Unless oil prices collapse, energy stocks now appear to be cheap, as Russ explains.

While much ink has been spilled this year on the rout in emerging markets, and, more recently, the fall from grace of technology stocks, natural resource shares are actually the worst performers year-to-date. The S&P Energy Sector Index is down more than 5%, underperforming the S&P 500 by approximately 900 basis points (bps, or nine percentage points).

More interestingly, although oil prices have dropped sharply in recent weeks, they have not collapsed, unlike in early 2016. West Texas Intermediate Crude (WTI) is flat year-to-date, but the global benchmark Brent is still up 6%. This suggests that either the recent collapse in energy shares looks overdone or oil prices have further to fall. Consider the following:

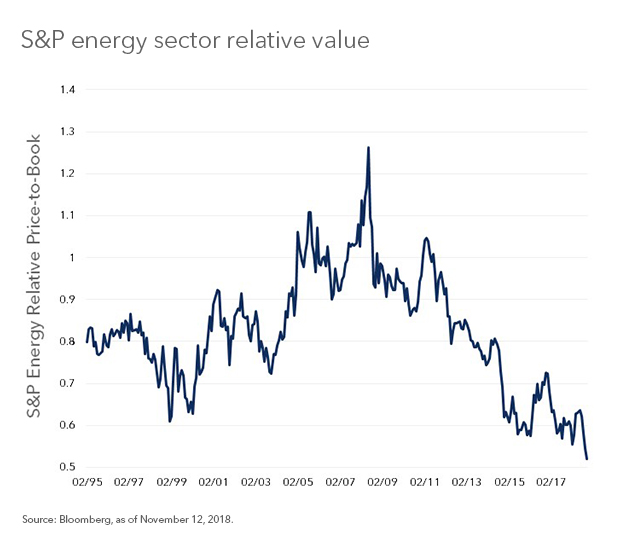

- Based on price-to-book (P/B) the energy sector is now trading at the largest discount to the S&P 500 since at least 1995 (see Chart 1). Energy stocks are currently trading at roughly a 50% discount to the broader market.

- The sector also appears unusually cheap on an absolute basis. At less than 1.7x earnings, the current valuation is the cheapest since early 2016 and is in the bottom 5% of all observations going back to 1995.

- As you would expect, the valuation of the energy sector tends to move (roughly) in tandem with oil prices. When oil prices are lower, the sector’s relative value versus the market also tends to be lower. Since 1995, this relationship has explained approximately 20% of the relative multiple of the sector. Based on oil prices at $60/barrel, history would suggest that the sector should be trading at a 15% discount to the market, not a 50% one.

Valuations hard to justify

As I’ve discussed in many previous blogs, value is a poor market timing tool. Neither cheap relative or even absolute valuations guarantee a bottom. The comparisons against both the broader market and oil prices could simply mean that the S&P 500 and/or oil prices might be too expensive, rather than energy shares too cheap. That said, both the market and oil would have to fall a significant amount to justify today’s sector valuation. As a simple example, if the historical relationship between oil prices and relative valuation were too hold, oil prices could fall to $40/barrel, roughly where they bottomed in 2016, and the energy sector would still appear underpriced.

Finally, there may be another reason to consider raising the allocation to energy shares. Historically, energy stocks have been more resilient than the broader market during periods of rising interest rates and/or inflation. If part of what has dislocated the market this year is the prospect for higher rates and an overheating U.S. economy, energy stocks seem a logical hedge. All of which suggests that for investors sifting through the rubble searching for bargains: Consider U.S. energy companies.

Russ Koesterich, CFA, is Portfolio Manager for BlackRock’s Global Allocation team and is a regular contributor to The Blog.