by Franklin Templeton Investments

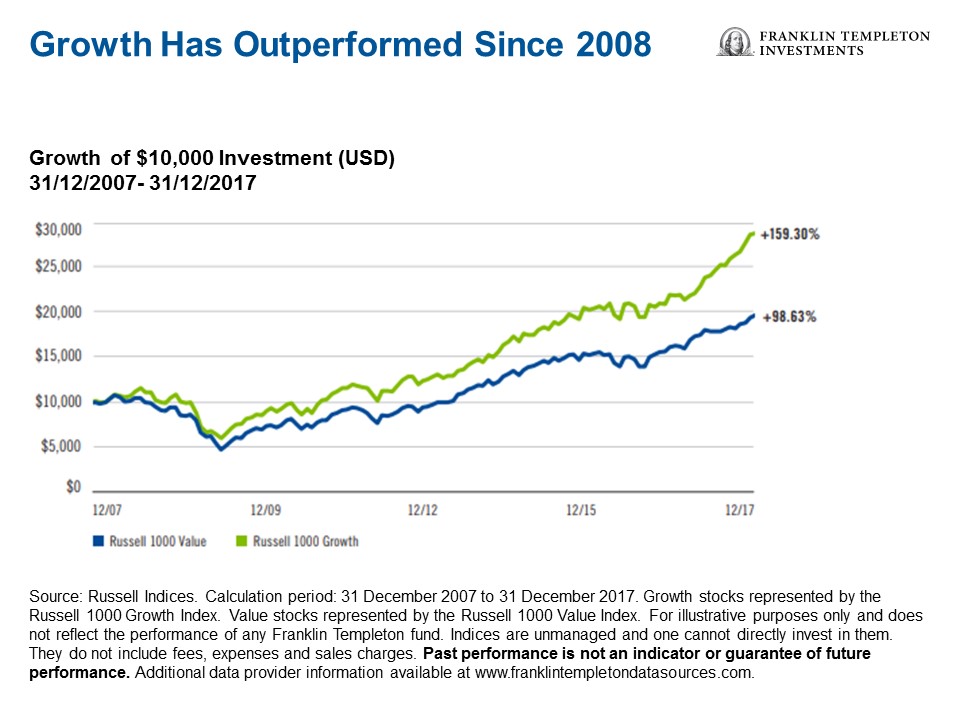

Since 2008, US growth stocks (particularly in faster-growing sectors such as technology) have tended to perform better than US value stocks, as the chart below shows.

As the performance gap between growth and value widens, more investors may be wondering when this dynamic between growth and value might change.

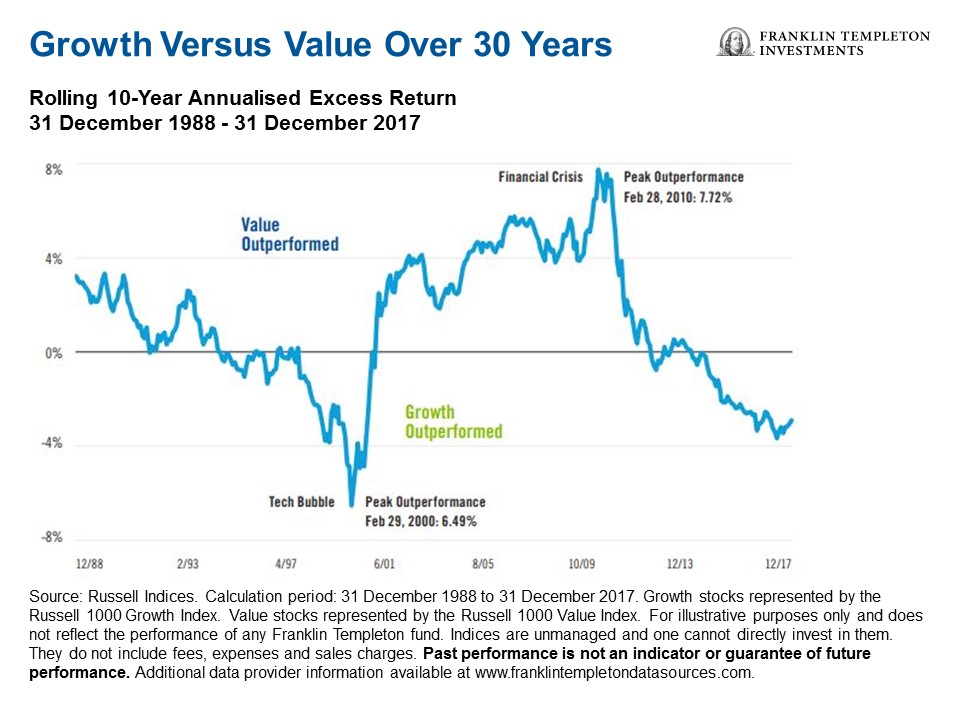

However, a different pattern emerges over longer periods of time. As the chart below shows, value outperformed growth for a 10-year that peaked about a year after the market bottom during the financial crisis. Since then, growth investing has had generally better performance.

A Bit of Background

In the United States, at the peak of the tech bubble, growth had significantly outperformed value for a number of years. By February 2000, the 10-year average annual return differential had reached 6.49% in favour of growth.1

Only 10 months later, in December 2000, that 10-year differential had been wiped out.

In this podcast and article, Stephen Dover, head of equities at Franklin Templeton Investments, recalls some of the prominent tech names that were leaders during the boom and bust.

“If you look back to the technology names before the technology crisis, who did it look like was going to win? It looked like it was going to be—let’s see if you can remember these names—Yahoo, CompuServe, Alta Vista, Compaq computer, Netscape. Great companies, multi-billion dollar companies, great big impact on the indices. They’re all gone or bought out or something else has happened. That’s the difficulty of growth.”

Dover says one of the reasons why growth has outperformed value over the past 10 years is due to monetary policy that has kept global interest rates low. The lower an interest rate is, the greater the value of future earnings.

“All things being equal, when you have artificially low interest rates, growth companies [are] worth more than value companies because earnings in 10 years become more valuable than earnings in one year.”

That said, Dover cites rising inflation and higher interest rates as potential headwinds for growth stocks.

Why Value May Catch Up with Growth

As growth stocks have outperformed value in recent years, some of our investment professionals think value stocks have become cheap, based on historical levels.

According to Templeton Global Equity Group’s analysis of companies in the MSCI All Country World Index universe, at the end of the second quarter of 2018, global valuations spreads (the gap between the market’s cheapest and most expensive stocks) were the widest they have been in at least 30 years.2

“Put another way, value globally has only been this cheap 1% of the time in the past three decades. This could be a meridian hour for value investors.” – Templeton Global Equity Group, July 2018

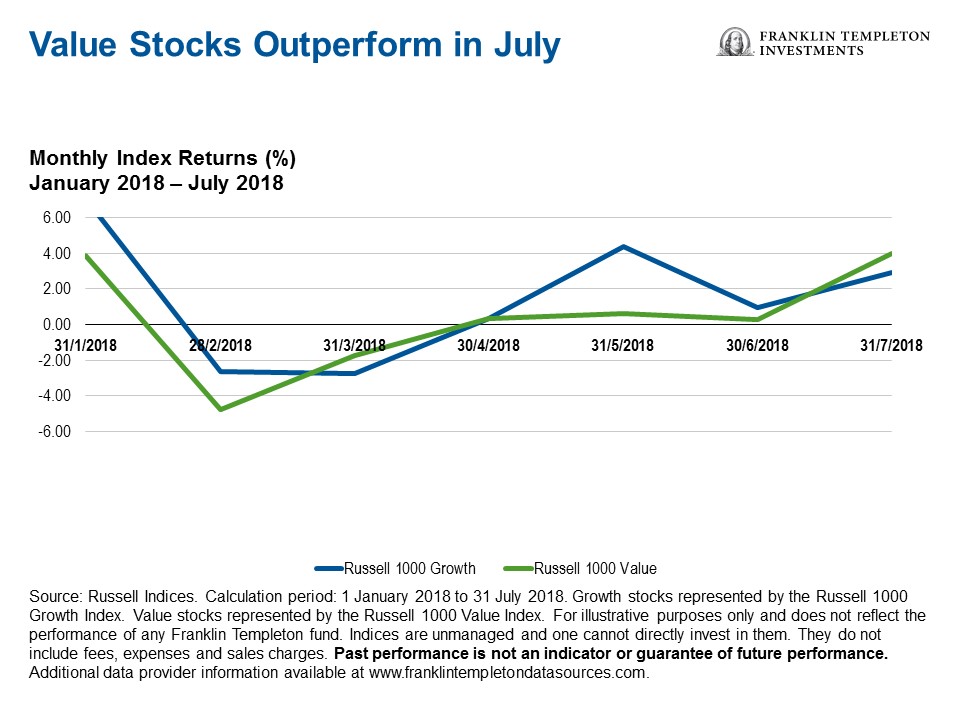

Valuations may also explain why US value stocks outperformed US growth stocks during July 2018, as the chart below shows.

In this article and video, Franklin Mutual Series CEO Peter Langerman explains why he thinks a shift to higher interest rates could benefit value investing going forward.

“We are not predicting that there’s going to be a period of dramatic value outperformance versus growth. Rather, fundamentals suggest to us there should be more of an equilibrium reached. And so, we think it’s an environment that’s more attractive for us as value investors than it has been for the past several years.”

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

Get more perspectives from Franklin Templeton Investments delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.