by Corey Hoffstein, Newfound Research

Summary

- We’re often asked, “is now a good time to implement tactical strategies?”

- We believe there are better and worse periods for tactical, largely based upon expected risk/reward trade-offs and available diversification opportunities.

- For investors, we believe an equally important consideration is where they are in their investment lifecycle trajectory. For investors with longer horizons, the potential costs of tactical strategies may not make sense, except in extreme capital market scenarios.

- Specifically, we believe that investors should most actively seek to manage risk when they are most susceptible to sequence-of-return risk. In this commentary, we seek to identify exactly when that is.

As a tactical manager, one of the questions we often receive is, “is now a good time for tactical?” With many investors concerned about both high equity valuations and low interest rates, tactical strategies seem like a natural way to “protect and participate.”

Our response to this question is, “for whom?”

We’re of the view that tactical is not for everybody, nor is it necessary in all periods of an investor’s lifecycle. Rather, tactical makes the most sense, in our opinion, when sequence risk is highest and when traditional forms of risk management are expensive. What is sequence risk and when does it peak?

Most individual investors follow the same, broad investment life cycle. In their early years, they have little investment capital and a lot of human capital. Over time, they transform their human capital – through income earned and savings – into investment capital. At some point, they deplete their human capital (i.e. retire) and then spend the rest of their life living off of their investment capital.

And, if planned correctly and with a bit of luck, the investment capital outlives the investor.

While many of the variables in the retirement equation can be influenced by the investor (e.g. savings rate and withdrawal rates), some – like the market return – are entirely out of their control.

Worse, the actual sequence of returns – not just the long-term rate – can have a material impact on an investor’s experience. A 50% portfolio loss the year before an investor retires will have a large effect upon their safe withdrawal rate, and therefore the lifestyle they can afford to lead. That is sequence risk.

But sequence risk is not a constant throughout an investor’s lifecycle. Understanding when sequence risk peaks may be critical for establishing optimal financial plans in the future.

Methodology

To get an understanding of when sequence risk peaks, we will simulate an investor’s investment lifecycle.

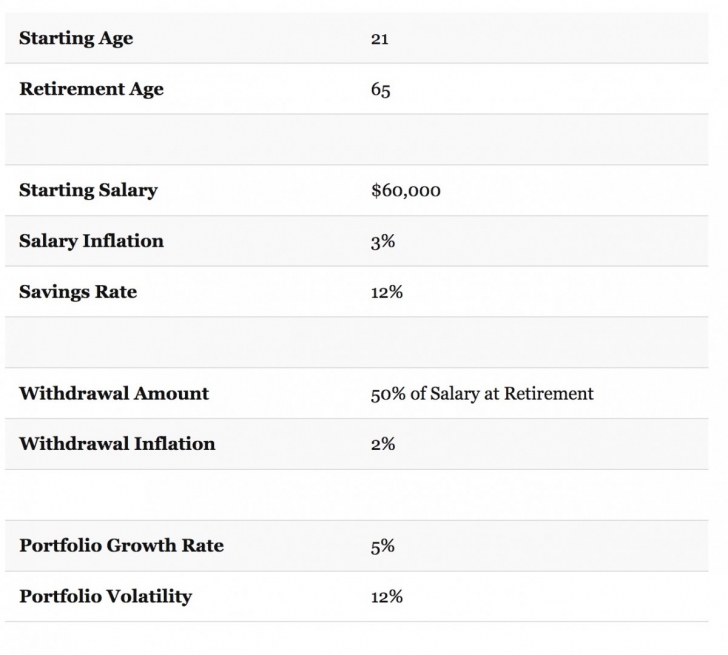

Specifically, we will assume an investor who starts saving at age 21 and retires at age 65. We’ll make a number of other assumptions about salary, savings rate, withdrawal amounts, et cetera; all of which we will keep constant across simulations.

To establish when sequence risk has the greatest impact, we will run 7,900,000 simulations (79 years x 100,000 simulations). For each simulation, from age 21 to age 100, we will assume a constant rate of portfolio return. Except for one randomly selected year, for which we will inject some volatility by randomly drawing a return for that year.

Given each simulation’s sequence of market returns, we will then calculate the age at which the investor ultimately runs out of money.

Finally, for each year between age 21 and 100, we then accumulate all the simulations that shocked that specific year and calculate the minimum, average, and maximum age when the investor ran out of money.

We used the following assumptions within our simulation:

We make no assumptions about guaranteed income (e.g. pension or Social Security) and savings and withdrawals are assumed to be made at the end of each year, after returns are applied to the portfolio. To further simplify, we will ignore taxes.

Note that while changing many of these figures would ultimately change when an investor runs out of money, they do not have a material impact about when sequence risk peaks during an investor’s lifecycle.

When Does Volatility Matter?

With our setup, we can now ask: when does market volatility (i.e. sequence risk) have the greatest impact on our financial plan? Below, we plot the minimum, average, and maximum age when we ran out of money, given the random volatility shock applied to a given year.

Sequence risk is captured by the spread between the maximum and minimum figures. Significant deviation from the mean is an indicator that volatility, when applied to that specific year, has a meaningful impact on final results.

What do we find?

What do we find?

- Volatility has little effect upon the average result. This makes sense, as volatility can be both positive and negative.

- Volatility always has an impact on the final result, even if the shock occurs the very first year the investor begins saving and investment capital is smallest.

We can clearly see that the impact of sequence risk peaks at retirement age (when investment capital has theoretically reached its peak) and is most important in the years immediately preceding and following retirement.

This is one reason why we utilize glide paths that naturally de-risk an investor over time: as investment capital is maximized near retirement, sequence risk peaks. To limit this risk, we want to reduce the amount of volatility we are exposed to.

This is also an argument as to why it might make sense to have an increasing glide path during retirement: sequence risk decreases, but longevity risk remains.

Note: The convergence at age 86 is due to the fact that with the parameters chosen, the investor is guaranteed to run out of income by age 86 under almost all conceivable scenarios. Changing our parameters would increase or decrease this level (as well as the average), but would not change the result that sequence risk peaks around retirement age.

The Sequence Risk of Negative Volatility

Of course, we are probably more concerned about negative volatility than positive volatility. We can re-run this simulation, but only allow negative volatility shocks to occur.

- Negative volatility does affect the mean age at which we run out of money. The minimum is when the shock is applied at retirement, reducing the average age from 86 to 83.6.

- Again, sequence risk peaks at retirement age, with the years before and after having the largest impact. Negative shocks applied the year an investor retired caused the minimum age at which money lasted to fall to age 75: just 10 years after the investor retired, almost cutting the solvent retirement period in half relative to the average.

The Sequence Risk of Tail Events

We can take this one step further and ask, “what if the worst occurs?” To do this, our shocks will not only be negative, but will be randomly drawn from the worst 5% of possible return scenarios given the assumed mean and volatility of the annual returns.

Our take:

Our take:

- As would be expected, we now see that the maximum is also reduced over time. Significant negative return shocks at, or near, retirement now have a material negative impact of the longevity of our capital.

- Again, we see that the largest adverse impacts are found when the shocks are applied at retirement and the years surrounding.

- Negative market events occurring near retirement reduced the minimum age to 73: meaning an investor ran out of money just 8 years after retiring.

Do Glide Paths Solve the Sequence of Risk Problem?

The elevated sensitivity to sequence risk is a large reason why glide paths tend to “de-risk” over time.

Below, we plot the same tail risk experiment, but this time we use an “own-your-age” glide path model to de-risk our portfolio exposure over time. We increase our expected return and volatility assumptions to 7.7% and 14.9% (selected such that at age 65, the expected return and volatility of our portfolio is 5% is 12%), and assume that whatever is not in equities is in a zero-return cash position. Note that this means that the growth rate during the entire accumulation period is now higher.

We can see that the glide path almost completely eliminates sequence risk.

We can also see that it reduces the expected age at which we are going to run out of money by about 4 years. A glide path may help us control our sensitivity to bad luck, but it also reduces our exposure to the good as well.

We can also see that it reduces the expected age at which we are going to run out of money by about 4 years. A glide path may help us control our sensitivity to bad luck, but it also reduces our exposure to the good as well.

As we say here at Newfound, “risk cannot be destroyed, only transformed.”

A Different Kind of Glide Path

Instead of de-risking the portfolio over time, what if instead we introduce a tactical sleeve over time? Specifically, from 35 to 55, the tactical sleeve will go from 0% to 100%. From 55 to 75, the sleeve will stay at 100%. From 75 to 95, the sleeve will go from 100% back to 0%.

(We are entirely ignoring the tax implications of changing our portfolio during these years, but we’re just going to assume this can be done in a tax efficient manner, e.g. with a futures overlay or via asset location decisions).

We will assume that the tactical sleeve returns 1% less than the portfolio, but is able to cut drawdowns in half.

Similar to the glide path model above, we will assume the higher expected returns and volatility levels. Specifically, we will assume a 5.5% return and 12.6% volatility (simply increasing expected return by 0.5% and volatility proportionally). This time, however, that higher return and volatility will be constant over time, with the expectation that the tactical sleeve may help manage the excess risk. The idea behind the slightly higher expected return is that the tactical model enables us to remain more heavily tilted towards return-generating assets (e.g. equities) than a strategic model would recommend.

We can see that the new minimum is equal to the glide path model’s maximum.

We can see that the new minimum is equal to the glide path model’s maximum.

This result highlights one of the often-overlooked aspect of tactical strategies: when used correctly, they can potentially allow an investor to participate more than they would have with a strategic portfolio alone. Not only can they be used to de-risk a portfolio, but they can be used as a pivot to increase risk exposure as well. Indeed, we would expect even better results if we allowed for meaningful participation in positive shocks (as in the first section of this commentary).

We want to be very clear here: we are not saying that our contrived example proves that a glide path that introduces a tactical strategy is necessarily better than one based upon a strategic asset allocation. Rather, just that a glide path necessarily reduces return in order to reduce catastrophic risk. If that risk does not emerge, however, the risk reduction can be a large drag.

One potential solution is to diversify how we manage risk. This means controlling one part of our portfolio with a glide path and managing risk in the remaining part through other means. For example, equities could be tilted in a defensive manner (e.g. quality or low volatility), we could introduce managed futures, use valuation-driven strategic tilts, and embrace tactical equity solutions.

Indeed, the “Equity Like” model outlined in our commentary Building an Unconstrained Sleeve could be a perfect candidate for a portfolio replacement.

Conclusion

With a limited investment horizon and meaningful withdrawal phase, sequence risk is an important contributor to an investor’s overall experience.

In all three experiments – symmetric volatility, negative volatility, and tail events – we saw that sequence risk peaked in the years surrounding retirement.

While a simple own-your-age glide path rule was able to largely eliminate sequence risk, it also significantly reduced that age to which our money was expected to last. Eliminating sequence risk also eliminated significant growth (and positive luck) exposure.

To return to our original question: is it a good time for tactical? For us, this is actually a two-part question. First, “do the potential benefits of tactical outweigh its costs given the risks we see in the market?” Second, “does tactical make sense for where this investor is in their lifecycle?”

With high equity valuations and low forecasted return on traditional fixed income, we do believe now is a good time to consider how tactical may complement a strategic approach in diversifying how we manage risk. But importantly, we’d say much more so that now is a good time for tactical for investors in the years immediately before and after their retirement, where tactical strategies may be a meaningful way to reduce exposure to sequence risk while still allowing for the potential to participate in continued market growth.

*****

Corey Hoffstein

Corey is co-founder and Chief Investment Officer of Newfound Research, a quantitative asset manager offering a suite of separately managed accounts and mutual funds. At Newfound, Corey is responsible for portfolio management, investment research, strategy development, and communication of the firm's views to clients.

Prior to offering asset management services, Newfound licensed research from the quantitative investment models developed by Corey. At peak, this research helped steer the tactical allocation decisions for upwards of $10bn.

Corey is a frequent speaker on industry panels and contributes to ETF.com, ETF Trends, and Forbes.com’s Great Speculations blog. He was named a 2014 ETF All Star by ETF.com.

Corey holds a Master of Science in Computational Finance from Carnegie Mellon University and a Bachelor of Science in Computer Science, cum laude, from Cornell University.

You can connect with Corey on LinkedIn or Twitter.

Copyright © Newfound Research