by Kristina Hooper, Global Market Strategist, Invesco Ltd., Invesco Canada

Trade tensions have escalated in recent months to a point we haven’t seen in many years. At times in the past year, protectionist threats and actions have sent stocks downward, but investors have been all too willing to believe the threat has passed at the first sign of an abatement in trade drama. For example, after downward pressure on stocks caused by trade worries, Chinese President Xi Jinping’s conciliatory speech at the Boao Forum in March was all investors needed to hear to send stocks upward. But the elation was short-lived, as it soon became clear that President Xi had no interest in making serious concessions.

I believe the damage to the global economy caused by tariffs has been woefully underestimated. I attribute that to two reasons:

1) most investors were not alive the last time we saw trade wars occur, in the late 1920s and 1930s, and so there is no frame of reference for the current trade tensions and their potential impact;

2) it is very difficult to model out the potential damage, given that there are so many different possible outcomes – and so many consequences.

The economic consequences

Price increases. Simply put, tariffs increase the price of goods. And so, one of three things could happen when a tariff is applied to a particular good:

1. In some industries, companies will be unable to pass the cost onto its customers. This means the company’s profits are reduced. For public companies, this of course negatively impacts earnings and could therefore impact stock prices

2. A company passes the cost of tariffs to their customers (as, for example, Apple has suggested it would do) and consumers pay more for the same item. This means that, all else being equal, they have less money left to spend on other goods or services.

3. A company tries to pass the cost of tariffs to their customers, but there is demand destruction as consumers cut back their purchases. Traditionally economists have largely discussed demand destruction in the context of energy. For example, if OPEC lowers production, thereby increasing oil prices, consumers will reduce their driving and thereby their consumption of oil, creating demand destruction. In the case of the current trade wars, we have already begun seeing demand destruction in an industry that was one of the first to experience the imposition of tariffs at the start of 2018: washing machines. The same fate could befall other items, including other “big ticket” purchases such as autos, if tariffs are applied to them.

As illustrated previously, tariffs can create inflation – not by stimulating demand, but by simply increasing the cost of goods. It is important to note that imports from China lowered US consumer price levels by 1%–1.5% in 2017.1 Conversely, the imposition of tariffs and other forms of protectionism will only serve to drive up prices. As early as the April Federal Reserve Beige Book, which was released after the imposition of aluminum and steel tariffs, business contacts in a variety of districts articulated significant concerns over tariffs (they were mentioned 36 times) and expressed worry that input costs were already increasing. Historically, input costs have risen following the imposition of tariffs and quotas. For example, research has shown that the Corn Laws (in which the UK imposed tariffs and quotas on imported grains in the 1800s) increased the cost of living for British workers.2 Another example of price increases was seen in 1984, when US consumers paid an estimated $53 billion in higher prices because of import restrictions levied that year.3

Economic policy uncertainty. In a recent European Central Bank (ECB) meeting, ECB President Mario Draghi explained that protectionist threats and actions can “have a profound and rapid effect on business, on exporters’ confidence … and confidence can in turn affect growth.” A recent academic paper concluded that, “Uncertainty over domestic and international economic policy adversely affects the international flow of goods, services, and investment. When sunk costs are associated with acting, uncertainty about expected profits leads entrepreneurs to wait rather than act, reducing commerce domestically and internationally.”4 I expect that, at some point, data will indicate a decline in business investment as tariff conflicts with China intensify.

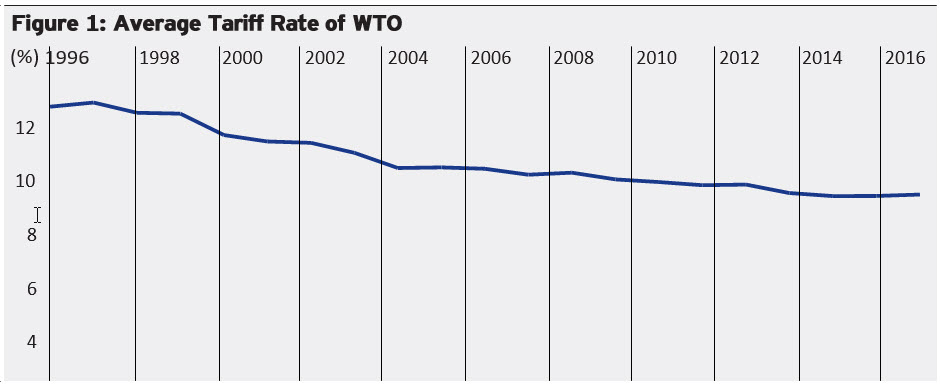

Disruption of global supply chains. Global supply chains are a product of comparative advantage, the economic principle that countries should specialize in the production of goods and services in which they have a comparative advantage in order to grow their economy most effectively. This principle is embodied in global supply chains, which were enabled by the lowering of tariffs and other trade barriers globally over the last several decades, which in turn was helped by the creation of the World Trade Organization (WTO) in 1995, which greatly expanded on the progress made by the General Agreement on Tariffs and Trade (GATT). In fact, the average rate of tariffs on imports by WTO members declined from slightly more than 12.74% in 1996 to 8.8% in 2016.5

Lower tariffs fueled a major increase in global trade, from $5 trillion in 1996 to $19 trillion in 2013.5 A recent policy brief from the Peterson Institute on US-China trade issues recognizes legitimate issues around intellectual property rights and access to markets, but notes that “the Trump Administration’s tactic of imposing tariffs in the sectors specified by USTR (Office of the United States Trade Representative) may prove more harmful than effective”, noting that “US firms rely on global supply chains to remain internationally competitive. To the extent that the tariffs land directly on productive inputs, they raise the cost of manufacturing goods in the United States, push American firms offshore, and handicap US-based exporters selling in foreign markets.”6

As the Cato Institute explained, “Whereas in the 20th century, most of a company’s production and assembly took place in one location, often under one roof, the factory floor has since broken through those walls and now spans borders and oceans. Taxing imports today is akin to erecting a wall through the center of that 20th century assembly line, impeding production and raising costs in similar fashion. That helps explain the preponderance of opposition among US manufacturers to Trump’s trade tack. US tariffs raise their costs, and the resulting retaliation from foreign governments will reduce their export revenues, squeezing profits from both ends.”7

Economic consequences: Key takeaways

In short, protectionism stands in the way of progress and economic growth. In its August meeting minutes, the Federal Reserve said all participants pointed to ongoing trade disagreements as a source of risk that could affect growth and inflation.

Protectionism doesn’t create jobs – it destroys them by making the economy inefficient. Shielding the US steel industry may save a few steelworkers’ jobs, but it creates a ripple effect that increases input costs, hurts the economy and results in job losses. In a statement earlier this year, the US Chamber of Commerce warned that these tariffs will “hit American manufacturers with higher costs, slow the growth of the US construction sector and put the brakes on job creation in both of these key industries.”

Some compelling statistics can be found from the protectionist environment of the 1920s and 1930s: US imports from Europe declined from $1.3 billion in 1929 to $390 million in 1932, while US exports to Europe fell from $2.3 billion in 1929 to $784 million in 1932.7 And from 1929 to 1934, world trade declined by approximately 66%.

Some believe that the US economy is better positioned to handle any damage created by trade conflicts given that a comprehensive tax reform package has helped boost economic growth, and unemployment is very low. The theory is that a trade war will hurt other economies (particularly China, which is experiencing a mild economic slowdown) more than it will hurt the US. However, I believe protectionism will inflict significant damage on all economies involved.

It is worth noting that in 1929, when the Smoot-Hawley Tariff Act was proposed and passed by the House of Representatives, US economic growth was robust: Real GDP growth was 6% and the unemployment rate was 3%. In addition, China is arguably better equipped to combat any economic damage inflicted by protectionism through an increase in domestic spending, which has already begun. Conversely, the US is unlikely to be able to create enough fiscal stimulus, given that it needs Congress’ approval for a stimulus package.

The capital markets consequences

I believe it is no coincidence that protectionist actions have preceded stock market sell-offs.

• In May 1929, the House passed a version of the Smoot-Hawley Act. Within several months, the stock market crashed.

• In April 1987, the US imposed 100% tariffs on some Japanese electronics and technology goods. The stock market crash of October 1987 soon followed.

• In March 2002, President George W. Bush imposed tariffs of between 8% and 30% on various steel products. Stocks, as represented by the S&P 500 Index, fell from March 2002 through October 2002.

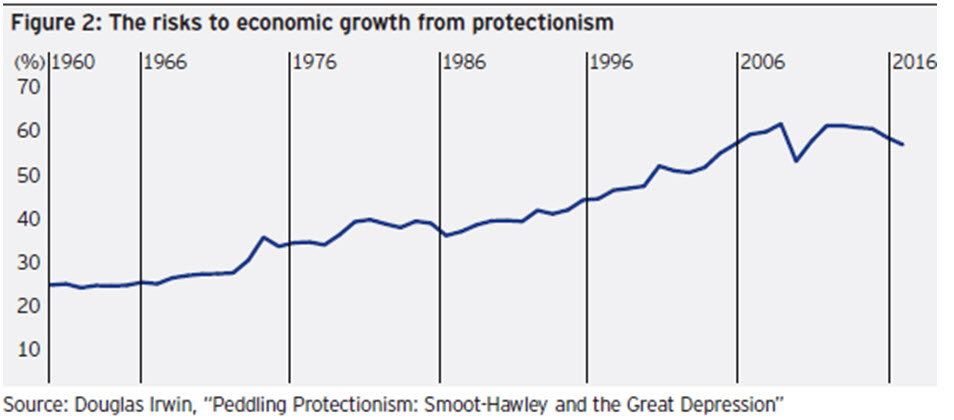

I believe the stock market reaction to today’s trade conflicts could ultimately be worse given that we are in a more globalized economy, and so the stakes are higher in terms of impact on economic growth. Consider that in the early 1960s, less than 25% of global GDP could be attributed to international trade. As of 2016, that figure is nearly 60%,9 a statistic that suggests today’s global economy is far more vulnerable to trade wars (Figure 2). As the IMF has explained, “An intensification of trade tensions and the associated further rise in policy uncertainty could dent business and financial market sentiment, trigger financial market volatility, and slow investment and trade”10 — none of which are positive for capital markets.

Possible outcomes

It is very difficult to model all the possible outcomes of the burgeoning trade wars. However, my base case scenario is that the conflict between the US and China will continue to escalate for the foreseeable future as the US is not interested in a compromise and China has no compelling reason to capitulate to US demands. At the very least, I expect protectionism to escalate until the US mid-term elections in November.

After the mid-terms, Congress could attempt to limit the power of the executive branch in negotiating trade agreements, given foreign policy implications. This scenario isn’t probable, but it’s also not as unlikely as it may seem, given that the Constitution (Article 1, Section 8) gives Congress the power to levy tariffs. While Congress has been shifting trade powers to the executive branch for many decades, it can certainly take them back. For example, in 1934, after the negative economic implications of the Smoot-Hawley tariffs became clear, Congress – which was responsible for Smoot-Hawley – acquiesced to President Roosevelt’s entreaty to cede some of its own powers with regard to trade to the executive branch of the US government.10 As negative implications about current trade policies become more apparent, Congress may attempt to pass legislation to take back from the executive branch some tariff powers – but it would need a veto-proof majority.

The International Monetary Fund recently revised (as of October 2018) downward its estimates for global growth, as well as growth for China and the U.S. as a result of the escalation in trade tensions. The IMF projects that long-term U.S. GDP and long-term China GDP will both decline 0.3% as a result of all the tariffs implemented as of September 2018. It expects long-term U.S. GDP to decline 0.5% and long-term China GDP to decline 0.55% if the U.S. imposes its threatened 25% tariff on an additional $267 billion in Chinese goods and China retaliates. In addition, it expects long-term U.S. GDP to decline 0.9% and long-term China GDP to decline 0.6% if the U.S. imposes its threatened 25% tariffs on cars and parts, and then trading partners retaliate.10 The IMF of course expects this to have a negative impact on global growth, with long-term global GDP projected to decline 0.4% if all tariffs discussed above are implemented.10 The IMF expects the impact of the current trade conflict to be felt in 2019: its estimate for U.S. GDP growth was downwardly revised to 2.5% from 2.7%, while China GDP growth was downwardly revised from 6.4% to 6.2%.

Investment implications

I expect stock market sell-offs to occur as we move deeper into trade wars, as well as more downside volatility for stocks in general. This suggests the importance of greater diversification, including adequate exposure to alternative asset classes, which have historically had exhibited lower correlations to equities. However, it also suggests that more tactical investors could take advantage of buying opportunities created by market irrationality, such as the price drop in many Chinese technology stocks in 2018. Also, investment portfolios could benefit from diversification by factors, such as low volatility, in order to hedge downside risk. In addition, I expect inflation to increase, and so adequate exposure to inflation hedges could be important, including gold and other commodities, real estate, and inflation-protected securities.

Finally, I would not assume that the US will win its trade wars and that US stocks will therefore outperform. Market breadth among US stocks is very narrow, and valuations are stretched. Moreover, valuations are very attractive in other areas of the world. Therefore, adequate equity and fixed income diversification among regions is important.

Conclusion

Institutional investors should not be deceived by protectionist advocates who minimize the dangers of their aggressive trade policies. Recall that in 1930, as the Smoot- Hawley Tariff Bill was being debated in the US Senate, California Senator Samuel Shortridge dismissed the objections to tariffs by economics professors: “I am not at all disturbed by the proclamation of college professors who have never earned a dollar by the sweat of their brow by honest labor.” Former Oregon Senator Mark Hatfield decried free trade advocates as “intellectuals … who seem to be more concerned with the prosperity of foreigners than they are with the well-being of our own American people.”

In other words, we have seen this strident opposition to widely held and proven economic principles of free trade before, and we know how it ended. As the IMF explained in its October 2018 World Economic Outlook, “Escalating trade tensions and the potential shift away from a multilateral, rules-based trading system are key threats to the global outlook.” Institutional investors need to be prepared.10

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog