by Ryan Detrick, LPL Research

President Trump is reportedly set to announce his selection for the next Chair of the Board of Governors of the Federal Reserve (Fed) in the very near future, with Jerome Powell emerging as the likely nominee. Though he’s yet to make a final decision, reports suggest that a final decision will come before November 3.

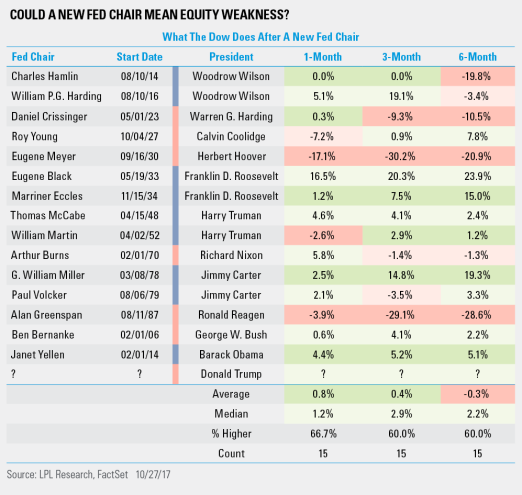

In our latest Bond Market Perspectives, we took a dive into the potential shift in composition of Fed members in 2018, in addition to the chair, and why it could be quite hawkish—but what does new Fed leadership really mean? Per Ryan Detrick, Senior Market Strategist, “Just as a new President brings uncertainty, a new Fed chair can do the same. In fact, going clear back to Charles Hamlin (the first Fed chair) in 1914 and his 14 successors, the Dow is down on average six months after a new chair.” Keep in mind that the sample size is quite small and the results below are skewed due to WWI, the Great Depression, and the crash of 1987.

We’re not suggesting that a new Fed chair is likely to trigger a sharp selloff, but it would add to market uncertainty, and markets don’t like uncertainty. So we wouldn’t be surprised if Trump’s announcement spurs a bout of volatility, but when we look at the bigger picture, we continue to see very few signs of the excesses seen at previous major market peaks. This suggests very low odds of a recession beginning over the next 12–18 months and a likely continuation of the equity bull market in 2018.

*****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The Dow Jones Industrial Average (DJIA) Index is comprised of U.S.-listed stocks of companies that produce other (nontransportation and nonutility) goods and services. The Dow Jones Industrial Averages are maintained by editors of The Wall Street Journal. While the stock selection process is somewhat subjective, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth, is of interest to a large number of investors, and accurately represents the market sectors covered by the average. The Dow Jones averages are unique in that they are price weighted; therefore, their component weightings are affected only by changes in the stocks’ prices.

The economic forecasts set forth in the presentation may not develop as predicted.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-661555 (Exp. 10/18)

Copyright © LPL Research