by Jeffrey Kleintop, Senior Vice President and Chief Global Investment Strategist, Charles Schwab & Co., Inc.

Key Points

- Economic growth for many of the world’s biggest economies is expected to slow in 2019, yet China appears to be the only one planning on implementing economic stimulus.

- In our view, growth in developed economies has been at least as important to the performance of stocks in emerging market countries as their own domestic economic growth.

- While a bounce from China’s stimulus is possible, we believe global growth is likely to slow as the economic cycle nears a peak, leaving investors to consider reducing volatility by trimming the more volatile asset classes such as emerging market stocks.

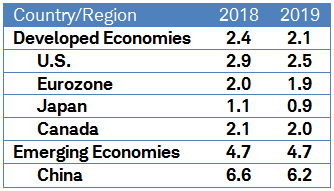

The economic growth of the developed world is expected to slow from 2.4% in 2018 to 2.1% in 2019, according to estimates by the International Monetary Fund. Slowdowns are expected across many major countries and regions including the U.S., Europe, Japan and Canada. China, an emerging market and the world’s second largest economy, is also expected to slow. Yet, China is the only major economy which is currently planning on implementing economic stimulus in 2019.

Estimated GDP growth rate

Source: International Monetary Fund as of October 2018.

Policymakers in most major economies are now either ending economic stimulus or actively removing it. The European Central Bank is set to end the QE (quantitative easing) program in December and expected to begin to raise interest rates later in the year. The Bank of Japan has been slowing their QE program. The U.S. Federal Reserve will probably continue to raise interest rates in 2019. Following two years of corporate tax cuts in the U.S., France, the U.K. and Japan, fiscal policy will likely go from a tailwind to a headwind in 2019.

In contrast, economic policy in China is becoming increasingly stimulative. Policy moves last year intended to curb excesses has caused China’s economy to slow more than expected in 2018. These actions included tighter lending controls and higher interest rates. This, combined with the pressures of heightened trade tensions with the U.S., led to an economic slowdown best seen in the Caixin China Composite Purchasing Managers Index (PMI). It has dropped to 50.5, the lowest level in nearly a year and a half and only just above the breakeven level of 50, as you can see in the chart below.

China’s economy has taken a recent turn for the worse

Source: Charles Schwab, Bloomberg data as of 11/10/2018.

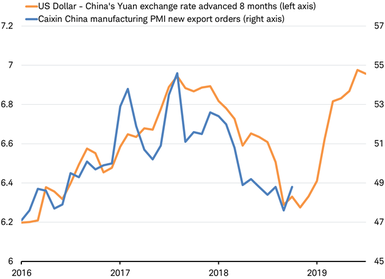

China’s policymakers have now been reversing their actions. The People’s Bank of China has loosened lending and pushed down interest rates, causing China’s currency, the yuan, to weaken. To illustrate the impact this could have, let’s review the chart below. Here we see that the dollar-yuan exchange rate has tended to lead the new exports component of China’s PMI by about 240 days, or about eight months, pointing to a potential economic rebound in 2019. In the currency world, a rising yuan exchange rate means a decline in value of the currency.

China’s currency points to a rebound in exports in 2019

Source: Charles Schwab, Bloomberg data as of 11/10/2018.

Additional policy stimulus is coming in China, with tax cuts scheduled to take effect next year. A breakthrough on trade tensions with the U.S. could also offer a significant economic boost.

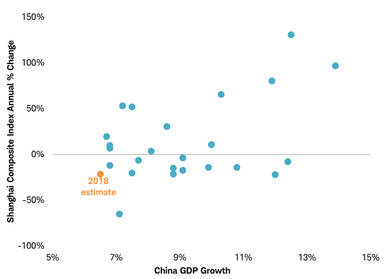

What does this mean for investors? Perhaps very little. Historically, stimulus alone has meant very little to China’s stock market. Although it’s possible that China’s growth outlook improves and helps emerging market growth to accelerate, this doesn’t necessarily mean emerging market stocks will rebound and outperform. With global growth set to slow as leading indicators point to an overheating global economy, emerging market stocks may not benefit from any improvement in the economic outlook for China. Historically, growth in developed economies has appeared to be at least as important to the performance of stocks in emerging market countries as their own domestic growth. In fact, there is little correlation between China’s annual GDP growth and stock market performance over the past 25 years.

China’s annual economic and stock market performance for past 25 years (1994-2018)

Source: Charles Schwab, Bloomberg data as of 11/10/2018.

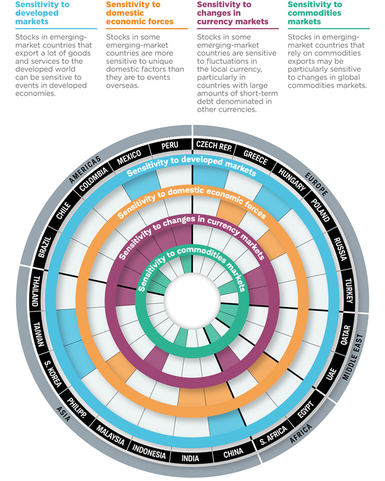

Stocks of emerging market countries tend to be sensitive to different factors, as you can see in the graphic below. Nearly 60% of the MSCI Emerging Markets Index is composed of stocks from China, South Korea and Taiwan—all three of these countries are very sensitive to the pace of growth in developed markets.

Each emerging country stock market tends to respond to different forces

Source: Charles Schwab, MSCI Emerging Markets Index components as of 11/10/2018.

With growth in developed economies likely to slow and emerging market economic growth expected to be stable next year, any positives may have to come in the form of a weaker dollar and stronger commodity prices—which would require reversing recent trends. While a bounce is possible as China applies stimulus, global growth is likely to slow as the economic cycle nears a peak, leaving investors to consider reducing volatility by trimming the more volatile asset classes such as emerging market stocks.

Copyright © Charles Schwab & Co., Inc.