © Wells Fargo Asset Management