We hope that everyone in Argentina left with a full stomach because other than a good meal and a photo-op, not much else came out of the G-20 meeting over the weekend. China and the U.S. agreed to kick the can down the road by 3 months now 4 months (until April 1) to put pencil to paper and try to eliminate some of their trade differences.

The market likes the delayed hike to 25% tariffs on Chinese goods in the short term, but how much longer will this drag out? It took NASA’s spaceship only seven months to fly 300 million miles and successfully land on Mars. I bet that the two countries’ rocket scientists could come up with an optimal China/U.S. trade solution in a few days or weeks. Why don’t we let them while all the current trade negotiators are off beaching and golfing on their winter holidays?

To receive this weekly briefing directly to your inbox, subscribe now.

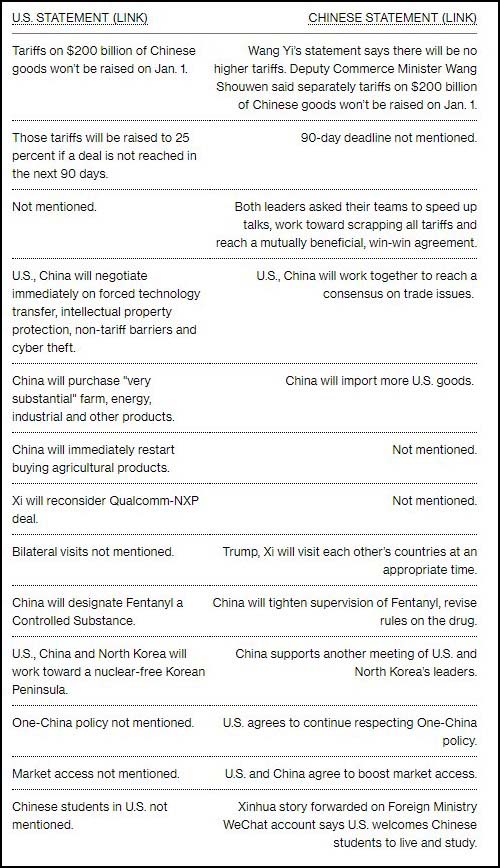

The trade dinner meeting statement comparison show little commonality…

Only the decision to delay another $200 billion in Chinese tariffs and an agreement on Fentanyl are written up by both countries. If a trade deal wasn’t completed before the mid-term elections, then what has changed to make a trade deal occur in the next four months? Watch this drag out until the 2020 U.S. election primaries.

The equally big news last week was the discussion about the Fed’s neutral rate…

The market rallied big on Wednesday after Fed Chairman Powell noted that interest rates “remain just below the broad range of estimates of the level that would be neutral for the economy”. Some took that to thinking that the Fed will only raise one more time and then be done. Of course, the midpoint for the neutral range of estimates is three hikes higher, not just one. And if job growth does not slow and wage inflation continues, then the range itself could move higher.

(WSJ)

RenMac would also remind you to think beyond Fed Funds rate…

Fed Funds aren’t the problem, at least as we see it. The spread is close to 50bps between FF and 2yr yields, not flat, not inverted, but rather accommodative. The liquidity story is in the supply of money balance sheet), not the price of money (rates), and while a Powell pause may placate a pandering President, the real tightening is taking place thru QT, not the Fed Funds rate.

(Renaissance Macro)

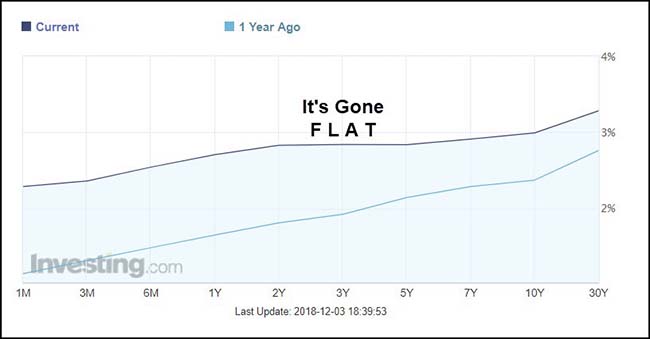

And as the Fed shrinks its balance sheet, you will notice that the 2-to 5-year section of the curve has gone flat…

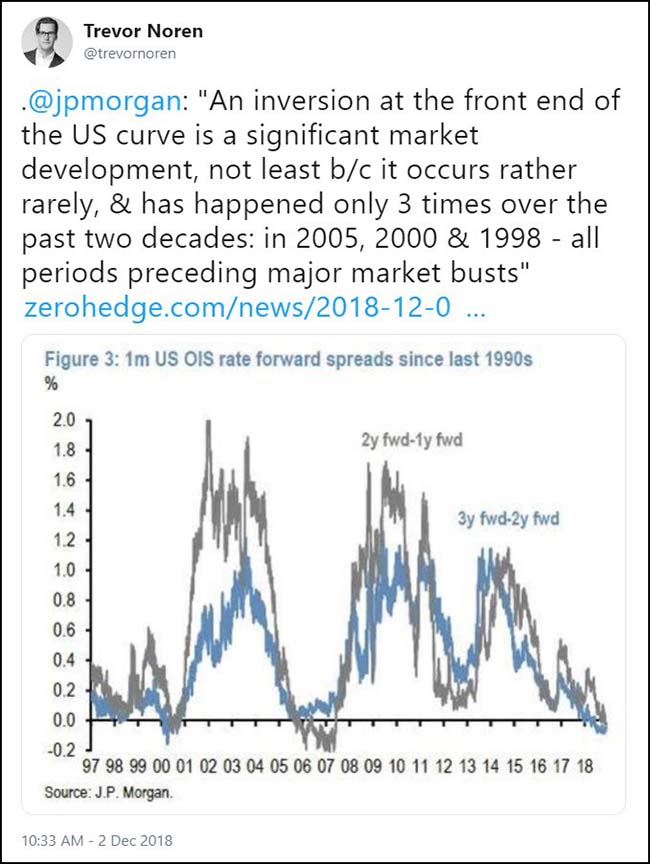

It is rarely healthy for the markets when the short end of the curve inverts…

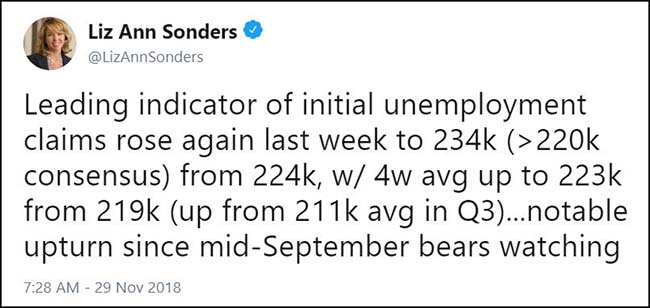

We are also watching closely, Liz…

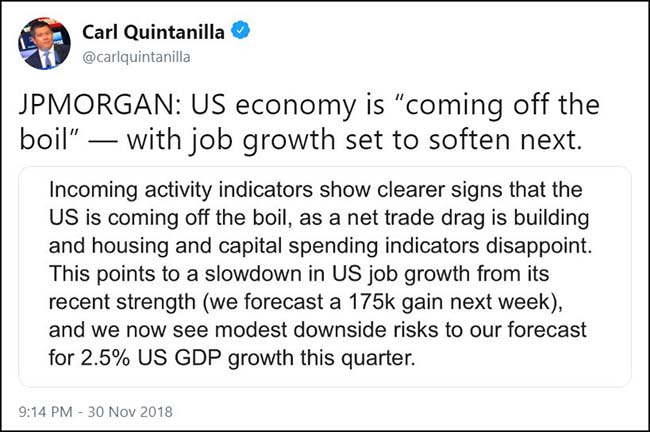

J.P. Morgan’s other indicators now seeing a slowdown in U.S. job growth…

The Fed hopes that the U.S. job market can slow down right now, otherwise…

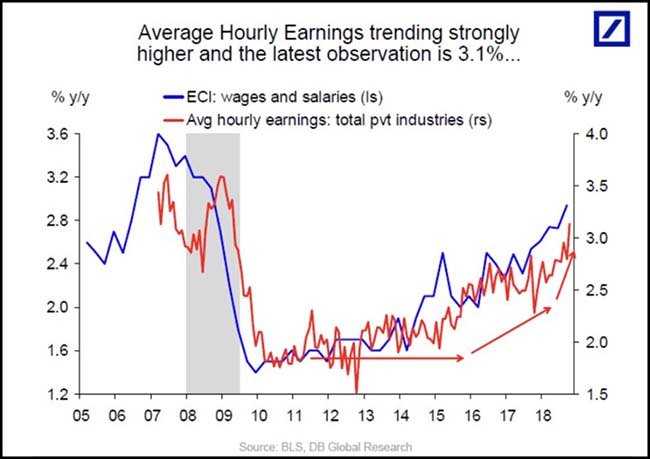

DEUTSCHE BANK: “If the Fed decides to ignore the trends in the charts below, we run the risk of returning to 1970s-style unanchored wage inflation with an associated bear market in both bonds and equities”

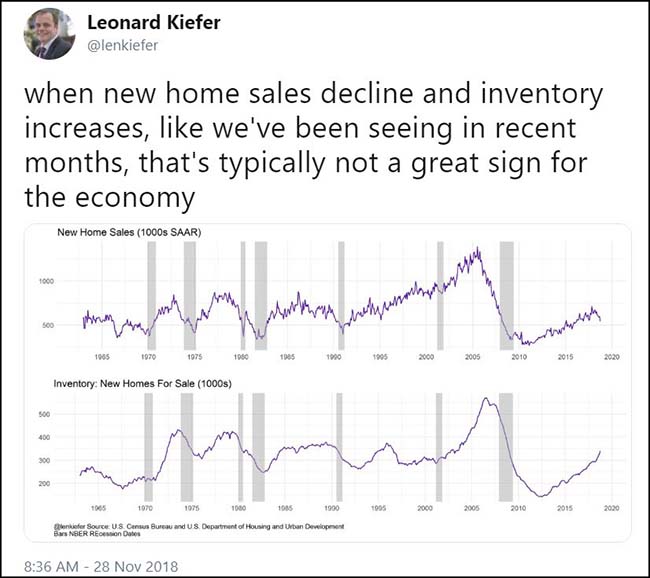

Pay attention when the economist at Freddie Mac sends out worrying housing charts…

And if you own a home in Dallas, consider selling and renting for a few years…

At least don’t be in an unaffordable mortgage or long three rentals across a stack of credit cards. You don’t want to be represented in ‘The Big Short 2: North Dallas Zero’.

Dallas’s once vibrant housing market is sputtering. In the high-end subdivisions in the suburb of Frisco, builders are cutting prices on new homes by up to $150,000. On one street alone, $4 million of new homes sat empty on a visit earlier this month. Some home builders are so desperate to attract interest they are offering agents the chance to win Louis Vuitton handbags or Super Bowl tickets with round-trip airfare, if their clients buy a home. Yet fresh-baked cookies sit uneaten at sparsely attended open houses…

Dallas, which had the second-strongest annual increase in employment of any metropolitan area in the country in September, helps explain why. Even though the economy in the sprawling metro area has boomed, home prices have grown much faster than wages, and buyers have been straining to afford homes.

Those price challenges have been masked in part by access to cheap credit, but that era is coming to an end. Since the beginning of the year, mortgage rates have risen about a percentage point, to the highest level since 2011.

“We have this huge affordability crisis,” said Ted Wilson, principal at Residential Strategies, a Dallas consulting firm. “With mortgage rates going higher, we’re hitting a ceiling.”

(WSJ)

A bit more difficult to downsize a mansion in the Hamptons…

The Hamptons, the chain of moneyed oceanfront villages on Long Island’s Eastern tip, are considered a highly desirable place to be—unless you’re a home seller.

“Every block has a ‘For Sale’ sign,” said Robert Hohmann, who has been trying to move his five-bedroom Southampton house for the past two years. First priced at $3.7 million, the roughly 5,200-square-foot home with a swimming pool is now listed for $2.999 million with Frank and Dawn Bodenchak of Sotheby’s International Realty.

The fortunes of the Hamptons real-estate market are closely tied to those of nearby Manhattan, and the current slowdown is no exception. The Hamptons saw a dramatic drop in activity in the third quarter, with home sales plummeting 13% to 448 from 517 in the same period last year, according to a Douglas Elliman Real Estate market report. That is the third consecutive quarterly decline, said the report’s preparer, appraiser Jonathan Miller, who said he hasn’t seen such a scenario since 2008. Meanwhile, the number of luxury listings (those priced at the top 10% of the market) surged to 452—the highest level in seven years.

(WSJ)

NYC is also feeling gut wrenching real estate pain…

New York is facing the convergence of several large economic forces: an oversupply of new condos, a drop in international buyers as some countries impose capital controls, changes to the tax law that cap state and local deductions, and rising interest rates. There is also a shift in taste from uptown to downtown.

As Lee J. Stahl of the design/build firm the Renovated Home put it: “It’s a crazy Bermuda Triangle of forces that have lined up against people trying to sell and buy these properties.” The Upper East Side luxury co-op market in particular is “a train wreck,” said Mr. Stahl, who often works with agents listing properties in need of renovation…

In the third quarter of this year, the overall number of Manhattan home sales dropped 11%, according to a report from Douglas Elliman. Some sellers of Manhattan apartments have taken losses of up to 30% or more from what they originally paid for them at various points in time, according to a data analysis for The Wall Street Journal by the real-estate listings website StreetEasy.

(WSJ)

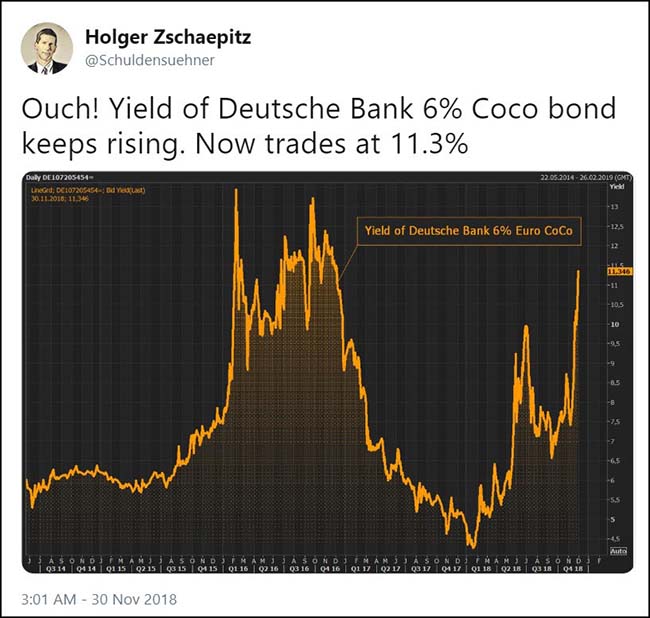

Deutsche Bank bond yields revisiting their 2016 highs…

Which explains why the stock of the 15th largest bank in the world is nearing new lows…

@charliebilello: Deutsche Bank ADR hits a new all-time low, down 93% from its 2007 high and 72% since it began trading in 1996 (note: total return). $DB

Consider using the 200-day moving average rule to protect yourself when the underlying business is complicated or highly leveraged…

GE is a very complicated company. Lending, Insurance, Leasing, and library stacks of contracts tied to the underlying credit of their customers. If the managers inside of the company could not keep it all straight, how are you supposed to fully understand it? When it comes to highly complex business models where we cannot fully understand the financial moving pieces and where management assumptions and creative accounting could come into play, you have to pay close attention to the stock price action. When the stock is soaring, it is highly unlikely that you are going to wake up overnight and find a disaster in your portfolio the next day. But when a stock begins to often trade below its 200-day moving average, it is telling you that something is less than perfect and that you need to pay close attention. Financial stocks and complex business models that strongly fall out of favor with investors can lose more value than you ever though possible and can even go ‘poof’ in the middle of the night. Life is short and there are plenty of great stocks and other assets in the world. If you ever find one of your complicated positions trading below its 200-day moving average, just move to the sidelines and wait for its clouds to clear. You can always buy it back at a later date and avoid the stress of a significant decline. Look at the chart below. Any investor in GE who only owned the stock as it traded greater than its 200-day moving average would have done well and missed three very big headache periods.

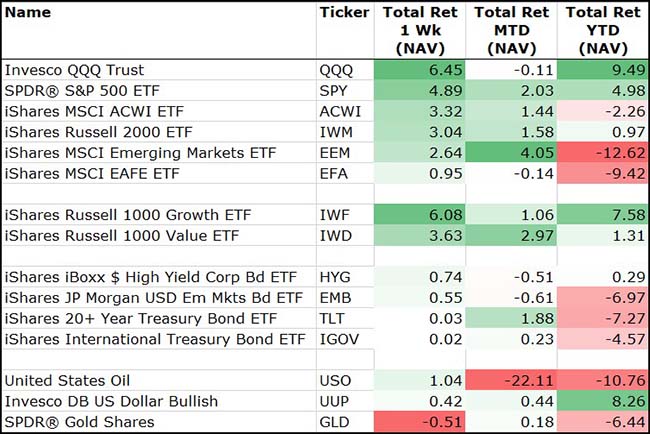

Thanks to the Fed comments, risky assets had a good week…

And because it was month end, important to highlight the outperformance in Emerging Market stocks and U.S. Value stocks. Also, the -22% decline in Oil is not a mistake.

Green across all sector performances for the week with Tech, Health Care and Consumer Discretionary leading…

For the month of November, Health Care and REITs led the charge. Oil Service and Apple were tattooed.

Don’t argue with the strength that Health Care is showing right now…

@johnscharts: $XLV at all time highs moving on expanding volume

On a relative basis, Health Care is tops among U.S. sectors…

At the bottom, the Energy sector is busting many portfolio managers bonus expectations.

A fairly accurate update on Brexit…

And as a result, British stocks are now trading at seven-year relative lows to the rest of the world…

Junk auto loans at a 6% yield with uncertain future auto prices?

Buckle up if you own these bonds. I see a brick wall with no skid marks coming your way.

Investors are gobbling up auto loans extended to the riskiest borrowers, looking past market warning signs as they reach further for returns.

This year, they have been buying subprime auto securitization deals that offer slices with single-B credit ratings, well into junk territory and the lowest grade offered when such bonds are sold. Auto lenders have issued $318 million worth of single-B debt in 2018, more than all prior years combined, according to data from Finsight.

Subprime auto deals, often bought by large money managers and other institutional investors, are typically backed by loans to borrowers with FICO scores below the mid-600s. Because these borrowers are at higher risk of default, the bonds tied to their loans can offer higher yields.

(WSJ)

Speaking of autos, few companies want a China trade deal more than GM…

Why, on the face of it, would GM walk away from the world’s largest car market? Despite falling volumes, the company still expects to book $2 billion of equity income in China this year. While its market share has plummeted, margins still remain close to 9 to 10 percent there, higher than 6 percent to 7 percent for the company as a whole.

GM has committed to going big in China: It launched the Cadillac XT4 luxury SUV earlier this year and had planned to roll out as many as 10 models by Dec. 31. The company sells more cars wholesale in that market than at home – 835,934 of them, including joint ventures, in the third quarter, against 700,000 in the U.S…

Barra, who said she’d visited China twice in October, also said on an earnings call the company is watching the market there very closely. It wouldn’t be surprising to see GM double down on luxury models, if it can afford to do so. In Shanghai last year, Barra said “China is playing a key role in the company’s strategy” as she talked up electrification, autonomous vehicles and ride-sharing.

The Fighting Illini are buying insurance to protect them from a drop in Chinese students…

The University of Illinois at Urbana-Champaign has paid $424,000 to insure itself against a significant drop in tuition revenue from Chinese students.

In what is thought to be a world first, the colleges of business and engineering at the university signed a three-year contract with an insurance broker to pay the annual six-figure sum, which provides coverage of up to $60 million…

Jeff Brown, dean of the Gies College of Business, told Times Higher Education that the insurance would be “triggered” in the event of a 20 percent drop in revenue from Chinese students at the two colleges in a single year as a result of a “specific set of identifiable events.”

“These triggers could be things like a visa restriction, a pandemic, a trade war — something like that that was outside of our control,” he said.

Tuition revenue from Chinese students makes up about a fifth of the business college’s revenue.

Speaking of college, you can already predict this girl’s future college essay topic…

Geek tweet of the week…

Finally, what will you be doing in your 93rd year of life? Wimp, my ass.

Former President George H.W. Bush free falls with Golden Knights parachute team member Sgt. 1st Class Mike Elliott, as he makes a dramatic entrance to his presidential museum during a rededication ceremony in College Station, Texas, on Nov. 10, 2017.

Photographer: Sgt. 1st Class Kevin McDaniel/U.S. Army via AP

(Bloomberg)