by Nicholas Colas, DataTrek

A Man for All Seasons

To our thinking, Chair Powell’s speech today was a stroke of genius. By easing the Fed’s public stance on rates, he puts all the responsibility for near term market direction on President Trump’s shoulders as he prepares to meet Chinese President Xi at the G20. US equities are barely up on the year, so what happens in Buenos Aires will determine if stocks post a positive 2018.

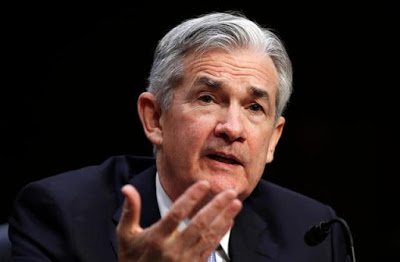

Federal Reserve Chair Powell really is a “Markets guy” after all, as today’s speech at the The Economic Club of New York showed. After saying interest rates were “far from neutral” on October 3rd, he didn’t make the crowd wait long today for his revised assessment. Powell’s new take, which appears in the 2nd paragraph of his talk: rates “remain just below the broad range of estimates of the level that would be neutral for the economy.”

We’ve been repeatedly pointing you to Fed Funds Futures as a forward-looking indicator for US central bank policy, and that market has been pricing in Powell’s speech as if it had an advanced copy a month ago. After October’s stock market swoon, Futures only gave the Fed a 17% chance of getting to a +3% funds rate, for example. Two-year Treasury yields - our other favored indicator – told a similar story, peaking on November 8th.

Since Fed Fund Futures had this event nailed, even if US stocks did not, let’s see what they say now with the benefit of a few hours to digest Powell’s talk:

- The odds that the Fed moves in December by 25 basis points are now 83%, up from 79% yesterday.

- Odds that the Fed stands pat or even cuts rates back to current levels at the March 2019 FOMC meeting are now better than 50/50, at 58/42. Yesterday they were about the same, at 55/45.

- Futures give the edge to seeing just one 25bp rate increase during all of 2019 (assuming the December 2018 bump), with 38% odds. Chances that the central bank raises rates twice or more in 2019 are now just 33%, down from 37% yesterday.

Hard-nosed numbers aside, the real genius of Chair Powell’s speech today is that it takes Fed policy out of the near term market narrative and shifts investors’ focus to President Trump’s end-of-week G20 meeting with Chinese President Xi. Here’s how this calculus works:

- US equities rallied strongly today because Powell’s comments effectively acknowledge the market’s concerns of a slowing global economy, driven in large part by the effect of US trade policy.

- All major US equity indices are up slightly on the year, or at least flat. The Dow: +2.6%. S&P 500: +2.6%. Russell 2000: -0.3%, but up 1% with dividends.

- The Trump/Xi G20 meeting on Friday is now the make-or-break event that will determine if US stocks print a positive or negative 2018. There simply are no other near-term catalysts that equal the importance of this event.

Squint only slightly through Machiavellian eyes, and Powell’s rate retreat looks very much like a calculated effort to pressure President Trump to make real progress at the G20. Chair Powell left himself enough wiggle room to change his stance in 2019. Mr. Trump does not have the luxury of time if he wants to see US stocks end the year on a high note. And Mr. Trump’s affinity for using the US stock market as a barometer for his professional success as President is well known…

Summing up: our Sunday note highlighted that US stocks sit on a fulcrum with “Hope” of a change in Fed/trade policy the only counterbalances to the heavyweight concerns of a slowing global economy. Chair Powell delivered on one of those hopes today. It will be up to President Trump to find a way to do the same later this week. Given today’s events, he does not really have a choice.