High Yield: Still All About Oil

by Anthony Valeri, Fixed Income and Investment Strategist, LPL Finanacial

KEY TAKEAWAYS

. High-yield bond prices are trading in tight correlation with the price of oil.

. Recent extreme outperformance of high-yield, relative to the broad bond market, suggests caution moving forward.

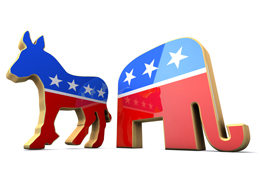

Oil and high-yield bond prices remain tightly linked. A close relationship between the two has persisted since summer 2014, when the price of oil began to decline from over $100 per barrel, and the linkage remains as strong as ever today [Figure 1]. In fact, for the 11 trading weeks ending April 29, 2016, the correlation between the average yield advantage of high-yield bonds (or spread) to Treasuries and the price of oil has been -0.77, a strong inverse correlation.

High-yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Higher oil prices reduce default risk for energy issuers, which comprise a significant 13% of the Barclays High Yield Index, and also lower spillover risk to the broader economy. Oil's impact on the economy is also reflected in a close, but inconsistent, relationship to Treasury yields [Figure 2]. Resurgent oil prices played a role in modest Treasury losses in April 2016, including a seven-day losing streak for Treasuries over April 18-26. Lower oil prices have been associated with slower growth and lower inflation, in response to investor spillover concerns from the energy sector, which, in turn, helped pressure Treasury yields lower. Conversely, higher oil prices tend to boost both growth and inflation expectations. The correlation between Treasury yields and oil has been relatively high (0.67) since the start of 2016 through April 29.

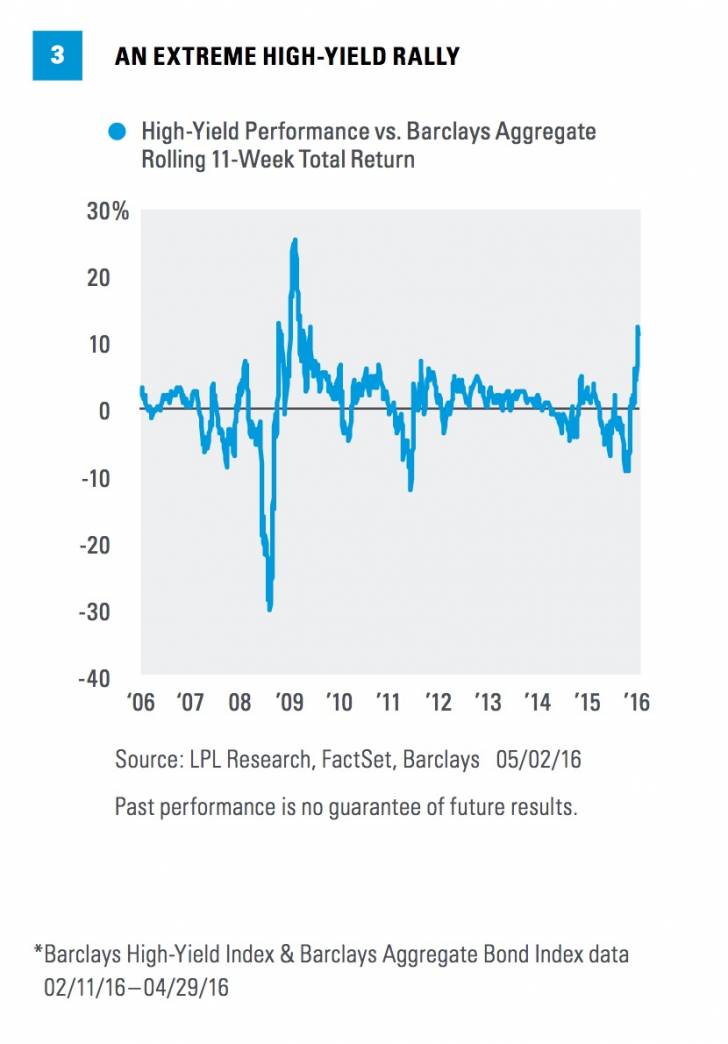

The recent rally in high-yield has been extreme. For the 11 weeks ending April 29, high-yield outperformed the Barclays Aggregate by 11%, which has only occurred one other time: during the recovery from the Great Recession in 2009 [Figure 3]. Therefore, the strength of the rally appears unsustainable and suggests caution going forward. It would be comforting to say that the impressive 11% rebound in high-yield bonds from the February 11 low[1] was due entirely to a refocus on broad high-yield market fundamentals, but the tight correlation says otherwise. The market's more reasonable assessment of fundamentals certainly helped, but it's still very much all about oil. This is less true for the broad bond market, but oil prices continue to have a heavy influence in 2016.

DEFAULTS ON THE RISE, BUT STILL CONTAINED

Defaults have been increasing but should remain low. Moody's 12-month trailing global speculative default rate increased to 3.8% through March 2016, up from 3.5% in December2015 based upon the number of issuers. Though increasing, this is still below the 20-year average of 4.4% and still well below the highs witnessed in the default cycles of 2002 and 2009 (11.1% and 14.7%, respectively). The default rate in the U.S. was 4.1%, according to Moody's, and higher than that of Europe; but on a dollar volume basis, the U.S. default rate was a more benign 3.0% for the 12 months ending March 2016. However, April saw an uptick in defaults, including a large coal conglomerate, reaffirming that defaults are likely to continue to rise. Through just the first two weeks of April, U.S. defaulted high-yield bonds totaled over $14 billion, nearly equaling the $15.7 billion total for the entire first quarter of 2016. Moody's forecasts the default rate will increase to 4.7% by March 2017.

Based on a potentially gradual rise in defaults over the coming months, we believe a yield spread between approximately 6.5% and 7.0% represents fair value, slightly above the 6.0% closing level of April 29. In addition to the extreme move described above, the current yield spread indicates a modestly expensive valuation given the expected rise in defaults. The rebound in oil prices suggests additional energy-related defaults may be postponed or avoided, but that scenario is likely factored into current prices and yields.

CONCLUSION

When suitable, we continue to recommend a small allocation of high-yield bonds in a diversified fixed income portfolio, but higher prices, more expensive valuations, and still tight correlation to oil prices suggest caution now. An average 7.4% yield[2] stands out in a low-yield world but the risk-reward is less favorable for investors. Further improvement based on fundamental factors alone may have run its course, leaving investors exposed to the whims of oil prices.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

High yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

Correlation ranges between -1 and +1. Perfect positive correlation (a correlation co-efficient of +1) implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. Alternatively, perfect negative correlation means that if one security moves in either direction the security that is perfectly negatively correlated will move in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random.

INDEX DESCRIPTIONS

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

The Barclays U.S. Corporate High Yield Index measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody's, Fitch, and S&P is Ba1/BB+/BB+ or below, excluding emerging market debt.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Copyright (c) LPL Finanacial