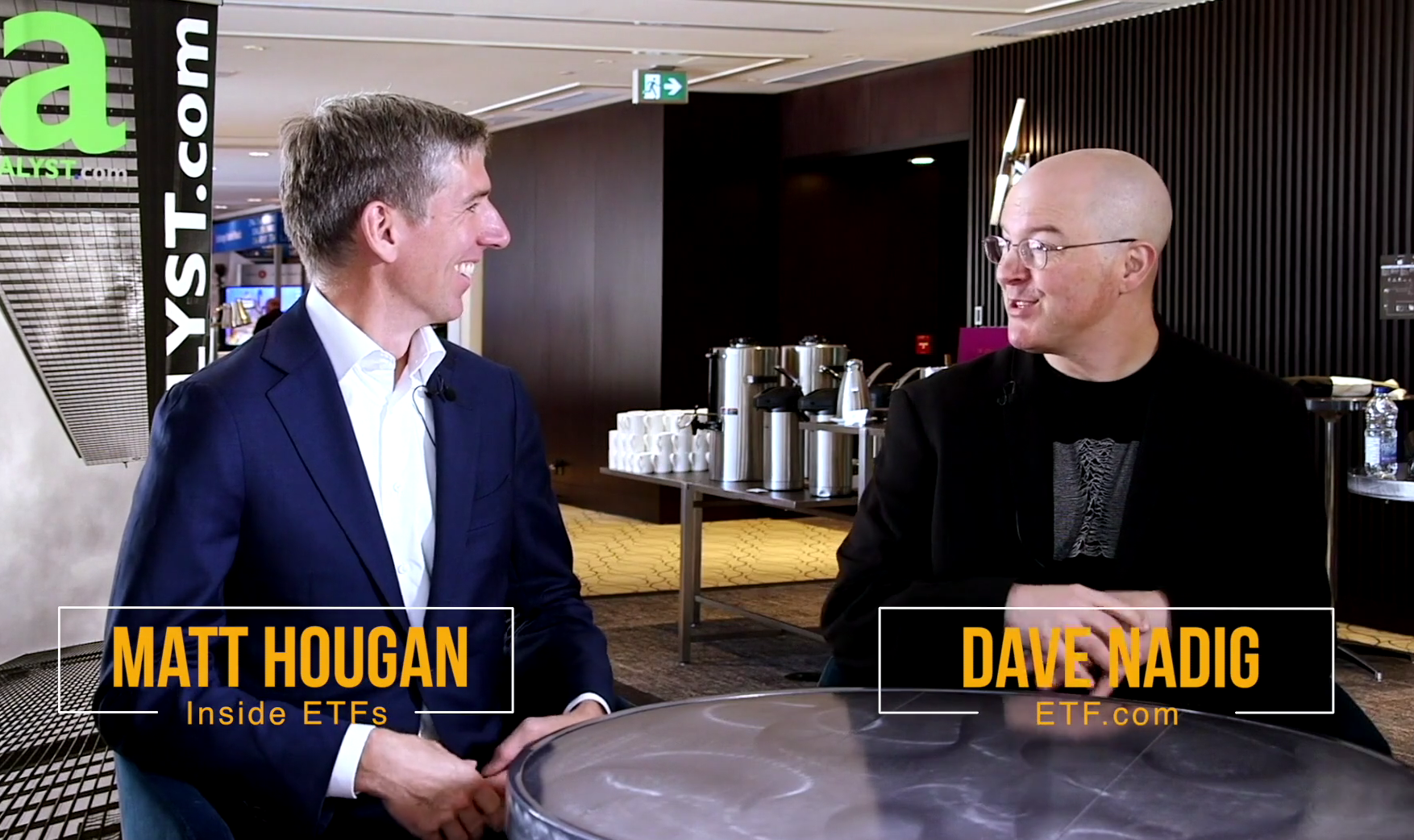

We chatted with Matt Hougan, Chairman, Inside ETFs (former CEO, ETF.com) and Dave Nadig, Managing Director, ETF.com at the inaugural Inside ETFs Canada conference in Montreal, June 21-22, 2018. They keynoted at the conference, emphatic that the Canadian ETF industry is at a tipping point and could see explosive growth in assets over the next 7 years, rising from $150-billion today, to $800-billion by 2025.

In this exclusive interview, they share their insight on why this ETF investing revolution in the industry is inevitable.

Two interesting points of discussion:

- "Expense is the new alpha" - investing focus is shifting away from beating the index, to cuttting costs - it's easier to cut costs by using low cost indexing, than to beat the market over long investing periods.

- The commoditization of investment via Index ETFs is shifting the value proposition away from the fund issuers to the advisor - the advisor becomes the star of the show, in terms of providing value, in the relationship between issuer, advisor, and investor.

- "One of the really interesting things is that value in the ecosystem is shifting from the fund providers to the advisor," says Hougan. "The fund providers are increasingly providing commoditized product, and then its up to the advisor to implement those and work with the client to make sure they achieve the full spectrum of possible returns – its a massive shift of value, and it benefits the advisor."